- Article Summary

-

The Growing Demand for ESG Transparency Across Supply Chains

As ESG (Environmental, Social, and Governance) reporting requirements tighten globally, companies are increasingly compelled to expand transparency beyond their direct operations. The spotlight is now on supply chains—especially Scope 3 emissions, which often comprise the majority of a company’s carbon footprint.

The EU’s Corporate Sustainability Reporting Directive (CSRD) and the SEC’s climate disclosure proposals in the U.S. both signal a new era in ESG reporting. These frameworks demand that companies disclose not just internal sustainability performance, but also that of their suppliers. However, this shift exposes a glaring challenge: most suppliers are ill-prepared to meet these disclosure demands.

According to CDP’s 2023 Global Supply Chain Report, only 41% of suppliers disclosed Scope 1 and 2 emissions, and fewer than 20% reported Scope 3 data. For global corporations, this gap poses both regulatory and reputational risks. This article explores three primary barriers to ESG disclosure in supplier networks and presents real-world solutions from Toyota, Panasonic, and leading European manufacturers.

Barrier 1: Data Collection Complexity and Infrastructure Gaps

The Challenge:

For many suppliers, especially small and mid-sized enterprises (SMEs), ESG data collection is a logistical nightmare. Unlike large corporations with dedicated sustainability teams and integrated enterprise resource planning (ERP) systems, suppliers often rely on fragmented spreadsheets, manual processes, or no tracking at all.

Multi-tiered supply chains further complicate data collection. When a Tier 1 supplier depends on Tier 2 or Tier 3 partners for raw materials or components, tracing carbon footprints becomes a guessing game.

