In March 2022, the U.S. Securities and Exchange Commission (SEC) introduced a groundbreaking proposal for climate disclosures, marking a major shift in corporate environmental reporting. Expected to be implemented by April 2024, these rules aim to standardize climate risk and impact reporting, providing investors with transparent and comparable information. As the business world adjusts to this change, comprehending the details, applicability, and implementation timeline of these rules is crucial. Asuene is dedicated to clarifying these updates, helping businesses not only comply but also leverage these changes strategically.

Key Aspects of Climate Disclosure Rules

The SEC’s proposed rules are comprehensive, covering several key areas of climate-related disclosures:

- Greenhouse Gas (GHG) Emissions: Companies are required to disclose their direct GHG emissions (Scope 1) and indirect emissions from purchased electricity or other forms of energy (Scope 2). Critically, the rules also extend to Scope 3 emissions (those occurring in the value chain of the reporting company) if they are material or if the company has set a public target that includes Scope 3 emissions. This requirement introduces a significant expansion of reporting obligations, emphasizing the interconnected nature of corporate environmental impact.

- Climate-Related Risks: The rules mandate the disclosure of any climate-related risks that have had or are likely to have a material impact on the business, including both physical risks (from natural disasters or changing weather patterns) and transition risks (stemming from new legislation, market shifts, or technology developments). This section requires a forward-looking assessment, encouraging companies to consider not just current but future impacts over the short, medium, and long term.

- Impact on Business Strategy: Beyond identifying risks, companies must disclose how identified climate-related risks affect their business model, strategy, and outlook. This could include impacts on operations, investment in research and development, supply chain restructuring, or shifts in consumer demand.

- Governance and Risk Management: The disclosure rules also cover governance, requiring companies to describe the board and management’s role in assessing and managing climate-related risks.

Main Changes

The introduction of the SEC’s climate disclosure rules marks a significant shift from the previous, more voluntary, disclosure frameworks. Previously, companies were encouraged but not required to report on environmental matters, leading to a wide variance in the quality and quantity of information provided. The new rules standardize climate-related disclosures, making them mandatory and subject to the same level of rigor as financial reporting. This change not only enhances transparency but also ensures that all stakeholders have access to material information that could influence investment decisions.

Scope

The scope of the SEC’s rules is broad, applying to all SEC-registered public companies, including smaller reporting companies, foreign private issuers, and emerging growth companies. This wide applicability ensures that a substantial portion of the market will be engaged in more transparent and uniform climate-related reporting. However, the rules are designed with a phased approach to compliance, particularly for Scope 3 emissions, acknowledging the challenges and burdens smaller companies may face in collecting and reporting this information.

