- Article Summary

-

Carbon Credits: Bridging the Gap to Climate Targets

Carbon credits represent a crucial mechanism for mitigating global climate change by quantifying greenhouse gas (GHG) emissions reductions or removals. With the European Commission pursuing an ambitious goal of reducing emissions by 90% by 2040, a limited role for high-quality international carbon credits will be permitted starting from 2036. They intend to ensure that these credits adhere to strict standards to maintain environmental integrity. Moreover, the use of domestic permanent removals within the EU Emissions Trading System (EU ETS) will also become increasingly important, reflecting the EU’s commitment to supporting local and verifiable emissions reduction projects to achieve long-term sustainability goals.

Types of Carbon Credits

| Category | Type | Description | Example Projects |

|---|---|---|---|

| Based on Market Origin | Compliance Carbon Credits | Credits within regulated markets mandated by governmental bodies like the EU ETS. | Heavy industry, power generation, aviation sectors |

| Voluntary Carbon Offset Credits | Credits purchased voluntarily by companies and individuals to offset emissions. | Corporate ESG strategies, consumer carbon offsetting | |

| Based on Project Type | Renewable Energy Credits (RECs) | Credits from renewable energy generation, allowing renewable claims irrespective of electricity source. | Wind farms, solar installations |

| Carbon Removal and Sequestration Credits | Credits from removing carbon dioxide from the atmosphere through nature-based or technological solutions. | Afforestation, Direct Air Capture (DAC) | |

| Avoidance and Reduction Credits | Credits from projects that avoid emissions otherwise likely to occur. | REDD+ forest conservation, energy efficiency, methane capture projects |

Carbon Credits Based on Market Origin

Compliance Carbon Credits

Compliance carbon credits are traded within regulated markets established under mandatory emission reduction schemes, notably the European Union Emissions Trading System (EU ETS). Entities participating in these schemes, primarily heavy industry, power generation, and aviation sectors, must either reduce their emissions or purchase allowances or credits to offset excess emissions.

The EU ETS, strengthened significantly from 2025 onwards, emphasizes transparency and stricter monitoring, reporting, and verification (MRV) requirements, reducing loopholes such as double counting and enhancing market credibility.

Voluntary Carbon Offset Credits

In contrast, voluntary carbon offset credits are purchased by organizations and individuals voluntarily to offset their carbon footprint or pursue corporate ESG and sustainability goals. The market has grown rapidly, driven by increased consumer awareness, corporate climate pledges, and net-zero commitments.

Widely recognized standards such as the Verified Carbon Standard (VCS) and the Gold Standard ensure high-quality voluntary offsets, encouraging confidence and participation from businesses globally.

Carbon Credits Based on Project Type

Renewable Energy Credits (RECs)

Renewable Energy Credits represent renewable electricity generation, supporting the transition to sustainable energy. They allow businesses and governments to claim renewable energy usage irrespective of their direct source of electricity.

Prominent examples include wind, solar, hydroelectric, and biomass energy projects. These credits help incentivize renewable investment, with transparent certification essential to maintain trust and market effectiveness.

Carbon Removal and Sequestration Credits

Carbon sequestration credits originate from projects that actively remove carbon dioxide from the atmosphere. Nature-based solutions like afforestation, reforestation, soil carbon enhancement, and coastal ecosystem restoration play significant roles. Technological approaches like direct air capture (DAC) and carbon capture and storage (CCS) are rapidly gaining importance.

Avoidance and Reduction Credits

Avoided emissions credits are generated by projects that prevent emissions that would otherwise occur. These include conservation projects under the REDD+ framework, energy efficiency improvements, and methane capture projects.

These credits demand rigorous verification and ongoing monitoring to ensure their long-term validity and effectiveness, enhancing market credibility.

Challenges and Regulatory Safeguards: Ensuring Carbon Credit Integrity

Despite their potential, carbon credits face significant scrutiny regarding additionality, permanence, double counting, and transparency. The European Commission has introduced stringent regulatory frameworks from 2025 onward to mitigate these risks. Enhanced MRV guidelines, robust independent verification processes, and international cooperation on standardization are critical in maintaining carbon credit market integrity.

