In today’s environmentally conscious world, a clear definition of “green” is no longer a luxury, but a necessity. Investors, businesses, and policymakers all grapple with navigating the complexities of sustainable investing. Here’s where green taxonomies emerge as a powerful tool. These classification systems categorize economic activities based on their environmental impact, offering a standardized language to identify activities and assets that contribute to achieving critical sustainability goals. This article delves deep into the world of green taxonomies, exploring existing regulations in various countries, examining the benefits and challenges they present for different stakeholders, and outlining the future trajectory of this critical framework.

Beyond a Checklist: Shared Language for Sustainability

Green taxonomies go beyond simply providing a checklist of “green” activities. They function as a shared language, fostering clear communication and collaboration between investors and companies navigating the often murky waters of sustainable investments. Similar to biological taxonomy, which meticulously categorizes living things, green taxonomies utilize various tools to classify economic activities by their environmental footprint. These tools include:

- Eligibility Lists: These lists identify activities that align with specific environmental objectives, such as climate change mitigation or the protection of biodiversity.

- Substantial Contribution Criteria: Green taxonomies don’t settle for mere participation. These criteria ensure activities demonstrably contribute towards achieving environmental goals.

- “Do No Significant Harm” Criteria: A responsible approach is paramount. These criteria prevent activities that undermine other environmental objectives from being classified as “green.”

- Minimum Safeguards: Upholding best environmental practices is crucial. Minimum safeguards ensure companies maintain a high standard of environmental responsibility.

- Reporting Requirements: Transparency is key. Reporting requirements ensure companies disclose relevant data, allowing for informed decision-making.

Green taxonomies empower all stakeholders in the sustainable investment landscape by:

- Combating Greenwashing: By establishing clear criteria for defining truly sustainable activities, green taxonomies make it more difficult for companies to engage in misleading practices often referred to as “greenwashing.”

- Guiding Investment Decisions: Investors gain valuable tools to assess their portfolios’ “greenness.” This allows them to allocate funds with confidence towards initiatives that genuinely contribute to a sustainable future.

- Accelerating Sustainable Transition: By channeling investments towards environmentally responsible activities, green taxonomies accelerate the global shift towards a greener economy.

A Global Landscape of Green Taxonomies: A Flourishing Ecosystem

Source: EU Taxonomy Navigator

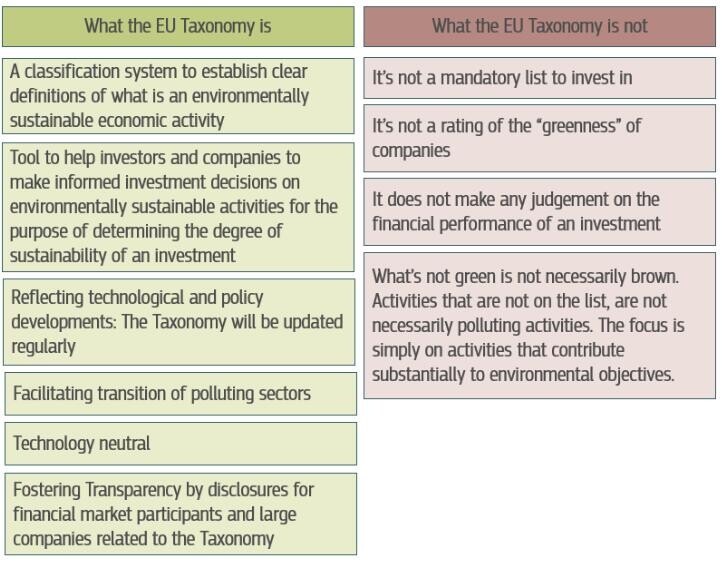

The European Union (EU) stands as a pioneer in the realm of green taxonomies. Their groundbreaking Taxonomy Regulation, launched in 2020, directly supports the ambitious environmental goals outlined in the European Green Deal. This comprehensive framework outlines four key requirements that companies must fulfill to be considered environmentally sustainable. These include making a “substantial contribution” to at least one environmental objective, ensuring they “do no significant harm” to others, complying with minimum safeguards, and adhering to specific technical screening criteria.

