The European Commission adopted in August 2023 detailed reporting rules for its newly created Carbon Border Adjustment Mechanism (CBAM). CBAM is a mechanism that aims to incentivize exporting countries to decarbonize their industries. However, for Southeast Asia’s economies, collectively known as ASEAN, which rely heavily on the EU export market, CBAM presents a potential double-edged sword. While it could spur much-needed environmental progress, it might also lead to economic losses if ASEAN nations are not prepared for the transition. This article will delve into the mechanics of CBAM, its current implementation status in ASEAN countries, and broader implications it will have on Asia. Learn how CBAM can shape the current trade dynamics and incentivize further sustainable development in Southeast Asia.

What is CBAM?

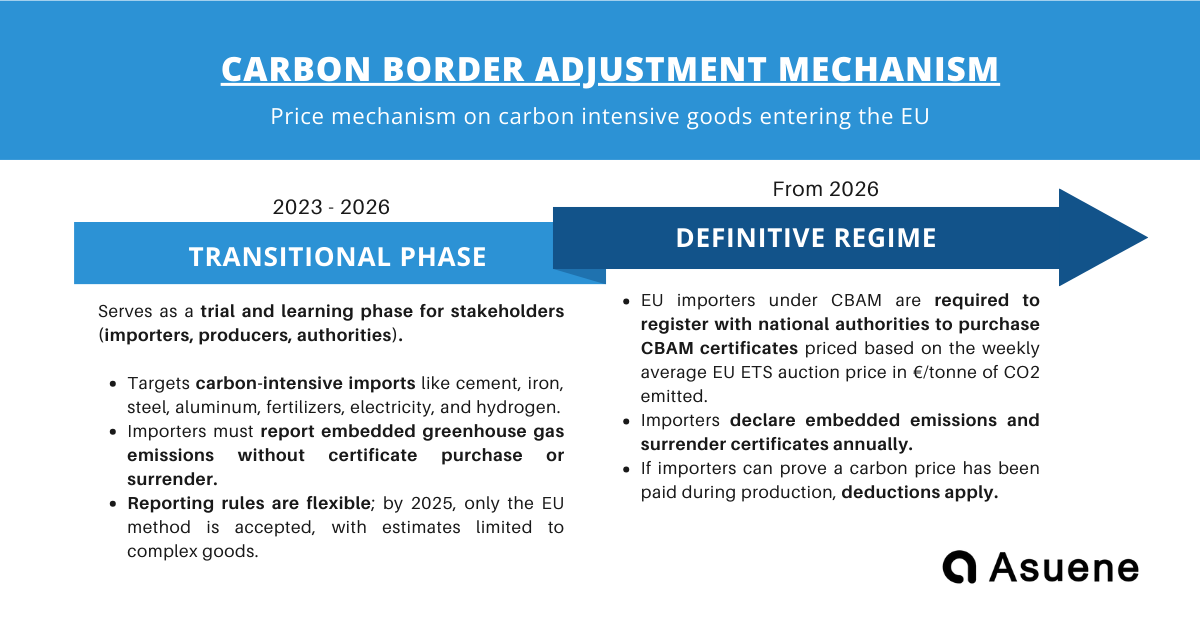

The EU Carbon Border Adjustment Mechanism (CBAM) is a “mechanism that puts a fair price on the carbon emitted during the production of carbon-intensive goods that are entering the EU, and to encourage cleaner industrial production in non-EU countries” (European Commission). CBAM essentially puts a price on the carbon emissions embodied in certain goods imported into the EU. This incentivizes cleaner production methods outside the EU and ensures imported goods compete on a level playing field with those produced within the bloc. From October 2023, CBAM entered its transitional phase. The carbon-intensive goods that fall under this period of CBAM include: cement, iron and steel, aluminum, fertilizers, electricity and hydrogen. During this period, importers of specific carbon-intensive goods are required to report the direct and indirect greenhouse gas (GHG) emissions associated with their imports. This reporting requirement serves as a learning period for all parties involved (importers, producers, and authorities) and allows for the collection of valuable data on embedded emissions. This data will be crucial for refining the methodology used in the definitive CBAM phase. A review of the CBAM’s functioning during its transitional phase will be concluded before the entry into force of the definitive system in 2026.

