- Article Summary

-

Overview

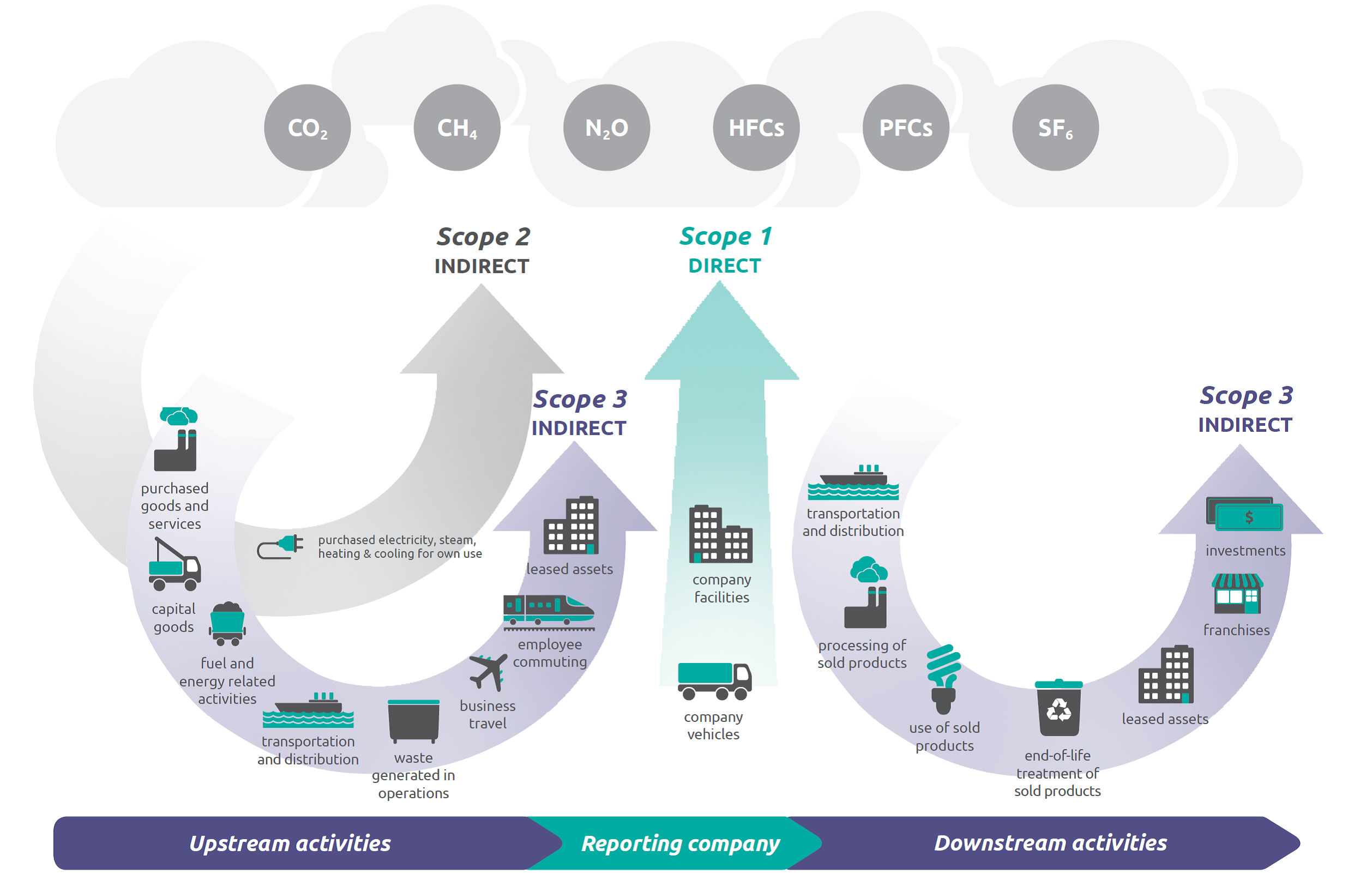

Scope 3 emissions, which include all indirect greenhouse gas (GHG) emissions occurring in the value chain of a reporting company, are often the largest contributor to a company’s total carbon footprint. Despite this, they remain the most challenging to quantify accurately. As regulatory demands increase in the United States and Europe, particularly with frameworks such as the EU’s Corporate Sustainability Reporting Directive (CSRD) and the anticipated SEC climate disclosure rules, the pressure is mounting for companies to understand and report Scope 3 emissions with greater precision. This article explores why Scope 3 is so difficult to calculate, and how challenges differ across key sectors.

The Scope 3 Landscape: Categories and Common Barriers

Scope 3 emissions span 15 categories, from purchased goods and services to use of sold products and end-of-life treatment. The variety of activities covered and their position outside the direct control of a company are central to the difficulty in calculating these emissions.

One major obstacle is data availability. Most companies lack direct access to emissions data from their suppliers or customers, making it hard to build a complete picture of their Scope 3 footprint. Even when such data is available, its quality often poses a problem. It may be incomplete, outdated, or based heavily on assumptions rather than primary measurements.