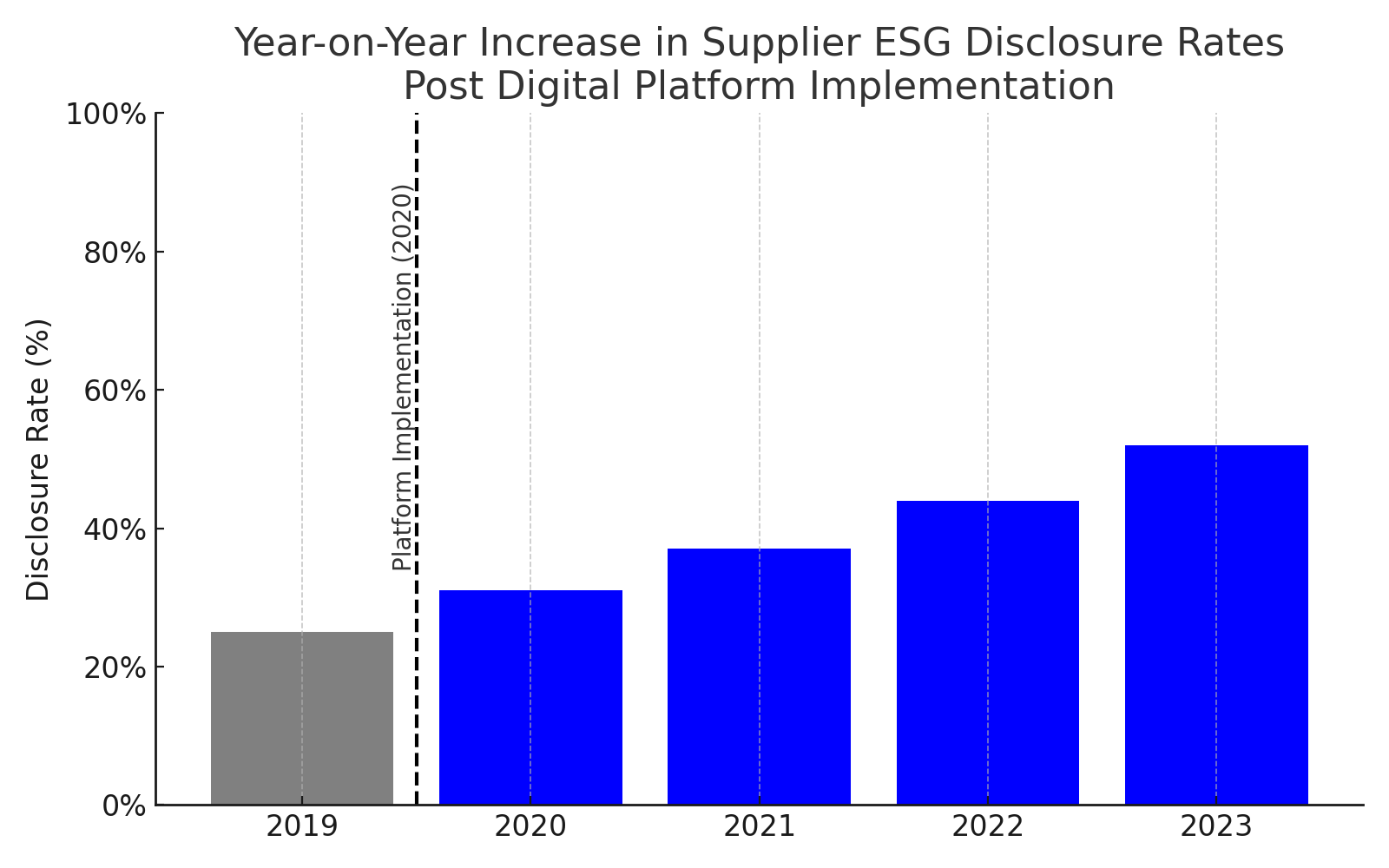

Case Study: Toyota

Toyota introduced a digital data-sharing platform that standardizes ESG reporting formats across suppliers. By offering templates, industry-specific guidelines, and API-based integration with existing ERP systems, Toyota reduced data friction and improved the accuracy of supplier disclosures.

Solutions in Action:

- Deploy ESG SaaS platforms like Asuene ESG to automate data intake and benchmarking.

- Use blockchain for traceable and immutable ESG data exchange.

- Establish data collection protocols tailored by industry, size, and region.

Barrier 2: Limited ESG Literacy and Misaligned Incentives

The Challenge:

ESG remains a foreign concept for many suppliers, particularly those operating in emerging markets or outside heavily regulated sectors. Lack of understanding around terminology (e.g., Scope 3, LCA, double materiality) creates confusion and hampers accurate reporting.

Moreover, suppliers are often not incentivized to prioritize ESG. Without clear links to procurement decisions or financial benefits, ESG is perceived as a compliance burden rather than a strategic imperative.

