- Article Summary

-

Federal Climate Policy Reversal under the Trump Administration

Since January 2025, the Trump administration has taken decisive steps to roll back U.S. climate leadership on the international and domestic fronts. These actions include:

Key Executive and Regulatory Changes:

- Executive Order 14162: Withdrew the U.S. from the Paris Agreement again.

- Clean Power Plan Rescinded: Removed federal carbon limits for fossil-fueled power plants.

- Energy Efficiency Rules Relaxed: Weakened standards for appliances and industrial equipment.

- Social Cost of Carbon Eliminated: Excluded from regulatory economic analysis.

- Federal Climate Funding Cut: Reduced EPA and DOE budgets for climate science and clean energy deployment.

Policy Direction:

- Prioritization of fossil fuel production (coal, oil, gas)

- Deregulation of emissions and environmental safeguards

- Abandonment of net-zero by 2050 as a national goal

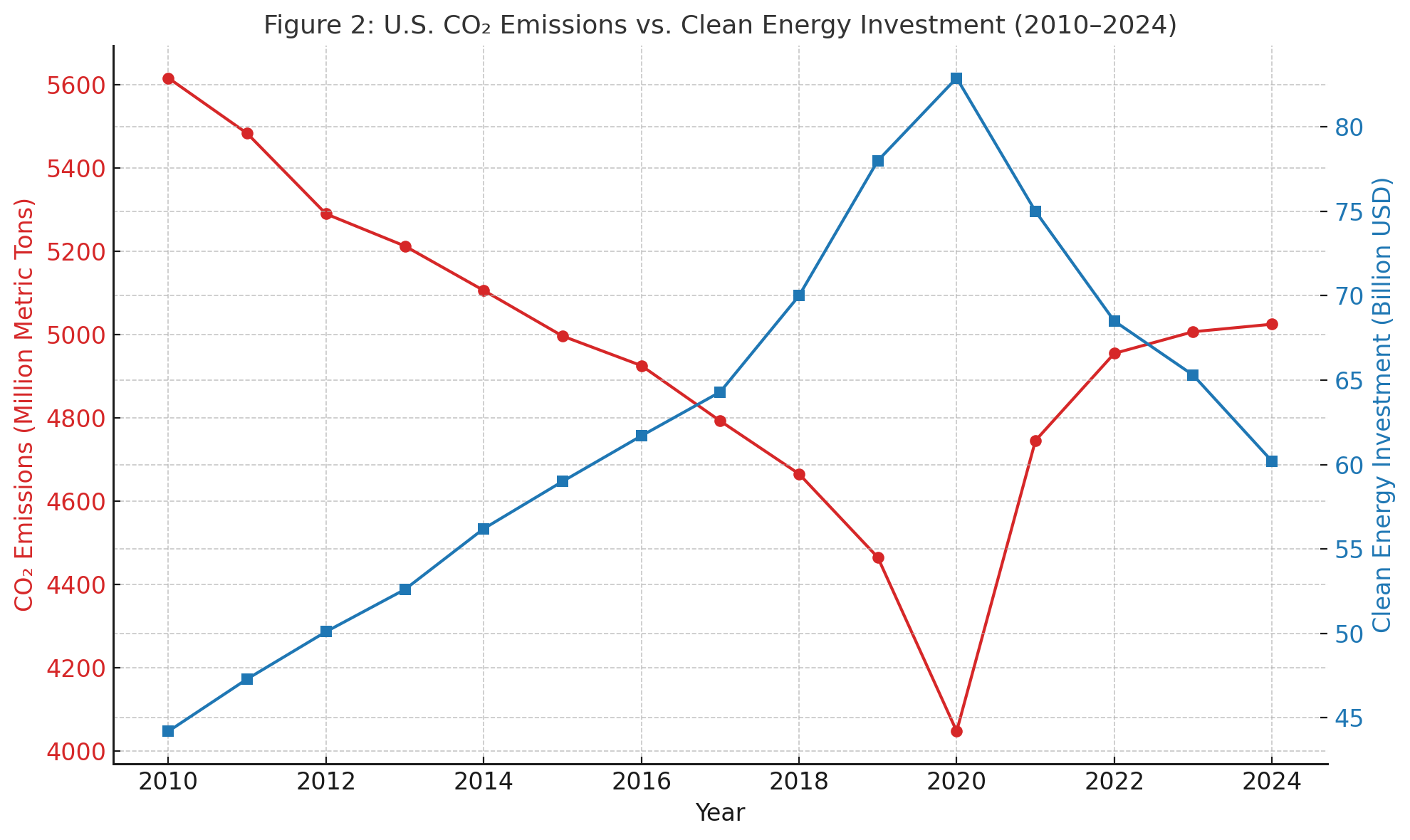

The Data Behind the Shift: Emissions and Investment Trends

Recent data shows a reversal in U.S. emissions trends and a drop in clean energy investment due to policy uncertainty.

U.S. Energy-Related CO₂ Emissions (2010–2024)

- From 2010 to 2022: Emissions fell by nearly 25% due to cleaner energy and efficiency improvements.

- From 2022 to 2024: Emissions rose from 4,125 MtCO₂ to 4,375 MtCO₂—a 6% increase in just two years.

- Investment in renewables dropped by 15% in 2024, according to BloombergNEF

Corporate Action: Staying on the Path to Net-Zero

Despite federal headwinds, corporations are maintaining climate commitments. Business leaders recognize that ESG performance is tied to:

- Investor expectations (e.g. BlackRock, State Street)

- Global supply chain requirements (e.g. EU regulations)

- Brand reputation and customer loyalty

- Long-term operational resilience

Corporate Net-Zero Commitments

You can view the detailed table here:

Corporate Net-Zero Commitments

Key observations:

- Many target 2040 or earlier for net-zero emissions.

- Strategies include electrification, renewables, AI optimization, and carbon removal.

State-Level Climate Leadership

With limited federal support, states and regions are filling the climate policy gap.

Highlights:

- 24 U.S. states + D.C. have adopted legally binding GHG reduction targets.

- States such as California, New York, and Washington maintain their own emissions trading schemes.

