- Article Summary

-

Introduction

The United States has seen a rapid expansion in domestic solar manufacturing capacity over the past several years. New facilities for modules, cells, and other key components have been announced across multiple states, driven largely by federal tax incentives designed to strengthen clean energy supply chains. This growth has positioned solar manufacturing as both an industrial policy success and a pillar of national decarbonization efforts.

At the same time, recent shifts in tax credit guidance and growing political uncertainty have introduced new risks for manufacturers, investors, and corporate buyers. While momentum remains strong, questions are emerging around the durability of incentives that underpin long term planning. For businesses with climate targets and supply chain emissions responsibilities, these uncertainties are becoming an increasingly important consideration.

Federal Tax Credits as a Catalyst for Domestic Solar Manufacturing

Federal tax credits have played a central role in reshaping the US solar manufacturing landscape. Production based incentives and investment credits lowered upfront capital costs and improved project economics, making domestic facilities more competitive with overseas suppliers. As a result, manufacturers committed billions of dollars toward new plants covering multiple stages of the solar supply chain.

This incentive driven expansion extended beyond final module assembly. Companies announced investments in ingots, wafers, cells, trackers, and other balance of system components. The emergence of a more complete domestic supply chain reduced dependence on imports and shortened logistics routes, aligning industrial growth with broader climate and energy security objectives.

For businesses operating within or alongside the clean energy sector, predictable tax policy reduced uncertainty and enabled long term supplier relationships. Stable incentives allowed manufacturers to scale production while corporate buyers gained confidence in the availability of domestically produced solar equipment.