Timeline for Implementation

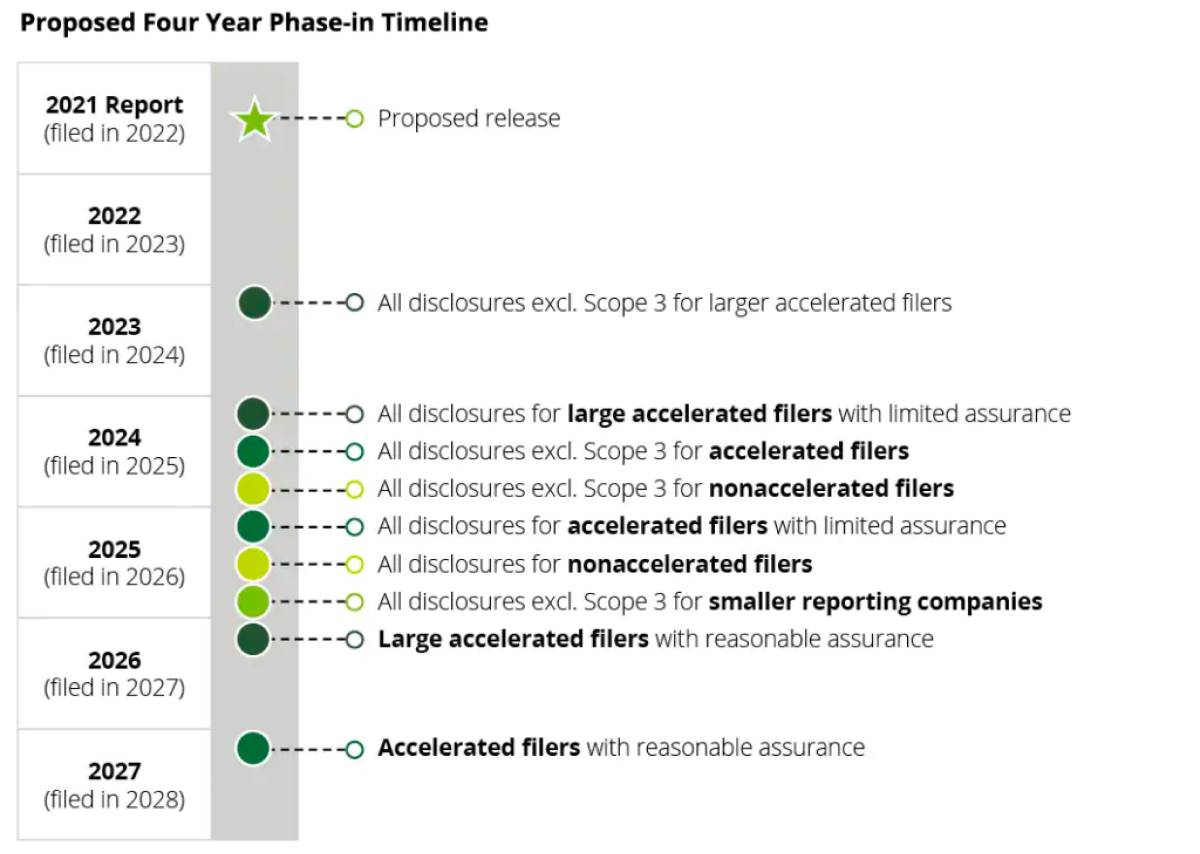

The implementation timeline reflects the SEC’s recognition of the significant preparation required for companies to comply with these new reporting standards. Following the announcement in 2022, the proposed rules are anticipated to take effect in April 2024, with a phased compliance approach:

- Large Accelerated Filers: Companies classified as large accelerated filers are expected to comply with the new rules for fiscal years ending on or after December 15, 2023, with Scope 3 emissions reporting (if applicable) required for fiscal years ending on or after December 15, 2024.

- Accelerated Filers and Non-Accelerated Filers: These companies will have an additional year to comply with Scope 1 and Scope 2 emissions disclosures and two additional years for Scope 3, if applicable.

- Smaller Reporting Companies: Recognizing the potential burden on smaller entities, the SEC has proposed exemptions from Scope 3 emissions reporting, with delayed compliance deadlines for other disclosures.

This staggered approach aims to balance the urgent need for climate-related information with the practicalities of gathering and reporting complex data, allowing companies time to develop the necessary reporting frameworks and controls.

Source: Deloitte Development, LLC

Preparing for Compliance

For companies navigating these new requirements, preparation is key. Beyond simply aiming for compliance, there’s an opportunity to integrate sustainability more deeply into strategic planning and operations, leveraging the disclosure process to identify risks and opportunities. Companies should begin by assessing their current climate-related data collection and reporting capabilities, identifying gaps, and developing a roadmap for compliance that aligns with their broader business objectives. Investing in sustainability initiatives, enhancing data analytics capabilities, and engaging with stakeholders on environmental matters will not only prepare companies for the forthcoming SEC regulations but also position them as leaders in corporate responsibility and environmental stewardship.

Moving Forward

As the SEC contemplates its next steps, the tension between the need for detailed, actionable climate-related information and the imperative to avoid overburdening companies remains a critical concern. The commission’s efforts to finalize a rule that balances these considerations will be closely watched, not only by U.S. stakeholders but also by global markets, as companies and investors alike seek clarity on the future landscape of climate disclosure. The potential for legal challenges, hinted at by entities like the U.S. Chamber of Commerce, adds another layer of complexity to the SEC’s deliberations. Ensuring that the final rules are both robust and defensible will be paramount, necessitating a careful, evidence-based approach to rulemaking that can withstand scrutiny in the courts.

Conclusion

The SEC’s journey towards finalizing its climate disclosure rules reflects the broader challenges that regulators, companies, and investors face as they transition towards a more sustainable global economy. In its efforts to balance transparency with investor protection and the practical realities of compliance, the SEC’s rule-making process is set to profoundly impact the future of corporate governance and environmental stewardship. As these new rules approach implementation, Asuene is dedicated to navigating businesses through the complexities of compliance. Our goal is to transform regulatory challenges into opportunities for innovation and leadership in sustainability, ensuring that companies not only adapt but thrive in this evolving landscape.