Impacts of CBAM in ASEAN Countries

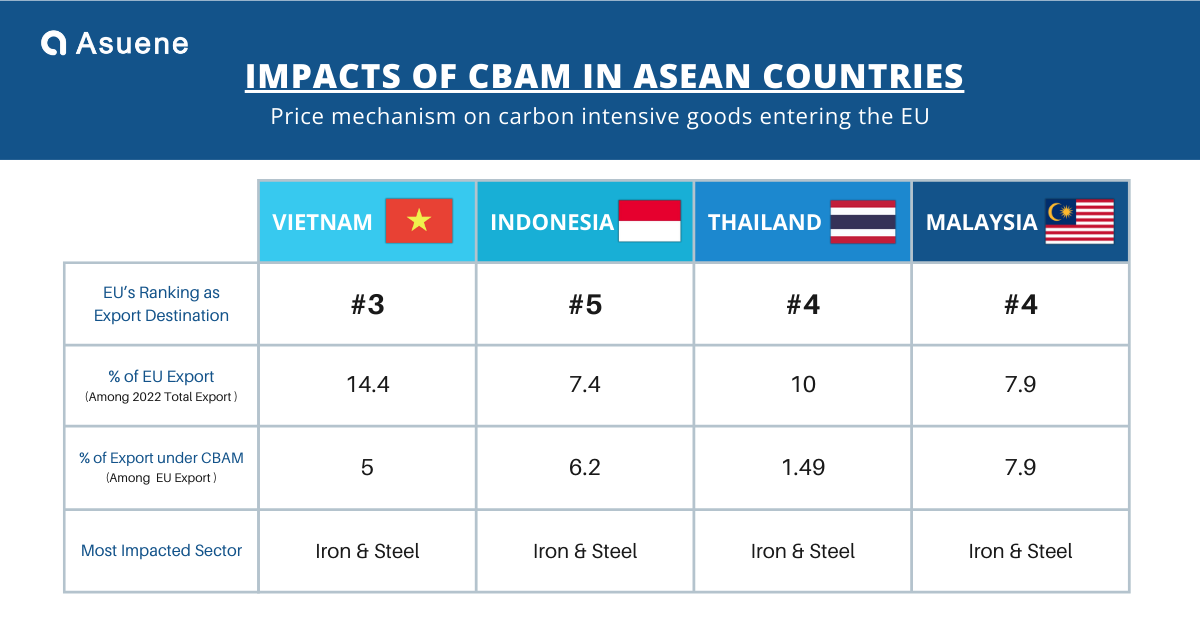

Strong trade ties between ASEAN and the EU mean the CBAM will have a noticeable influence, although the severity will differ across the region. This is because some countries rely more heavily on exports with high carbon footprints. Indonesia, Malaysia, Thailand, and Vietnam are likely to be most affected due to their significant exports in sectors covered by CBAM. Conversely, Cambodia, Lao PDR, Myanmar, and Singapore are expected to see minimal impacts as their primary exports currently fall outside the CBAM’s scope. Here’s a look at how some ASEAN member states could be affected:

Vietnam

The European Union (EU) is a vital market for Vietnam, ranking as its 3rd largest export destination in 2022 encompassing a significant 14.4% of total Vietnamese exports. CBAM regulation applies to 5% of Vietnamese exports to the EU and particularly affects the iron & steel sector the most (Trading Economics, 2022). Estimates suggest that CBAM could result in Vietnamese exporters from these sectors losing around USD $830 million annually, translating to roughly 0.6% of the country’s GDP (New Climate Institute, 2023). In anticipation of the CBAM transition period, the Vietnamese government took swift action. In November 2023, they issued an official directive outlining procedures for measuring greenhouse gas (GHG) emissions. This was followed by training programs designed to equip businesses with the knowledge and tools needed to comply with GHG regulations. These measures aim to minimize carbon footprints across the supply chain, with mandatory implementation set for 2025.