Global Regulatory Landscape: International Carbon Credit Regulations

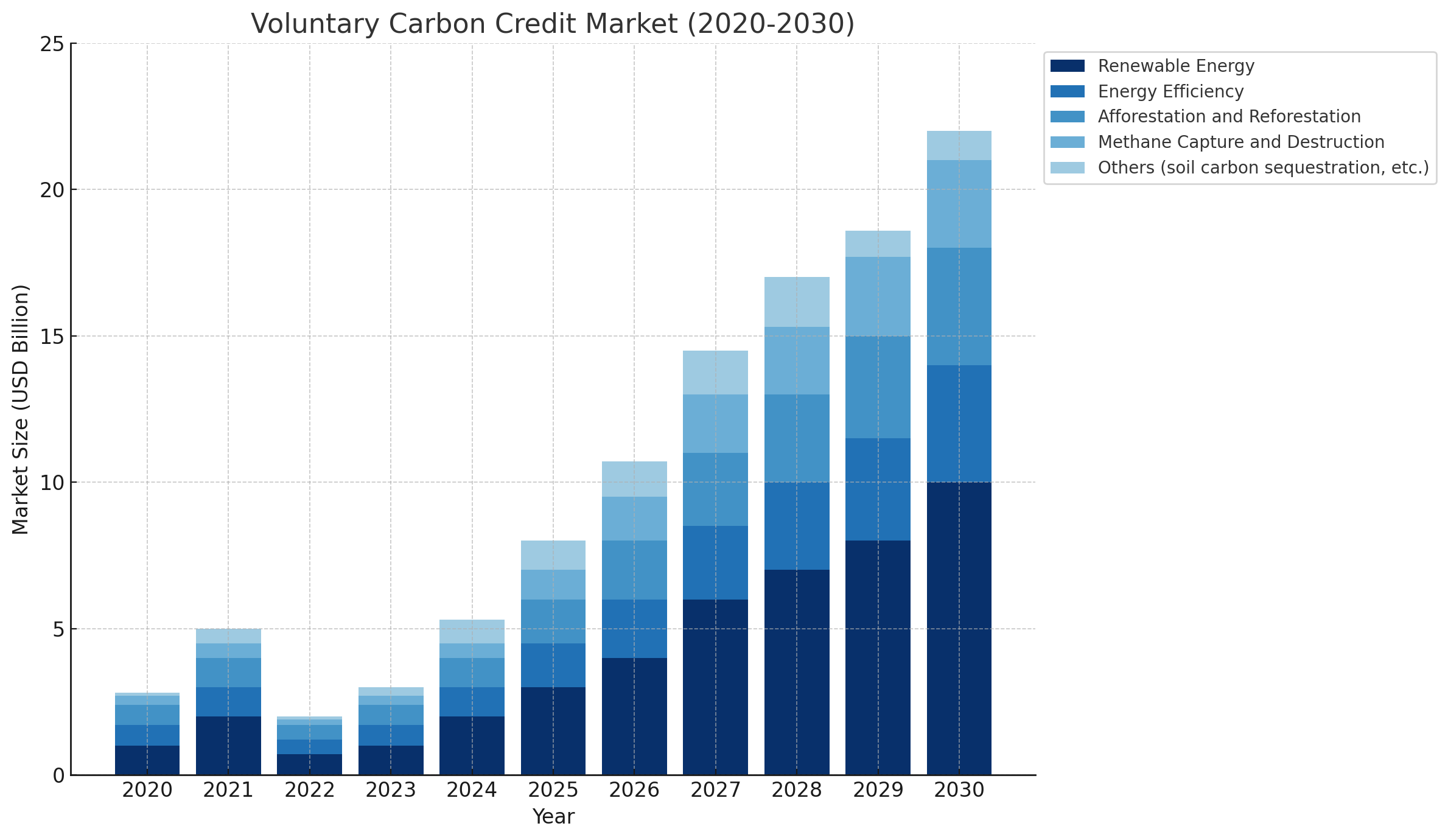

The carbon credit market is projected to expand dramatically, driven by regulatory support, corporate sustainability commitments, and technological advancements. Renewable energy and carbon sequestration credits, particularly technological innovations like direct air capture, are forecasted to see substantial growth.

Various global regulatory frameworks shape the carbon credit landscape, including:

- United States: California Cap-and-Trade Program, Regional Greenhouse Gas Initiative (RGGI).

- Canada: Federal carbon pricing, including the Output-Based Pricing System (OBPS).

- Asia: China’s National Emissions Trading Scheme, Japan’s Joint Crediting Mechanism (JCM).

- Australia: Emissions Reduction Fund and Safeguard Mechanism.

- Latin America: Brazil’s RenovaBio program, Mexico’s national emissions trading system.

Each jurisdiction adopts distinct regulatory approaches, influencing carbon market participation, compliance standards, and project validation criteria.

Integrating Carbon Credits into Corporate ESG Strategies

Effectively integrating carbon credits into ESG and sustainability strategies requires careful planning and strategic alignment with corporate objectives. Organizations must:

- Evaluate their emissions accurately

- Identify suitable carbon credit projects aligned with their sustainability values

- Ensure transparency through reputable certification standards

Industry leaders such as Microsoft, Google, and Unilever serve as exemplary cases demonstrating strategic and impactful carbon credit use. Microsoft, for example, has heavily invested in nature-based carbon sequestration and direct air capture projects to achieve its carbon-negative goals. Google has primarily focused on renewable energy credits, ensuring its global data centers are powered entirely by renewable sources. Unilever has engaged extensively in avoidance and reduction credits, supporting sustainable agriculture and forest conservation projects globally.

Conclusion: Carbon Credits as Catalysts for Europe’s Climate Leadership

Carbon credits will be essential for Europe’s ambitious 2040 emissions reduction targets. As market standards evolve and innovations advance, these credits will enable significant climate actions, driving corporate sustainability efforts, regulatory compliance, and overall global climate resilience. Ensuring integrity, transparency, and innovation will remain paramount in maximizing their environmental impact and effectiveness.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.