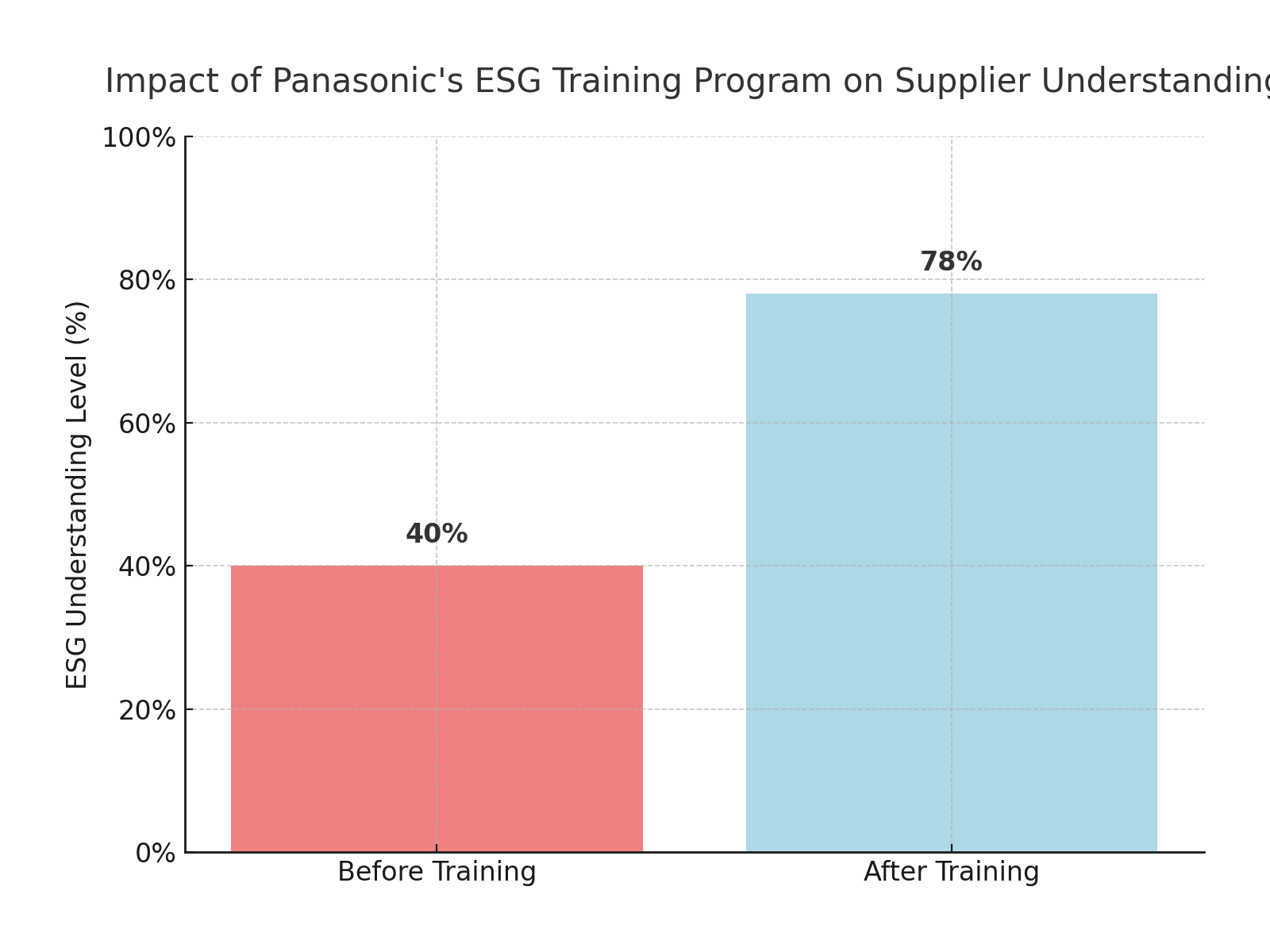

Case Study: Panasonic

Panasonic developed a supplier capacity-building program in Southeast Asia. Through workshops, multilingual materials, and gamified scoring systems, suppliers not only learned ESG principles but also competed for incentives tied to procurement eligibility.

Solutions in Action:

- Conduct regionally tailored ESG training for suppliers.

- Link ESG scores to procurement preference or payment terms.

- Create “ESG champions” within supplier networks who can train peers.

Barrier 3: Trust and Verification Challenges

The Challenge:

Even when suppliers provide ESG data, buyers often struggle to trust its validity. Self-reported information can be inconsistent, unaudited, or exaggerated. This raises the specter of greenwashing, which could backfire on lead companies relying on flawed disclosures.

Cross-border verification is another hurdle. A supplier’s report in Vietnam might not align with ESG standards expected in Germany or the U.S.