Compounding these issues is the inherent complexity of modern supply chains. Globalized and multi-tiered networks introduce layers of opacity, making traceability and transparency challenging. Methodological gaps remain a significant concern as well. There is limited standardization in emission factors and calculation methods, which hinders comparability and accuracy across industries and geographies.

To overcome these hurdles, companies often rely on secondary data, spend-based estimates, or industry averages, which sacrifice accuracy for feasibility. While helpful for initial scoping, such methods often fail to support long-term decarbonization strategies.

Sector by Sector: Unique Scope 3 Challenges Across Industries

The pain points in Scope 3 emissions calculations vary significantly by industry, depending on the structure of value chains, product lifecycles, and reliance on third parties.

- Fashion and Apparel: This sector faces intense scrutiny due to its complex global supply chains. Most emissions occur during raw material extraction, dyeing, and manufacturing—often in countries with limited emissions data transparency.

- Technology and Electronics: Scope 3 challenges revolve around component-level emissions and product use-phase emissions, which can span several years and geographies.

- Financial Services: As investors, banks must account for financed emissions, which are technically Scope 3 but require entirely different calculation methodologies (e.g., PCAF standards).

- Automotive: Beyond supply chain emissions, the use-phase emissions from vehicles dominate the Scope 3 footprint. Tracking these emissions involves assumptions about vehicle lifespan, usage patterns, and fuel types.

- Food and Agriculture: Land-use change, farming practices, and downstream refrigeration logistics all contribute to the sector’s Scope 3 complexity. Emissions vary widely by commodity and geography.

Regulatory Momentum: Rising Expectations for Scope 3 Reporting

Recent policy developments are raising the bar on Scope 3 disclosure. In the EU, CSRD mandates large companies to disclose Scope 3 emissions starting in 2025, while in the US, the SEC’s proposed rules may require Scope 3 reporting if deemed material or included in climate targets. This shift from voluntary to mandatory disclosure accelerates the need for better tools, supplier collaboration, and auditable methodologies.

A number of regulatory trends are shaping the future of Scope 3 reporting. One key shift is the emphasis on double materiality, which requires companies to consider both how sustainability issues affect their financial performance and how their activities impact the environment and society. Forward-looking metrics are also gaining importance, encouraging firms to disclose projected emission trends and decarbonization pathways.

In addition, there is growing alignment with global reporting standards, notably the International Sustainability Standards Board’s (ISSB) IFRS S2 and the European Financial Reporting Advisory Group’s (EFRAG) European Sustainability Reporting Standards (ESRS). These frameworks aim to harmonize disclosure practices and improve comparability across jurisdictions.

Lastly, regulators are increasingly requiring third-party assurance for greenhouse gas disclosures, ensuring the reliability and integrity of reported data. This trend reinforces the need for robust internal processes and verifiable data sources.

Toward Better Accuracy: Innovations and Strategic Approaches

To achieve greater accuracy in Scope 3 emissions reporting, companies are embracing a range of advanced tools, methodologies, and collaborative initiatives that bridge current data and methodology gaps. One promising avenue is the rise of supplier engagement platforms. These tools are designed to streamline the collection of primary emissions data directly from upstream partners, improving data granularity and enabling real-time tracking. Enhanced supplier collaboration also builds the foundation for longer-term decarbonization initiatives.

Another critical innovation is the integration of life cycle assessment (LCA) methodologies into corporate emissions accounting. LCAs provide detailed, product-level insights that extend from raw material extraction through to end-of-life disposal. This level of specificity is crucial for identifying emissions hotspots and making data-driven decisions around product design, sourcing, and logistics.

Artificial intelligence and machine learning are also playing an increasing role in refining emissions estimates. AI can process vast amounts of secondary data, predict gaps in supplier information, and generate more reliable projections. When integrated with existing enterprise resource planning (ERP) systems, these algorithms can help automate data collection and ensure consistency in reporting.

In parallel, many companies are joining forces through industry coalitions and open-data platforms to standardize emission factors and share best practices. Examples include Catena-X in the automotive sector and the Higg Index in apparel, which provide shared databases and calculation methodologies tailored to specific industry needs.

Ultimately, achieving accuracy in Scope 3 accounting is not just a matter of technology but of organizational commitment and cross-sector alignment. Leadership buy-in, internal capacity building, and continuous stakeholder engagement are essential to make emissions data both actionable and auditable. sector-specific standards and databases (e.g., Catena-X in automotive, Higg Index in apparel).

Conclusion: Embracing the Complexity to Drive Climate Action

While Scope 3 emissions remain a formidable challenge, understanding their complexity is the first step toward action. Sector-specific strategies, investment in better data infrastructure, and alignment with emerging regulatory frameworks are essential. Companies that commit to transparency and innovation today will be better positioned to lead in the low-carbon economy of tomorrow. As Scope 3 reporting becomes a norm rather than an exception, the ability to calculate and act on these emissions will be a key differentiator in both compliance and credibility.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, helping collect primary emissions data with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.