- Article Summary

-

Introduction

Financial institutions play a distinct role in the net-zero transition by directing capital toward or away from companies and sectors. Their influence stems not from their own operations, but from the financial products and services they provide; across lending, investment, underwriting, and capital markets. As these activities shape real economy emissions, the Science Based Targets initiative (SBTi) released the Financial Institutions Net-Zero Standard (July 2025) to guide the sector with science-based, actionable pathways.

Unlike corporate entities that emit directly through operations and supply chains, financial institutions’ emissions are overwhelmingly indirect. More than 99% of their greenhouse gas emissions typically come from Scope 3 Category 15, while Scopes 1 and 2, and Categories 1-14 of Scope 3, often account for less than 1% combined. This makes traditional corporate-focused standards unsuitable for the financial sector.

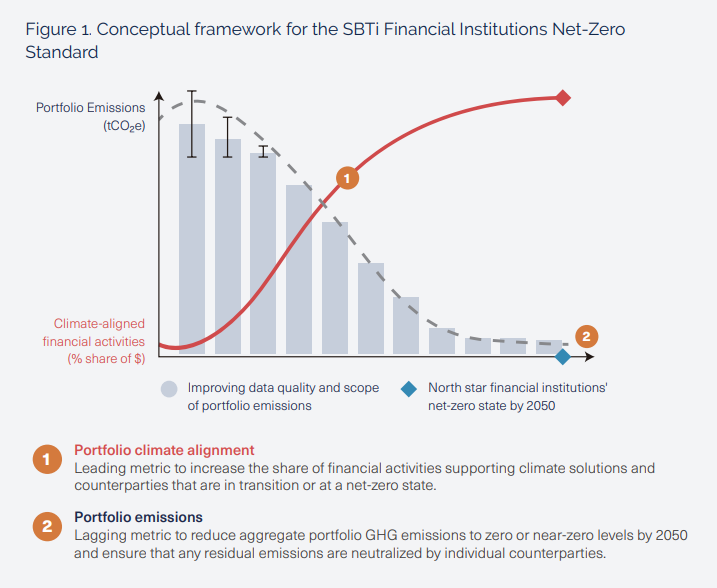

To address this gap, the new SBTi standard offers targeted requirements for financial institutions to set both near- and long-term climate targets. These are designed to align their portfolios with a 1.5°C pathway through tailored approaches such as portfolio climate alignment and sector-specific benchmarks.

Key Requirements of the Net-Zero Standard

Covered Financial Activities

The standard applies to any entity deriving 5% or more of its revenue from key financial services. These include lending, asset owner and asset manager investing, insurance underwriting, and capital market activities. These five categories represent the most influential levers financial institutions have to reduce financed emissions across the global economy.

Target Setting Obligations

Institutions are required to set two types of targets. Near-term targets are designed with a five-year horizon to catalyze early action and accountability. Long-term targets require that all financed counterparties achieve net-zero emissions by 2050, including the neutralization of any residual emissions that remain.

In addition to these timelines, institutions must ensure comprehensive coverage. All activities in high-impact sectors such as fossil fuels, heavy industry, and real estate must be included. For how targets are structured, financial institutions can choose between two complementary methods:

- Portfolio climate-alignment targets, which measure the percentage of counterparties categorized as “in transition,” aligned, or already net-zero

- Sector-specific targets, which define emissions reduction pathways for sectors like cement, steel, and aviation

Engagement First, Divestment Later

A central tenet of the standard is its “engagement first” approach. Rather than immediately pulling capital from high-emitting companies, financial institutions are expected to use their influence to steer those entities toward decarbonization. This is done by requiring portfolio companies to adopt science-based targets, actively engaging through shareholder dialogue and voting, and developing escalation strategies for persistent noncompliance.

If these efforts fail and the company shows no meaningful transition, divestment becomes a necessary last resort.

Policies for Fossil Fuels, Deforestation, and Real Estate

Fossil Fuel Policy Requirements

The fossil fuel financing policy includes strict measures. Financial institutions must immediately end new finance for coal expansion projects. They are also required to halt project finance for oil and gas expansion activities, such as exploration and liquefied natural gas terminals. Additionally, they must commit to phasing out general-purpose finance for oil and gas expansion companies by 2030.

Deforestation Risk Management

To address deforestation exposure, institutions are expected to assess and disclose any links to deforestation by 2030 at the latest. Where significant exposure exists, a formal engagement plan must be published. This ensures accountability and encourages portfolio companies to adopt no-deforestation commitments aligned with global standards.

Real Estate Policy (Recommended)

The standard also provides guidance for the built environment. Financial institutions are encouraged to stop financing new buildings that are not designed to be zero-carbon-ready. Furthermore, they should shift capital toward retrofitting existing real estate assets, focusing on energy efficiency and the elimination of fossil fuel-based infrastructure.

Reporting, Validation, and Progress Tracking

Validation Model

Target validation occurs in three stages. First is the initial validation, which takes place when targets are first submitted. Next comes renewal validation, required at least every five years or after significant organizational changes. Finally, the net-zero year validation serves as the final checkpoint, confirming that the institution has achieved its long-term goals.

Annual Reporting

To support transparency, institutions must publicly disclose key metrics on an annual basis. This includes:

- Greenhouse gas emissions by sector

- Ratios comparing fossil fuel to clean energy exposure

- Levels of deforestation exposure within portfolios

All reporting must be backed by approved climate-alignment methodologies, such as those provided by PCAF and the Net-Zero Data Public Utility.

How This Differs from Corporate Net-Zero Standards

| Aspect | Corporate Net-Zero Standard | Financial Institutions Net-Zero Standard |

|---|---|---|

| Primary Emissions Focus | Scope 1, 2, and Scope 3 (categories 1-14) | Scope 3 Category 15 (financed emissions) |

| Main Decarbonization Lever | Operational efficiency, value chain engagement | Capital allocation through financial services |

| Target Types | Near-term (5-10 years), Long-term (net-zero by 2050) | Near-term per financial activity; long-term portfolio-wide |

| Policy Requirements | Encouraged but optional fossil fuel and deforestation policies | Mandatory fossil fuel financing restrictions and deforestation risk disclosure |

| Approach to Emissions Control | Direct control over operations and suppliers | Influence via engagement; divestment as last resort |

| Validation Scope | Entity’s full operational footprint | Organizational and portfolio boundaries by activity type |

Conclusion

The SBTi Financial Institutions Net-Zero Standard is more than a compliance checklist. It’s a strategic transformation guide that enables financial institutions to embed credible, science-aligned targets across their value chains. This empowers them to accelerate the decarbonization of the real economy, mitigate climate-related financial risks, and enhance stakeholder trust. The message is clear: institutions that act now will not only lead in sustainability, but also in financial resilience.