- Article Summary

-

Federal Rollbacks and the SEC’s Shifting Mandate

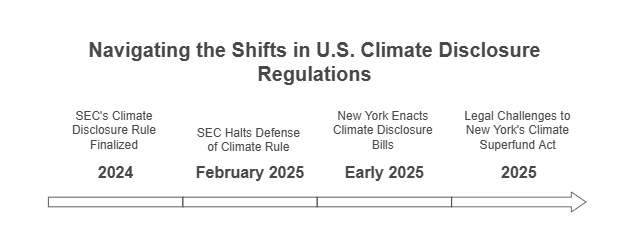

In the turbulent arena of U.S. climate policy, the Securities and Exchange Commission’s (SEC) climate disclosure rules have become a focal point of legal and political contention. Following the 2024 presidential election, the Trump administration’s deregulatory agenda has systematically dismantled federal climate initiatives, including the SEC’s 2024 climate disclosure rule. This retreat has catalyzed a patchwork of state-level regulations, with New York and California emerging as vanguards of corporate climate accountability. This report examines the SEC’s regulatory trajectory, the implications of federal inaction, and the rise of state-led frameworks reshaping corporate sustainability reporting.

The Biden-Era Climate Disclosure Rule

The SEC’s 2024 climate disclosure rule, finalized under Chair Gary Gensler, aimed to standardize climate risk reporting for publicly traded companies. The rule required disclosures of material climate risks, greenhouse gas (GHG) emissions (Scopes 1 and 2), and costs linked to severe weather events. Notably, Scope 3 emissions—those from supply chains and product use—were excluded from the final rule after intense lobbying from industry groups. The regulation sought to align U.S. standards with global frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB).

However, the rule faced immediate legal challenges from Republican-led states and business coalitions, who argued it exceeded the SEC’s statutory authority. By February 2025, Acting SEC Chair Mark Uyeda halted the rule’s defense in court, declaring it “deeply flawed” and initiating a formal repeal process. This reversal reflects the Trump administration’s broader strategy to unwind Biden-era climate policies, including EPA emissions standards and clean energy incentives.

Implications of Federal Inaction

The SEC’s retreat creates a regulatory vacuum, compelling corporations to navigate conflicting state requirements. While the Biden-era rule prioritized investor transparency, its dissolution leaves companies without unified federal guidance, exacerbating compliance complexities. The U.S. Chamber of Commerce estimates that fragmented state regulations could increase compliance costs by 30–50% for multinational firms operating across jurisdictions.

State-Level Climate Disclosure Frameworks

New York’s Legislative Countermeasures

In response to federal rollbacks, New York enacted Senate Bills 3456 and 3697 in early 2025, establishing stringent climate disclosure mandates:

- SB 3456 (Climate Corporate Data Accountability Act): Requires entities with $1 billion+ revenue to report Scopes 1–3 emissions annually starting in 2027, adhering to GHG Protocol standards.

- SB 3697 (Climate-Related Financial Risk Disclosures): Mandates biennial TCFD-aligned risk reports for firms with $500 million+ revenue, including mitigation strategies and governance oversight.

These laws mirror California’s SB 253 and SB 261 but introduce unique provisions, such as a dedicated Climate Accountability Fund financed by corporate fees1. However, exemptions for foreign entities and delayed Scope 3 enforcement timelines have drawn criticism from environmental advocates.

Legal Challenges and Interstate Tensions

New York’s Climate Superfund Act, which imposes retroactive fines on fossil fuel producers, faces a multi-state lawsuit alleging violations of the Commerce Clause and Due Process rights1. Plaintiffs argue the law unfairly targets out-of-state entities, setting a precedent for interstate litigation over climate policies. Meanwhile, California’s earlier compliance deadlines (2026 vs. New York’s 2027) risk creating operational bottlenecks for firms subject to both regimes.

Compliance Challenges and Strategic Opportunities

Operational and Financial Burdens

For corporations, the shift to state-led disclosures necessitates significant investments in data infrastructure. Tracking Scope 3 emissions—which often constitute 70–90% of a company’s carbon footprint—requires granular supply chain monitoring1. The U.S. Chamber of Commerce estimates initial compliance costs at $2–$5 million annually for large firms, with ongoing expenses for third-party audits and software integration.

ESG Leadership in a Fragmented Landscape

Proactive companies are leveraging advanced tools to turn compliance into competitive advantage. Microsoft and Unilever, for instance, have adopted TCFD-aligned reporting ahead of mandates, securing preferential access to green financing. Technologies like blockchain-enabled carbon tracking and AI-driven scenario analysis are becoming critical for maintaining audit-ready datasets.

Global Alignment and Technological Innovation

Convergence with International Standards

Despite federal stagnation, U.S. companies face pressure to align with global reporting frameworks. The European Union’s Corporate Sustainability Reporting Directive (CSRD) and California’s SB 253 mandate Scope 3 disclosures, effectively creating de facto global standards for multinational corporations. Firms adopting TCFD and SASB metrics position themselves favorably in international markets, mitigating risks of trade barriers or investor divestment.

Scenario Analysis and Forward-Looking Disclosures

The SEC’s abandoned 2025 rules emphasized climate scenario analysis, requiring firms to model financial impacts under 2°C warming scenarios. Forward-looking disclosures remain critical for investors assessing long-term climate risks, particularly in sectors like real estate (sea-level rise) and agriculture (drought resilience).

Conclusion: Navigating a Bifurcated Regulatory Future

The SEC’s climate disclosure saga underscores the deepening divide between federal and state climate agendas. While the Trump administration prioritizes deregulation, New York and California are forging ahead with robust disclosure frameworks that may eventually coalesce into a national standard. For businesses, strategic adaptation involves:

- Investing in integrated GHG tracking systems to manage multi-jurisdictional reporting.

- Engaging with state policymakers to shape evolving regulations.

- Aligning with global standards to maintain market access and investor confidence.

As litigation over state laws progresses, the judiciary’s interpretation of federal preemption and corporate accountability will shape the next chapter of U.S. climate governance. In this uncertain landscape, companies that embed climate resilience into core strategies will emerge as leaders in the transition to a low-carbon economy

Why Not Work with ASUENE USA Inc.?

When it comes to navigating complex climate disclosure requirements, it is crucial to have the right tools and expertise on your side. That’s where ASUENE USA Inc. comes in.

Carbon Accounting: Our advanced software solutions automate emissions tracking across Scopes 1, 2, and 3, integrating with existing ERP systems to reduce manual data entry errors. Proprietary algorithms align with GHG Protocol standards, ensuring compliance with ESG reporting mandates.

Third-Party Verification: ASUENE’s network of accredited auditors provides ISO 14064-compliant verification services, a critical step for companies seeking to validate their disclosures.

Consulting Services: Our team offers tailored guidance on TCFD-aligned risk reporting, helping firms identify material climate risks and craft mitigation strategies that satisfy disclosure requirements.

By partnering with ASUENE USA, businesses can transform regulatory obligations into strategic advantages, enhancing sustainability performance while minimizing compliance costs.

So, why not partner with us to streamline your reporting and environmental efforts? Let ASUENE USA Inc. help you stay ahead of the curve while making a positive impact on both your business and the planet.

Talk to us today for your sustainable transformation!