- Article Summary

-

Introduction

Climate adaptation has rapidly become a central concern for global institutional investors, driven by the increasing materiality of physical climate risks and the need for long term resilience. While energy efficiency and renewable energy remain leading environmental investment priorities, climate adaptation has risen to third place in the 2025 Sustainable Signals survey of 967 institutional investors worldwide. This growing emphasis reflects a broad acknowledgment that climate impacts are no longer distant possibilities but active forces shaping asset values, operational continuity and capital allocation decisions across markets. As companies confront more frequent disruptions and investors evaluate exposure to environmental risk, adaptation is reshaping investment preferences and influencing engagement expectations. The following analysis explores the shift in investor priorities, the reasons behind the rise of adaptation, the barriers that continue to slow capital deployment, and the steps companies can take to align with this evolving landscape.

Shift in Investor Priorities in 2025

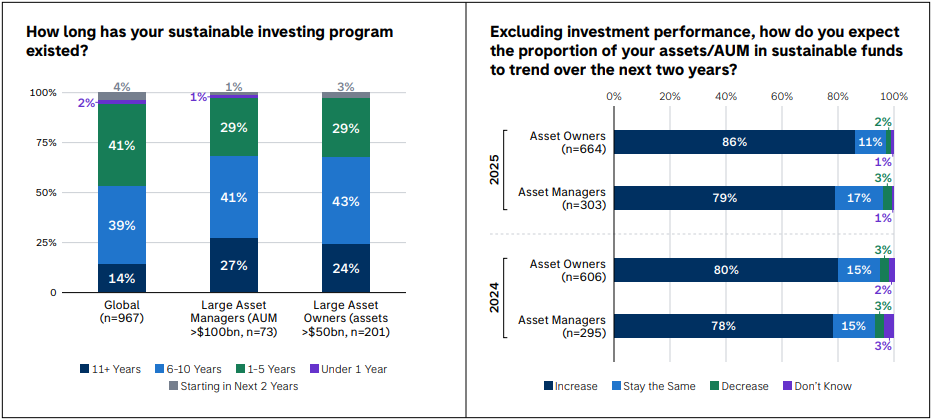

Over the past year, institutional investors strengthened their commitment to sustainable investing, with a significant majority planning to increase allocations to sustainability focused strategies. According to the survey, 86 percent of asset owners expect the proportion of their sustainable fund holdings to rise over the next two years, and 79 percent of asset managers expect sustainable AUM to grow. These expectations remain consistent across asset sizes, suggesting that the momentum for sustainability integration continues to accelerate. This trend aligns with the long standing maturity of sustainable investing programs, as nearly all surveyed institutions have actively practiced or planned to practice sustainable investing for at least one year.

The upward shift in climate adaptation within overall sustainability priorities is a notable development. Previously ranked sixth, adaptation now holds the third position, immediately behind renewable energy and energy efficiency. This ranking reflects a broader recognition that mitigation efforts alone cannot address the full spectrum of climate related investment risks. The heightened attention to adaptation signals a preference for solutions that strengthen resilience, support operational continuity and enable investors to navigate an increasingly unpredictable climate environment.

Why Climate Adaptation Is Rising

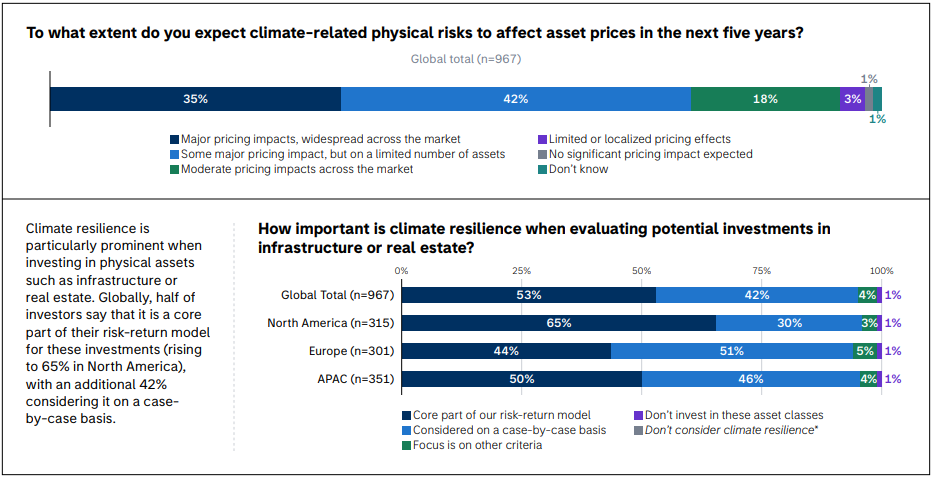

Physical climate risks are increasingly perceived as material and time sensitive by the global investment community. More than 75 percent of surveyed respondents expect physical risks to have a major impact on asset prices within the next five years. Thirty five percent anticipate widespread impacts across markets, while another 42 percent expect significant effects on a subset of assets. These expectations show a steadily rising concern about the direct financial implications of climate related events. Sectors with substantial exposure to physical infrastructure, such as real estate, transportation and energy systems, are particularly affected. Half of investors globally indicate that climate resilience is a core component of their risk return model when evaluating physical asset investments.

