- Article Summary

-

Introduction

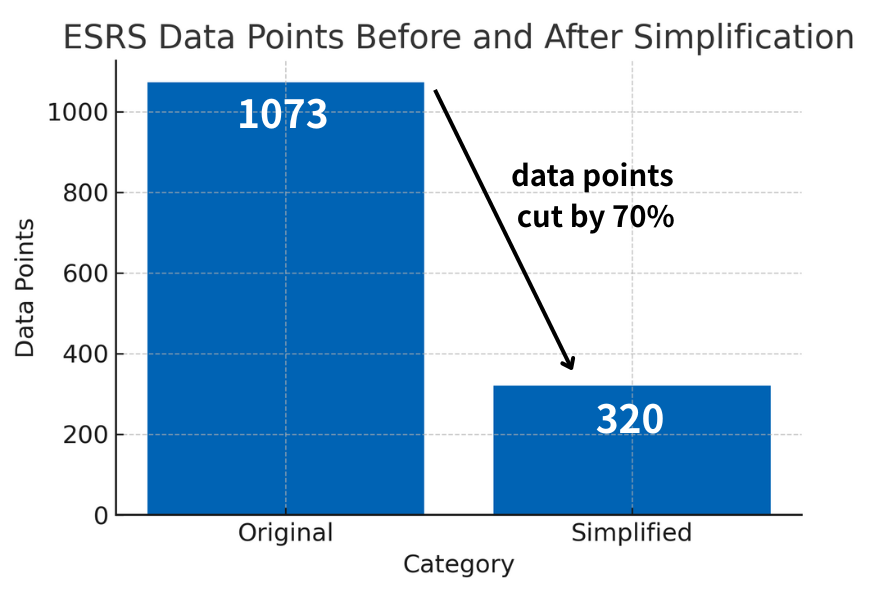

The release of the simplified European Sustainability Reporting Standards marks one of the most consequential regulatory shifts since the Corporate Sustainability Reporting Directive came into force. EFRAG reduced the volume of required data points by seventy percent, moving from 1073 to 320. This decision answers long standing concerns about reporting burden, yet the scale of simplification has prompted questions from sustainability scholars, preparers, and investors. Many observers argue that while clarity and usability have improved, essential indicators have been removed. Others see the revision as the result of political compromise rather than purely technical calibration. This article examines what was cut, why it matters, and how these choices will shape the usefulness and credibility of sustainability reporting across Europe.

Data Categories Most Affected by the Reductions

EFRAG did not simply trim redundant or low value indicators. The revised draft shifts several disclosures into optional status or removes them entirely. Three domains stand out for the scale and strategic relevance of the cuts.

Environmental disclosures were among the most heavily affected. Mandatory reporting of dependencies on ecosystem services was removed. These indicators were central to understanding how corporate activity relies on water regulation, soil fertility, pollination, or natural hazard mitigation. Without them, users lose insight into nature related risks that can reshape valuations and supply chain resilience. Granular energy consumption data by fossil fuel type was also eliminated. Companies are no longer required to specify the volumes of coal, crude oil, and natural gas consumed. Investors and transition planners now face weaker visibility on fossil lock in patterns.

Governance indicators also experienced notable simplification. Reporting on late payments to small and medium sized suppliers is now more flexible. This reduces transparency on practices that directly affect the financial health of suppliers and that previously served as a proxy for responsible procurement. Several governance competency indicators were streamlined, reducing detail on board expertise relevant to sustainability oversight.

Selected Data Points Removed or Made Optional

| Category | Original Requirement | Status in Simplified Draft |

| Ecosystem service dependencies | Mandatory | Removed |

| Fossil fuel energy breakdown | Mandatory by fuel type | Aggregated reporting allowed |

| Late payments to SMEs | Mandatory | More flexible disclosure |

| Board competency indicators | Detailed | Reduced granularity |

How Political Pressure Influenced the Draft

Although the technical teams within EFRAG pursued simplification to improve proportionality, the speed and scale of the reduction reflect substantial political influence. Several governments and business associations argued that reporting costs would become prohibitive for companies newly entering the CSRD scope. This argument gained traction despite analysis showing that a more targeted adjustment of ESRS would have been sufficient to ease the burden without broad scale removal of indicators.