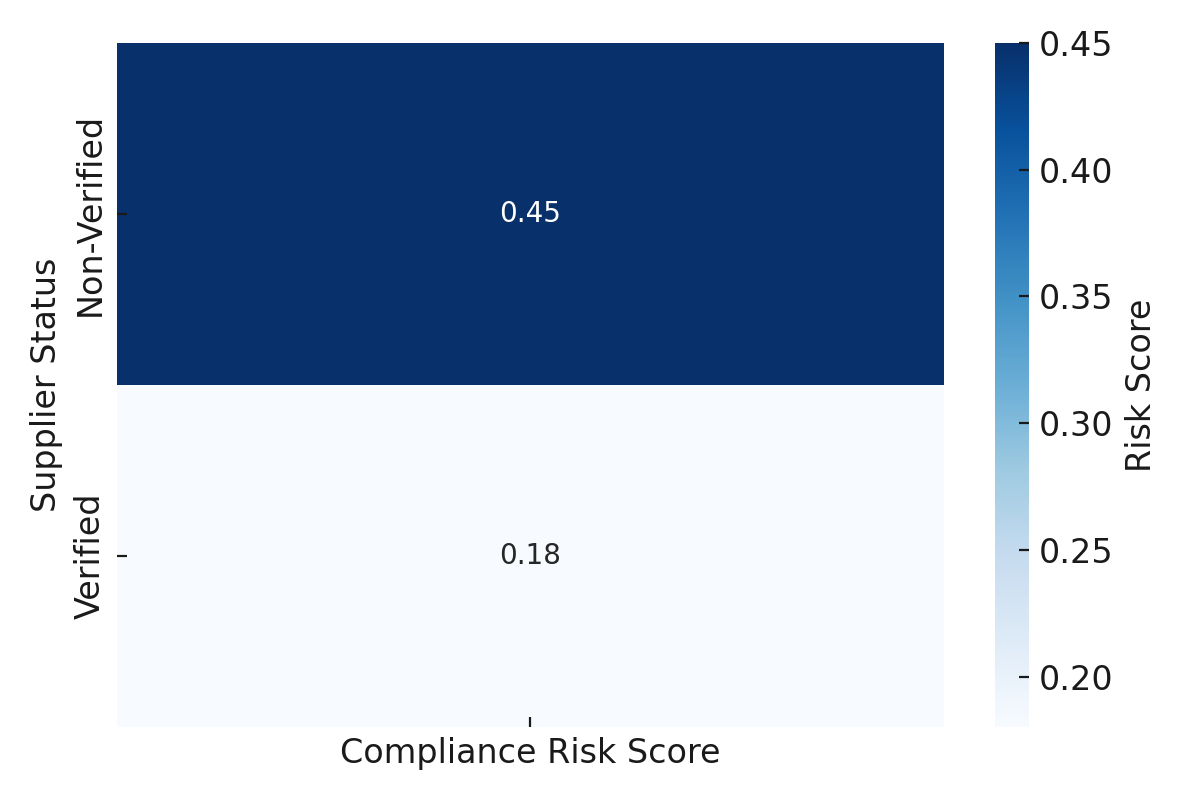

Case Study: European Automotive OEM

A major European automaker implemented blockchain-based traceability for critical raw materials and used third-party audits to validate ESG metrics. The company also categorized suppliers by ESG risk and adjusted procurement strategies accordingly.

Solutions in Action:

- Employ third-party verification bodies (e.g., SGS, DNV).

- Use blockchain or digital ledgers to ensure audit trails.

- Align supplier assessments with globally recognized frameworks (e.g., GRI, SASB).

Correlation Between Third-Party Verification and Compliance Risk

The Payoff: Business Value of Overcoming ESG Disclosure Barriers

When companies help suppliers overcome ESG disclosure barriers, the benefits extend beyond compliance:

- Risk Mitigation: ESG visibility enables companies to identify risks such as environmental violations or labor abuses early.

- Competitive Advantage: ESG-aligned suppliers are more likely to win contracts and preferred pricing.

- Investor Confidence: Transparent ESG data boosts ratings and opens access to ESG-linked financing.

Case Study: Unilever

Unilever’s Sustainable Living Plan integrated ESG metrics into procurement. Suppliers who scored high on ESG performance saw increased order volumes and co-investment opportunities. The result: enhanced sustainability metrics, improved supplier relationships, and stronger investor support.

Turning ESG Disclosure from Compliance to Competitive Advantage

As global ESG regulations expand, companies must take proactive steps to engage their supply chains. The three main barriers—data collection difficulties, ESG illiteracy, and trust issues—can be overcome with digital tools, training, and verification protocols.

Leading firms like Toyota, Panasonic, and European OEMs demonstrate that supplier ESG disclosure can evolve from a bottleneck into a strategic differentiator. The key lies in collaboration, education, and long-term investment in supplier capabilities.

In the new ESG paradigm, those who empower their supply chains to disclose credibly and consistently will not only comply—they will lead.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.