- Article Summary

-

In 2025, the sustainability disclosure landscape for small and medium-sized enterprises (SMEs) is undergoing a transformation. While most mandatory ESG reporting regulations have targeted large corporations, the European Commission has introduced the Voluntary Sustainability Reporting Standard for SMEs (VSME) as part of its broader effort to support non-listed and smaller businesses in aligning with the EU Green Deal. This article unpacks the implications of VSME, explains its value, and provides a roadmap for SMEs to take advantage of this voluntary framework without being overwhelmed.

What Is VSME and Why It Matters

VSME is a simplified reporting standard developed by the European Financial Reporting Advisory Group (EFRAG) specifically for SMEs. Introduced in early 2025, it is designed to be flexible, accessible, and scalable, accommodating a wide variety of SME structures and sectors.

| Feature | Description |

|---|---|

| Voluntary Nature | Reporting is not legally required, but strongly encouraged |

| Alignment | Consistent with CSRD and ESRS (European Sustainability Reporting Standards) |

| Focus Areas | Environmental, Social, and Governance topics relevant to SMEs |

| Intended Users | Non-listed SMEs, especially those in corporate supply chains |

Why it matters:

- Buyers and banks are increasingly requesting ESG data from SME partners.

- SMEs can use VSME to improve transparency, access green finance, and prepare for future regulations.

- Adoption of VSME can reduce reporting burdens by aligning with common expectations.

Strategic Benefits for SMEs

Engaging with VSME offers more than just compliance readiness. Key advantages include:

- Enhanced Credibility

Structured reporting builds trust with customers, investors, and stakeholders. - Operational Improvements

Mapping ESG risks and impacts leads to better risk management and resource efficiency. - Competitive Differentiation

SMEs using VSME can stand out in procurement processes and investor evaluations. - Pre-regulatory Preparation

Voluntary reporting serves as a training ground for future compliance under CSRD or sector-specific rules. - Investor Attraction

Banks and investors favor SMEs that demonstrate ESG maturity, especially when aligned with EU standards.

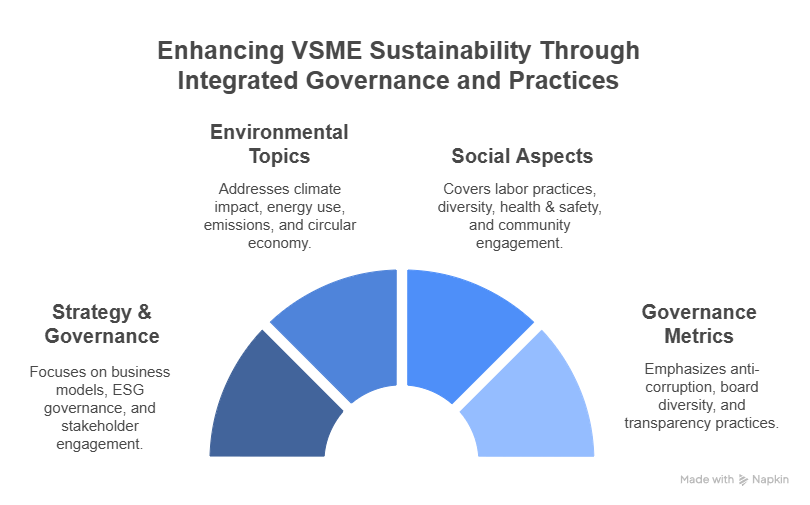

Key Components of the VSME Framework

The VSME standard includes the following structured modules:

| Module | Content |

| Strategy & Governance | Business model, ESG governance, and stakeholder engagement |

| Environmental Topics | Climate impact, energy use, emissions, circular economy measures |

| Social Aspects | Labor practices, diversity, health & safety, local community engagement |

| Governance Metrics | Anti-corruption, board diversity, transparency practices |

Each module contains narrative disclosures and basic quantitative metrics tailored to SME capacity and proportionality.

How to Get Started with VSME Reporting

A step-by-step approach for SMEs:

- Familiarize with the Framework

Download the VSME draft standard and understand its sections. - Engage Internal Stakeholders

Involve finance, HR, operations, and leadership in assessing data availability. - Conduct Materiality Analysis

Identify ESG topics most relevant to your business and stakeholders. - Pilot Reporting

Use available templates to prepare a mock report as an internal exercise. - Collect and Refine Data

Focus on key KPIs, such as energy usage, workforce statistics, and governance indicators. - Communicate Transparently

Share progress in sustainability updates, buyer questionnaires, or funding applications.

Conclusion

The VSME framework offers SMEs a vital opportunity to engage with sustainability in a structured but flexible way. Far from being a burden, it provides SMEs with a platform to build credibility, improve performance, and align with emerging expectations from regulators and value chain partners.

By adopting VSME today, SMEs can future-proof their operations, enhance their ESG narrative, and contribute to a more transparent and sustainable European economy.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.