- Article Summary

-

In an era where environmental, social, and governance (ESG) reporting has become a cornerstone of corporate strategy, third-party assurance has emerged as an essential mechanism to ensure the credibility and transparency of disclosed information. As stakeholders, including investors, regulators, and consumers, demand greater accountability, the need for independent verification has intensified. This growing pressure stems from the fact that ESG data often underpins critical decisions ranging from investment allocations to regulatory compliance. Without independent validation, the risk of greenwashing and misinformation can significantly erode trust. Therefore, understanding third-party assurance — what it is, why it is necessary, and how it should be implemented — is crucial for any organization committed to sustainability leadership.

What Is Third-Party Assurance and Why Is It Necessary?

Third-party assurance involves an independent entity evaluating a company’s ESG data, particularly environmental performance metrics like carbon emissions. This process provides external verification that the reported data is accurate, complete, and consistent with relevant standards or frameworks. Unlike internal audits, third-party assurance carries an impartiality that enhances stakeholder confidence.

The necessity for third-party assurance arises from several key factors:

- Regulatory Pressure: Governments and international bodies are increasingly mandating verified ESG disclosures.

- Investor Demand: Investors seek assured data to better evaluate risks and opportunities.

- Market Differentiation: Companies with verified ESG data can distinguish themselves from competitors.

- Risk Mitigation: Accurate reporting reduces the risk of reputational damage and financial penalties.

In essence, third-party assurance transforms ESG claims from mere declarations into verifiable, trusted disclosures that can withstand public and regulatory scrutiny.

Initiatives Requiring Third-Party Assurance

Several prominent initiatives and regulations now either require or strongly encourage third-party assurance.

| Initiative | Scope Covered | Third-Party Assurance Requirement | Assurance Standard |

|---|---|---|---|

| CDP | Climate-related data (Scope 1, 2, 3) | Encouraged for higher scores | ISAE 3000 / ISO 14064-3 |

| ISS ESG | Climate data (Scope 1 and 2) | Enhances rating credibility | ISAE 3000 / ISAE 3410 |

| TCFD | Climate-related financial risks (Scope 1, 2, 3) | Voluntary but increasingly expected | ISAE 3000 aligned |

| CSRD | Full ESG (environmental, social, governance) | Mandatory limited assurance, moving to reasonable assurance by 2028 | ESRS / ISAE 3000 / National Standards |

| SB253 | Climate emissions (Scope 1, 2, 3) | Mandatory assurance | ISAE 3000 / AICPA standards |

These initiatives aim to ensure that disclosed ESG data, particularly environmental and climate-related metrics, is robust and reliable. Scope 1 (direct emissions) and Scope 2 (indirect emissions from purchased energy) remain primary, but Scope 3 (value chain emissions) is also gaining increasing focus.

(Graph: Adoption Rates of Third-Party Assurance in Key ESG Frameworks — Blue-themed Line Graph)

How to Implement Third-Party Assurance Effectively

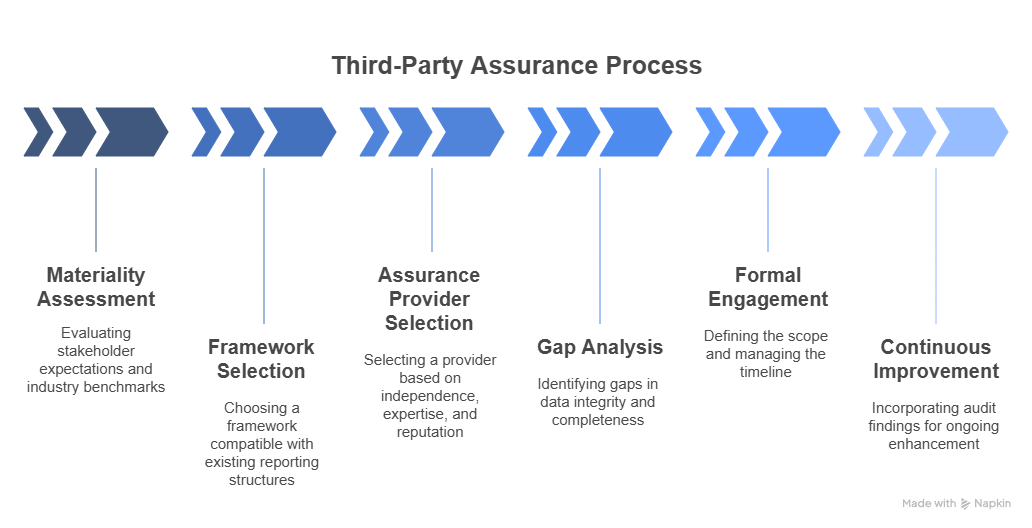

Organizations seeking to implement third-party assurance should follow a structured approach:

- Materiality Assessment: Identify which ESG metrics are most critical to stakeholders and likely to be scrutinized.

- Framework Selection: Align disclosures with recognized standards like GHG Protocol, SASB, or ISO 14064.

- Assurance Provider Selection: Choose an accredited, experienced assurance provider with a proven track record.

- Gap Analysis and Pre-Audit: Conduct an internal review to identify potential discrepancies and prepare necessary documentation.

- Formal Assurance Engagement: Engage in the assurance process, including site visits, data testing, and system reviews.

- Continuous Improvement: Use assurance feedback to refine data collection and reporting processes.

Following this roadmap ensures that third-party assurance efforts are both efficient and effective, enhancing the overall quality of ESG disclosures.

Conclusion: Building Trust Through Verified ESG Reporting

Third-party assurance is no longer a “nice-to-have” but a “must-have” for organizations serious about ESG leadership. By providing independent validation of ESG data, companies can build credibility with investors, comply with emerging regulations, and differentiate themselves in a competitive market. As global standards evolve and expectations heighten, the role of third-party assurance will only become more central. Companies that invest today in rigorous, verified ESG reporting will be better positioned for sustainable success tomorrow.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.