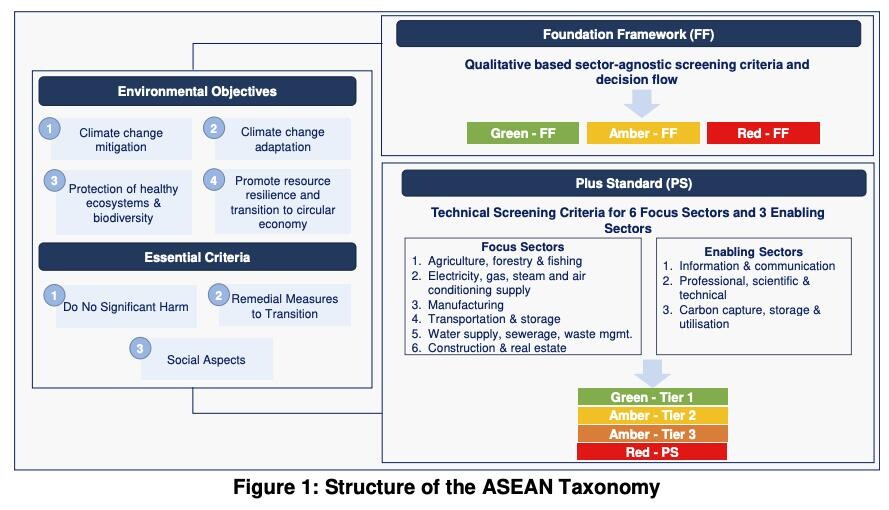

Source: ASEAN Taxonomy Board

The European Union (EU) stands as a pioneer in the realm of green taxonomies. Their groundbreaking Taxonomy Regulation, launched in 2020, directly supports the ambitious environmental goals outlined in the European Green Deal. This comprehensive framework outlines four key requirements that companies must fulfill to be considered environmentally sustainable. These include making a “substantial contribution” to at least one environmental objective, ensuring they “do no significant harm” to others, complying with minimum safeguards, and adhering to specific technical screening criteria.

Benefits and Challenges: A Balancing Act

While green taxonomies offer numerous advantages, they also present challenges that require solutions. Here’s a breakdown of both: Benefits:

- Companies: Green taxonomies empower companies to demonstrate their commitment to sustainability, attract capital for green initiatives, and defend against greenwashing accusations.

- Investors: Investors gain valuable tools to assess portfolio alignment with sustainability goals, make informed investment choices that align with their environmental values, and mitigate reputational risks associated with supporting environmentally harmful activities.

- Society: Green taxonomies establish a common language for all economic actors, fostering transparency and ensuring financial flows are directed towards sustainable activities that benefit society as a whole.

Challenges:

- Reporting Burden: The technical nature and complex criteria of green taxonomies can be challenging for companies to navigate, potentially leading to increased reporting costs.

- Data Accuracy: The absence of mandatory audits in some jurisdictions raises concerns about the accuracy of self-reported data. Robust verification mechanisms are crucial to ensure the integrity of the system.

- Global Harmonization: Inconsistencies across different regions can undermine the effectiveness of the taxonomy as a whole. International cooperation and efforts towards global harmonization will be crucial to overcome this challenge.

The Future: A Collaborative Path Forward

As sustainable investing gains global prominence, more countries are likely to implement their own green taxonomies. International cooperation and ongoing efforts towards global harmonization will be crucial in overcoming existing challenges. Green taxonomies are poised for widespread adoption, shaping investment decisions and driving sustainable practices on a global scale. By fostering transparency and facilitating informed decision-making, these frameworks offer a powerful tool to accelerate the transition towards a more environmentally responsible future.

Looking Ahead: Continuous Improvement and Adaptation

The development and implementation of green taxonomies are ongoing processes. Regular reviews and updates will be necessary to ensure they remain relevant and effective in the face of evolving environmental challenges and technological advancements. Furthermore, fostering stakeholder engagement through open dialogue and collaboration will be critical in ensuring the continued development of robust and impactful green taxonomies. Green taxonomies offer a promising solution for navigating the complexities of sustainable investing. By establishing a shared language and providing clear criteria for defining environmentally friendly activities, they empower all stakeholders to contribute to a more sustainable future. As green taxonomies continue to develop and gain global adoption, they have the potential to play a pivotal role in accelerating the transition towards a greener and more environmentally responsible global economy.