Market Momentum Meets Early Signs of Caution

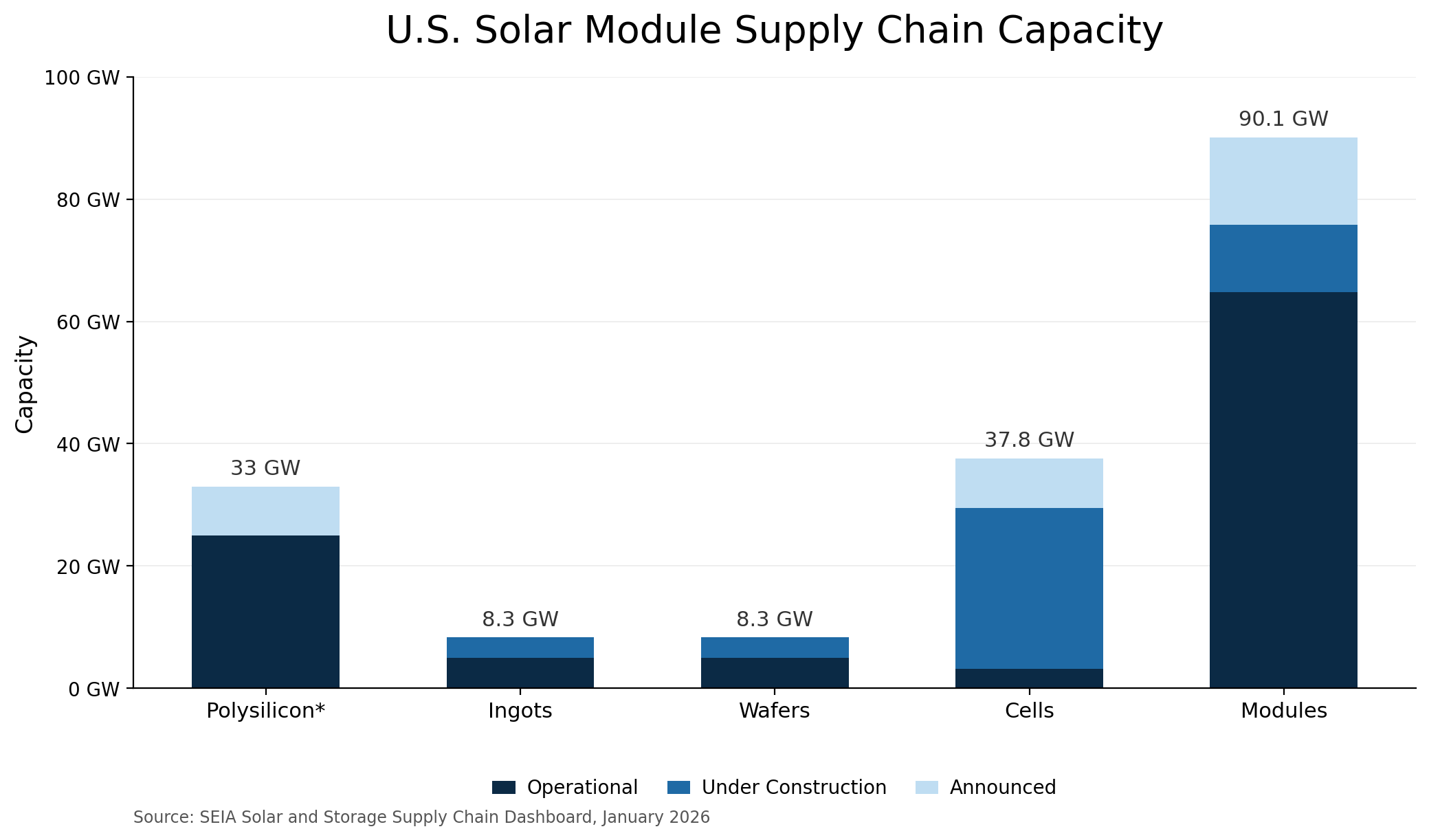

The latest data points to substantial and broad based growth in US solar manufacturing capacity. New figures from the Solar Energy Industries Association show that the entire solar supply chain has effectively been reshored, with manufacturing capacity expanding across every major segment of the solar and storage value chain since the end of 2024.

As of October 2025, domestic solar module production capacity in the United States surpassed 60 gigawatts, representing a 37 percent increase compared to December 2024 levels. Growth has not been limited to modules. Solar cell manufacturing capacity more than tripled over the same period, rising from 1 gigawatt to 3.2 gigawatts. Capacity additions have also been recorded across inverters, trackers, and energy storage components, reinforcing the emergence of a more complete domestic supply chain.

Despite this strong momentum, early signs of caution are emerging. Some manufacturers are reassessing expansion timelines as policy signals shift and long term incentive structures become less certain. While few projects have been halted, delays and more conservative capital allocation suggest that policy uncertainty is beginning to influence investment decisions.

For the market, this creates a mixed outlook. Capacity growth continues at scale, but the pace and sequencing of future investments may slow if incentives are perceived as unstable. This uncertainty affects not only manufacturers but also downstream companies that rely on domestic solar equipment to meet renewable energy goals.

Policy Uncertainty as a Business and ESG Risk

Shifting federal policy frameworks introduce more than short term financial risk for the solar manufacturing sector. Recent legislative developments have added new layers of uncertainty for companies planning multi year investments and supply agreements.

One of the most significant uncertainties is President Donald Trump’s One Big Beautiful Bill Act. The legislation accelerates the phase out of the Investment Tax Credit for solar projects that begin construction after 2027 and raises content requirements tied to the Domestic Content Bonus. While the bill preserves the Section 45X Advanced Manufacturing Production Credit for solar manufacturers, it also introduces new exclusions for businesses with links to Foreign Entities of Concern. These provisions complicate compliance planning and could limit access to incentives for some suppliers.

At the same time, the administration’s widely publicized tariffs introduce a countervailing dynamic. Increased trade barriers may offer a degree of market protection for domestic manufacturers by reducing exposure to international competition. For some companies, this could partially offset the impact of tighter tax credit rules, though the net effect remains uncertain.

From an ESG and governance perspective, this policy mix heightens supply chain risk. Manufacturers face challenges forecasting production volumes and emissions intensity, while corporate buyers must reassess procurement strategies tied to long term decarbonization pathways. Clear and consistent policy signals support resilience and planning, while uncertainty raises questions about risk management and long term supplier viability.

Implications for Corporate Decarbonization and Scope 3 Planning

For corporate sustainability leaders, developments in solar manufacturing policy have practical implications. Renewable energy procurement strategies depend on the availability, cost, and emissions profile of equipment. Changes in manufacturing momentum can affect project timelines and carbon accounting assumptions.

As supply chains adjust, companies may need to adopt scenario based planning that accounts for different policy outcomes. This includes evaluating alternative suppliers, updating emissions factors, and strengthening data collection across the value chain. Improved visibility into supplier emissions becomes critical when market conditions shift.

Key considerations for corporate decarbonization and Scope 3 planning include:

- Supplier diversification to reduce reliance on a single manufacturing geography

- Reassessment of emissions factors as domestic and international supply mixes change

- Greater scrutiny of supplier level emissions data and reporting quality

- Scenario analysis to account for policy driven shifts in availability and pricing

- Alignment between procurement teams and sustainability teams on long term decarbonization goals

Carbon management platforms and standardized reporting processes can help organizations navigate these changes. By maintaining accurate and flexible emissions data, companies are better positioned to respond to policy driven disruptions while staying aligned with climate targets.

Conclusion

US solar manufacturing growth demonstrates how targeted incentives can accelerate industrial development and support decarbonization goals. The current wave of investment highlights the effectiveness of tax credits in reshoring clean energy supply chains and enhancing emissions transparency.

At the same time, evolving policy guidance underscores the importance of predictability. For manufacturers, investors, and corporate buyers, long term confidence in incentives is essential for sustained growth. As companies pursue ambitious climate commitments, understanding and managing policy risk will remain a core component of effective ESG and carbon strategies.

Why Work with ASUENE Inc.?

ASUENE is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. The company serves over 10,000 clients worldwide with an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.