- Article Summary

-

Trump’s Executive Order Reshapes the Climate Policy Landscape

In March 2025, the Trump Administration issued a groundbreaking executive order aimed at limiting state-level climate and energy regulations. Framed under the banner of “economic freedom” and “energy independence,” the new directive, informally dubbed the “State Climate Policy Suppression Order,” seeks to curtail progressive climate policies developed by states like California and New York. By targeting regulations such as Scope 3 emissions disclosure and climate risk reporting, Trump has initiated a seismic shift in America’s climate governance structure. Immediate reactions from state governments, corporations, and investors have been swift and polarized, signaling the start of an intense legal and political battle over the future of environmental regulation in the United States.

California and New York in the Crosshairs

California and New York, long-standing leaders in climate legislation, find themselves directly in the crosshairs of the new federal intervention. California’s SB 253, mandating comprehensive Scope 1-3 emissions disclosures for large companies, and SB 261, requiring climate-related financial risk disclosures, are both facing unprecedented federal challenges. Meanwhile, New York’s ambitious Climate Leadership and Community Protection Act, targeting aggressive greenhouse gas reductions, is also under threat.

In response, California’s Attorney General has filed a lawsuit claiming that the federal action is unconstitutional, setting the stage for a high-stakes legal confrontation. Other states like Washington, Massachusetts, and Colorado, which have enacted their own climate policies, are watching closely, considering similar legal and legislative countermeasures.

U.S. State Climate and ESG Regulation Map (as of March 2025)

| State | Regulation Type | Status Post-Order |

|---|---|---|

| California | Scope 1-3 Emissions Disclosure, Climate Risk Reporting | Sued Federal Government |

| New York | Emissions Reduction Mandates | Under Review |

| Washington | Climate Risk Reporting Requirements | Monitoring Developments |

| Massachusetts | Net-Zero Emissions Targets | Monitoring Developments |

| Colorado | Renewable Energy Mandates | Monitoring Developments |

Trump’s Strategy: Shifting Federal Energy Priorities

Alongside the executive order, the Trump Administration directed the Department of Energy to halt federal support for clean energy initiatives, including programs for wind, solar, battery storage, and hydrogen development. This marks a sharp reversal from the Biden era, where such technologies received substantial backing. Instead, Trump’s policy realignment emphasizes the revitalization of fossil fuel industries, providing favorable subsidies and accelerating pipeline approvals.

The justification presented is the reduction of regulatory burdens and the strengthening of national energy security. However, critics argue that these moves severely compromise America’s long-term competitiveness in clean technology markets and derail its climate commitments.

Comparison of Federal Energy Policies

| Policy Area | Biden Administration (2021-2024) | Trump Administration (2025-) |

| Renewable Energy Funding | High | Eliminated |

| Fossil Fuel Subsidies | Phased Out | Expanded |

| Emissions Reduction Targets | Aggressive (Net-Zero by 2050) | Removed |

| Federal Climate Risk Disclosures | Mandatory | Suspended |

Global Perspective: Divergence from International Climate Standards

The regulatory rollback initiated by Trump places the U.S. at odds with global climate governance trends. The European Union’s Corporate Sustainability Reporting Directive (CSRD), the IFRS Foundation’s International Sustainability Standards Board (ISSB) guidelines, and the Carbon Disclosure Project (CDP) initiatives all continue to push for more stringent climate-related disclosures.