- Midwestern states (e.g., Illinois, Michigan) are investing in renewables and grid upgrades.

- Local utilities are setting clean electricity targets independent of federal policy.

Policy Tools in Use:

| Policy Mechanism | Examples |

|---|---|

| Renewable Portfolio Standards | 30+ states mandate clean electricity use |

| Cap-and-Trade Programs | California, RGGI states |

| Green Building Codes | California Title 24, NYStretch |

| Climate Alliances | U.S. Climate Alliance, RGGI |

These initiatives represent over 50% of U.S. GDP and population, creating strong regional markets for clean energy and sustainable development.

Why Companies Should Continue Decarbonizing

Even amid federal policy regression, there are compelling reasons for businesses to stay committed:

1. Financial and Regulatory Drivers

- Access to sustainable finance and ESG-linked bonds

- Anticipation of future climate regulations (e.g., SEC disclosure rules)

- Compliance with international carbon standards (e.g., EU CBAM)

2. Market and Consumer Expectations

- 70% of U.S. consumers expect brands to take action on climate

- Younger generations prioritize transparency and environmental responsibility

3. Operational Risk Reduction

- Energy efficiency reduces exposure to fuel price volatility

- Green infrastructure improves supply chain resilience

4. Competitive Advantage

- Proactive decarbonization supports innovation and global competitiveness

- Strong ESG performance is linked to brand value and investor confidence

Long-Term Climate Strategy Still Essential

The Trump administration’s current climate stance may slow federal progress, but it does not negate the long-term necessity—or business rationale—for climate action. States, cities, and companies are already creating an ecosystem where sustainability is embedded in regulation, innovation, and finance.

For companies serious about long-term value creation, building climate resilience and pursuing decarbonization remain critical priorities. Acting now ensures:

- Competitive positioning in ESG-sensitive markets

- Regulatory preparedness

- Lower transition costs

- Enhanced stakeholder trust

In the face of political cycles, businesses must remain aligned with the climate reality—and lead where governments falter.

Download Our Expert Publications!

Why Work with ASUENE Inc.?

ASUENE USA Inc., a subsidiary of Asuene Inc., is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.