Many sustainability researchers voiced concerns that political priorities overshadowed scientific guidance. One assessment identified twenty one blindspots and structural weaknesses in the initial simplified package. When evaluated through the lens of planetary boundaries and accelerating climate tipping points, this number increased to forty two. These findings suggest that simplification removed not only redundant data but also information needed to understand environmental thresholds and system level risks. The political timeline also placed pressure on EFRAG. Delivering major simplification within months limited the opportunity for deep consultation and technical iteration.

Flexibility, Reliefs, and New Loopholes

The revised standards introduce several forms of flexibility intended to support smaller or less mature companies. However, these same mechanisms can undermine comparability and create openings for selective transparency. The undue cost or effort relief allows companies to omit disclosures when they determine that the cost of producing the information is excessive. Without stricter guardrails, this relief could enable omissions precisely where data is expensive because it is material to long term risk.

Similarly, the simplified double materiality assessment places more discretion in the hands of preparers. Information previously required by default may now be excluded if a company concludes it is not material. This further increases variability across disclosures and weakens the ability of investors to benchmark companies. Transitional provisions provide additional room to delay or limit reporting. Together, these adjustments create uncertainty about whether the simplified ESRS can deliver decision useful, comparable, and credible sustainability information.

Key Reliefs Introduced and Their Associated Risks

| Relief Mechanism | Intended Purpose | Potential Risk |

| Undue cost or effort | Reduce reporting burden | Selective omission of critical data |

| Simplified double materiality | Improve usability | Inconsistent scope decisions |

| Transitional provisions | Allow phased adoption | Delayed transparency |

Conclusion

The simplified ESRS represent an important step toward making sustainability reporting more manageable for companies. Yet the volume and placement of the cuts raise legitimate concerns about the future robustness of European sustainability data. Essential indicators relating to nature, energy transition, governance accountability, and supply chain fairness were diluted or eliminated. The political impetus behind the revisions has shaped the technical outcome in ways that may weaken alignment with global frameworks such as ISSB and TNFD. The credibility of the new standards will depend on careful implementation, strong guidance on materiality, and vigilance against misuse of reliefs.

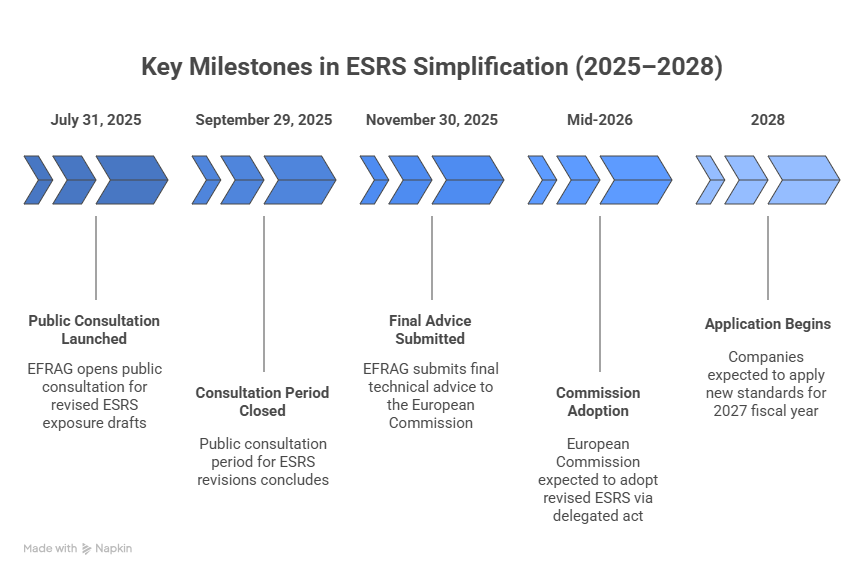

As the Commission, Parliament, and Council conduct the next consultation phase, the central question remains whether the simplified regime can maintain coherence and comparability. Companies need clarity to prepare for reporting in financial year twenty twenty seven, and possibly twenty twenty six. Investors and stakeholders need assurance that simplification has not compromised insight. The coming months will determine whether Europe can preserve both usability and rigor in sustainability reporting.

Why Work with ASUENE Inc.?

ASUENE is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. The company serves over 10,000 clients worldwide with an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.