The growing importance of climate adaptation also aligns with broader shifts in corporate behavior and regulatory requirements. Companies face increasing pressure to conduct physical climate risk assessments, improve transparency in resilience planning and adopt forward looking disclosure practices. Investors view strong adaptation strategies as indicators of operational robustness and financial durability. As global supply chains experience recurring disruptions from extreme weather events, institutional investors are prioritizing solutions that enhance resilience at both the enterprise and system level.

Barriers Slowing Adaptation Investment

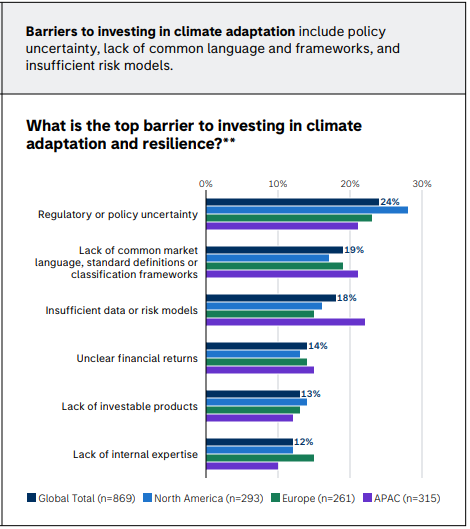

Despite the rising interest in climate adaptation, several structural challenges continue to hinder significant capital flows toward adaptation related solutions. Policy uncertainty remains the most frequently cited barrier, reflecting the difficulty investors face when long term regulatory commitments are unclear or inconsistent across jurisdictions. A lack of common classification frameworks and standard definitions further complicates investment decisions, as investors struggle to compare potential solutions or evaluate their effectiveness. Insufficient data and underdeveloped risk models represent another significant constraint, as accurate assessments of adaptation outcomes require granular, location specific climate projections and methodologies that remain in early stages.

Unclear financial returns and limited investment ready products also limit the pace of adaptation finance. Unlike mitigation technologies, which often have well established business models and measurable emissions benefits, adaptation projects can involve avoided losses rather than direct revenue generation. This makes it harder for investors to evaluate financial performance. As a result, adaptation investments still require clearer valuation frameworks, stronger performance metrics and enhanced technical expertise within investment teams.

Implications for Companies and Future Investment Trends

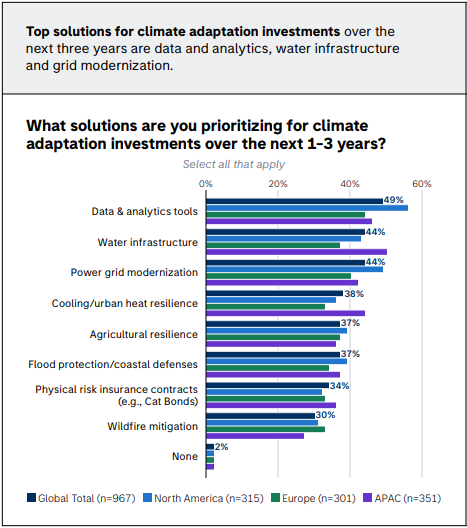

The rise of adaptation as a leading investment priority is reshaping expectations for corporate climate strategy. Companies that proactively address physical climate risks are better positioned to attract capital, maintain operational stability and align with evolving investor criteria. Adaptation related solutions gaining momentum include data and analytics tools, water infrastructure improvements, power grid modernization, cooling and heat resilience strategies and agricultural resilience technologies. These solutions reflect a blend of digital innovation, infrastructure enhancement and sector specific protective measures.

For companies seeking to strengthen their appeal to institutional investors, several steps are essential. Conducting rigorous physical climate risk assessments and integrating the results into enterprise risk management processes can provide a solid foundation for resilience planning. Transparent disclosure of adaptation strategies, scenario analyses and facility level risk profiles can further strengthen investor confidence. Companies can also explore collaborations across supply chains to enhance collective resilience, improve continuity planning and support rapid recovery following climate related disruptions.

Looking ahead, adaptation finance is likely to grow as methodologies improve and regulatory frameworks evolve. Clearer standards for physical risk disclosure and adaptation metrics will support greater comparability, while advances in climate modeling will help quantify financial benefits with more accuracy. These developments will contribute to a more mature adaptation investment ecosystem and create new opportunities for companies and investors committed to long term resilience.

Conclusion

Climate adaptation has emerged as one of the most prominent priorities for institutional investors in 2025. Rising concerns about physical climate impacts, coupled with increasing recognition of the financial risks involved, are driving a shift toward resilience focused investment strategies. Companies that demonstrate clear, evidence based adaptation planning will differentiate themselves in a market where climate risks play an increasingly central role in asset valuation and investment decisions. By integrating resilience into strategic planning and reporting, organizations can position themselves for sustained performance in a rapidly changing climate landscape.

Why Work with ASUENE Inc.?

ASUENE is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. The company serves over 10,000 clients worldwide with an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.