Indonesia

The European Union (EU) remains a significant export destination for Indonesia, ranking as the 5th largest covering approximately 7.4% of Indonesian exports. Among these exports to the EU, approximately 6.2% are subjected to CBAM, where the most impacted sectors are iron & steel and fertilizers (Trading Economics, 2022). New Climate Institute estimates CBAM could lead to a modest decline in annual GDP, around 0.1% or $500 million. Indonesia views CBAM as a catalyst for adaptation and a chance to prepare for future climate-driven trade measures. The Indonesian government is finalizing carbon tax regulations to incentivize businesses in lowering emissions. This will allow Indonesian companies to choose between purchasing carbon credits on the IDXCarbon exchange or paying the carbon tax, directly contributing to emissions reduction.

Thailand

The European Union (EU) is Thailand’s 4th largest export destination, receiving around 10% of Thailand’s total export in 2022. Among the total exports to the EU, approximately 1.49% of the exports will be subjected to CBAM (Work Point Today, 2023), with iron & steel being the most vulnerable industry. The implementation of CBAM could result in potential annual revenue losses for Thailand of around USD $500 million, representing a modest 0.2% reduction of its GDP. In response to CBAM, Thailand has launched the BCG (bio, circular and green) economic development plan. This initiative aims to incentivize manufacturers to adopt environmentally friendly technologies that enhance product value while minimizing environmental footprint.

Malaysia

The European Union (EU) is a significant and growing trade partner for Malaysia, accounting for 7.9% of its total trade and ranking as its 4th largest export destination in 2022. This market holds even greater potential, with Malaysian exports to the EU surging by an impressive 21.8% in recent years. Currently, an estimated 6.7% of Malaysia’s exports to the EU fall under CBAM, with the iron and steel sector being the most affected (Bank Negara Malaysia, 2022). Furthermore, it is estimated that by 2026 (midf Research, 2023), if domestic manufacturers fail to comply with new CBAM standards, up to 57% of Malaysia’s exports to the EU could be impacted In response to this potential hurdle, Malaysia has taken proactive steps:

- Mandatory Reporting: Starting October 2023, Malaysian exporters will be required to report greenhouse gas (GHG) emissions.

- Government Support: Initiatives are underway to introduce carbon pricing and support emission reduction efforts. These measures aim to assist exporters in meeting CBAM requirements.

- National Framework: The government is establishing pre-conditions for a national carbon accounting framework.

The Domino Effect

CBAM’s impact on ASEAN exporters may be modest initially, as a small portion of their exports fall under its current regulations. However, as CBAM expands and export volumes rise, the financial burden could become significant. This poses a long-term threat to ASEAN’s competitiveness in the European market if its manufacturing sector remains heavily reliant on carbon-intensive processes. Similar to China’s opposition to the EU’s unilateral approach and its plans to expand its domestic carbon trading scheme, ASEAN economies should be compelled to take similar actions, to encourage their exporting businesses to decarbonize at a faster pace. This could involve ramping up energy efficiency, accelerating emissions reductions, and potentially implementing domestic carbon pricing mechanisms. While some ASEAN governments are already strengthening their environmental regulations in response to CBAM, a more substantial and swifter approach is necessary. To truly compete in the evolving global market, ASEAN will need to significantly tighten its regulations and strive to reach a level closer to the EU’s ambitious environmental commitments. CBAM presents both challenges and opportunities. At Asuene, we are committed to helping you turn this regulatory shift into a competitive edge for your business. Together, let’s make your business a leader in the transition to a greener future.