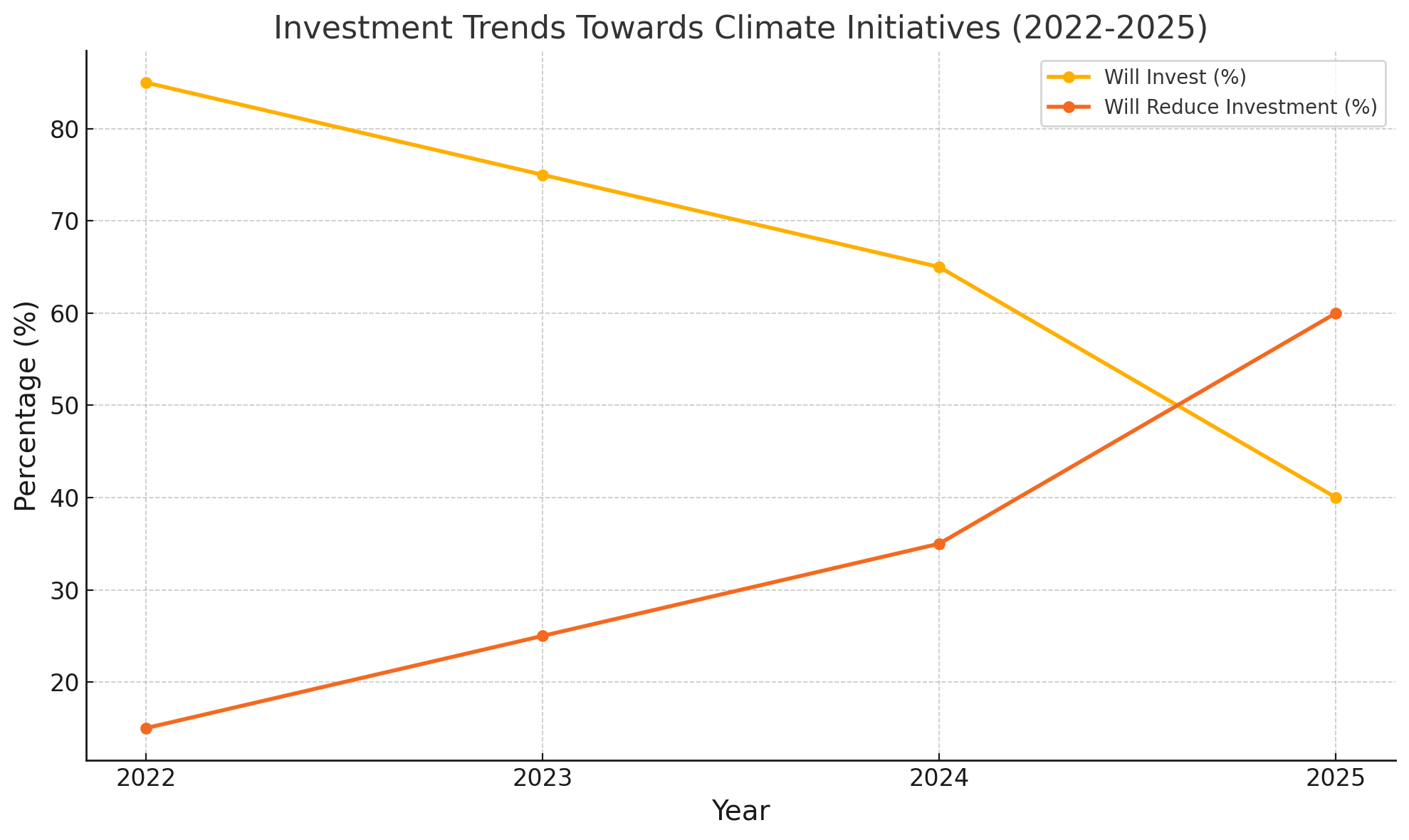

Investors worldwide are increasingly recalibrating their strategies. A recent survey showed that nearly 65% of ESG-focused institutional investors plan to reduce exposure to U.S. assets if climate risk disclosures weaken further.

Investor Survey – Willingness to Invest in Countries with Climate Policy Rollbacks (2022-2025)

The rising divergence between U.S. and international standards may lead to fragmentation of global supply chains, as multinational companies seek to maintain compliance with stricter jurisdictions such as the EU and Japan, further marginalizing the U.S. market.

Conclusion: Navigating the New ESG Landscape under Trump’s America

For corporations operating in the United States, the regulatory environment has become a labyrinth of conflicting requirements. Companies must now choose whether to adhere to weakened federal standards, comply with defiant state laws, or align with stringent international expectations.

Prudent companies are choosing to maintain or even enhance their climate-related disclosures, viewing robust ESG practices not as regulatory burdens but as essential to sustaining investor trust, securing market access, and mitigating long-term operational risks. Developing internal capabilities for Scope 3 emissions tracking, climate risk modeling, and sustainability reporting is no longer optional but strategic.

As the legal battles between states and the federal government unfold, the private sector’s proactive leadership in climate and ESG domains may well determine the future trajectory of American competitiveness and credibility in the global economy.

In this turbulent new era, the message is clear: Adapt, lead, or risk falling irreversibly behind.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.