- Article Summary

-

Overview: Climate Risk as a Strategic Business Catalyst

As the effects of climate change become more pronounced and regulatory frameworks mature in the United States and Europe, climate risk has shifted from an environmental concern to a critical business issue. Climate risks generally fall into two categories:

- Physical risks come from the direct effects of climate change, like floods, droughts, heatwaves, and storms that can damage facilities, disrupt operations, or reduce resource availability.

- Transition risks arise from the shift toward a low-carbon economy, including new climate laws, carbon taxes, technology changes, and evolving consumer preferences.

Understanding the organization’s carbon footprint is fundamental to climate resilience. Carbon accounting and life cycle assessment (LCA) are essential tools that allow businesses to quantify emissions across their value chains and identify the most effective pathways for emissions reductions. This article explores how companies can move from reactive risk mitigation to proactive opportunity creation through robust climate resilience strategies rooted in data transparency.

The Financial and Operational Costs of Climate Inaction

The financial implications of physical risks are no longer hypothetical. According to Munich Re, global insured losses from natural catastrophes in 2023 reached over $95 billion, with significant impacts across the U.S. and Europe. Chronic physical risks, such as prolonged droughts and temperature extremes, are degrading agricultural productivity and stressing water-intensive industries. Natural disasters from hurricanes to floods have caused severe disruptions in logistics and energy infrastructure.

Meanwhile, transition risks are manifesting rapidly. The EU’s Corporate Sustainability Reporting Directive (CSRD), in effect from 2025, and the SEC’s proposed climate disclosure rules in the U.S., are redefining corporate transparency standards. Both include requirements for detailed greenhouse gas (GHG) emissions disclosure. Without carbon accounting systems in place, companies risk non-compliance and financial penalties.

A McKinsey study projects that sectors like automotive, energy, and real estate could see profit pool contractions of up to 60% by 2030 if transition pathways are not adequately managed. Accurate carbon accounting is a prerequisite to understanding exposure to these transition risks and determining cost-effective emissions reduction strategies.

Embedding Resilience in Enterprise Risk and Strategy

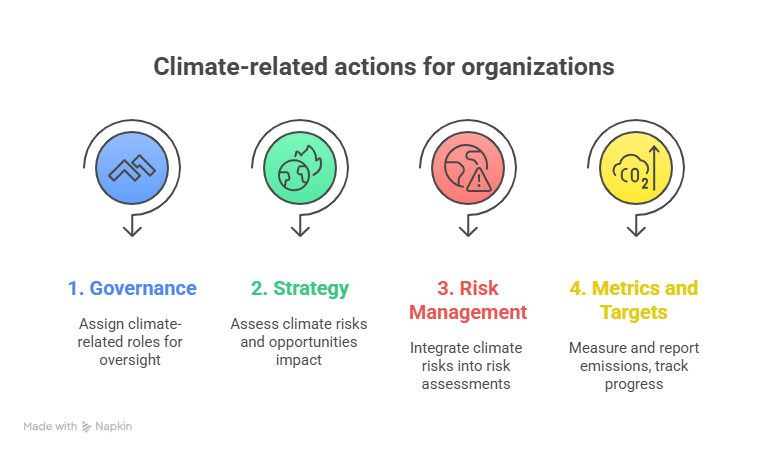

To structure effective climate resilience strategies, companies can follow the four key pillars recommended by the Task Force on Climate-related Financial Disclosures (TCFD):

- Governance: Assign climate-related roles to board members and executives to ensure clear oversight and accountability.

- Strategy: Use scenario analysis to assess how climate risks and opportunities could impact operations, supply chains, and markets.

- Risk Management: Integrate climate risks—both physical and transition—into enterprise risk assessments and decision-making.

- Metrics and Targets: Measure and report emissions using carbon accounting for Scopes 1, 2, and 3. Track progress with science-based targets and use LCA to guide reductions.

Case Studies: Resilience in Action

| Company | Climate Resilience Strategy |

|---|---|

| Schneider Electric | Identifies supply chain risks and uses LCAs and Scope 3 carbon data to guide investments. |

| Ford Motor Company | Uses emissions tracking and scenario planning to support a $50 billion EV transition. |

| Nestlé | Tracks full value chain emissions to support sustainable agriculture and low-carbon logistics. |

These companies show that using data on emissions and climate risk helps not just in avoiding losses, but also in capturing new business opportunities.

The Road Ahead: Digital Tools, Regulation, and Investor Pressure

Climate resilience is becoming more important due to new rules, investor expectations, and better technology. Governments in the U.S. and Europe are creating consistent rules that require companies to share clear and detailed information about their climate risks and how they are addressing them.

At the same time, investors want to see that companies are serious about climate risk. They look for solid data, especially on carbon emissions, to decide where to invest. Companies that cannot provide this data may struggle to attract funding.

Technology is also making it easier to track climate risks and carbon emissions. Tools like artificial intelligence, satellite images, and digital carbon trackers help companies understand their risks and plan smarter actions.

Many financial products, like green loans and ESG-linked bonds, now require strong climate strategies and emissions reporting. Companies that invest in these areas will be better positioned to meet expectations and access new funding opportunities.

Conclusion: Reframing Climate Risk as a Value Driver

Climate resilience is no longer optional. It is a strategic imperative that allows companies to safeguard operations, meet regulatory demands, and seize new opportunities in the evolving green economy. Organizations that proactively embed resilience into their core strategy and have an accurate understanding of their carbon footprint will not only weather the storms ahead but emerge as leaders in the climate transition era.

From boardrooms to supply chains, climate resilience offers a lens to reimagine risk; not as a constraint, but as a catalyst for sustainable value creation.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.