- Article Summary

-

US Emissions Are Rising Again

After two years of decline, US CO2 emissions increased in 2025. This reversal surprised many observers, particularly as efficiency improvements, renewable energy deployment, and corporate climate commitments continued to expand. For businesses, the significance of this shift goes beyond national climate targets. It exposes how vulnerable corporate emissions profiles are to external forces such as weather, grid dynamics, fuel prices, and policy uncertainty.

For sustainability, ESG, and finance teams, the lesson from 2025 is clear. Emissions outcomes are increasingly shaped by system-level dynamics that sit outside direct operational control. This makes accurate, timely, and decision-ready carbon accounting more critical than ever.

The Big Picture: How US CO2 Emissions Are Changing

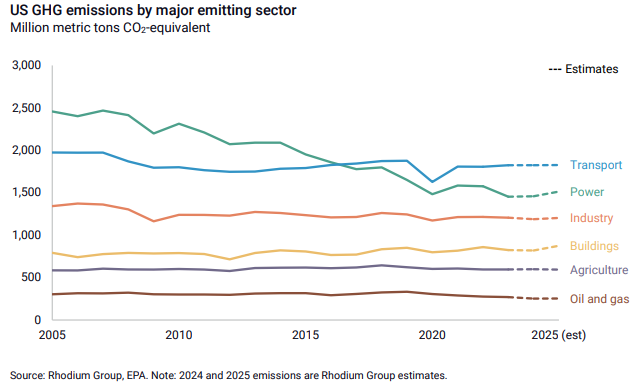

US emissions remain well below their historical peak and are still significantly lower than in 2005. However, the 2025 increase marks a break from the recent trend where economic growth and emissions were moving in opposite directions. In 2025, emissions grew faster than the economy, reversing a period of relative decoupling.

At a sector level, transportation remains the largest source of emissions, though growth there has slowed due to vehicle efficiency gains and the continued adoption of hybrid and electric vehicles. The more notable changes occurred in the power and buildings sectors, where emissions rose sharply due to increased energy demand and higher fossil fuel use.

This pattern highlights an important reality for businesses. National emissions trends are no longer driven primarily by technology adoption alone. They are increasingly shaped by how resilient the energy system is under stress.

What Is Driving the Increase and Where Companies Are Exposed

The primary drivers of higher emissions in 2025 were colder winter temperatures and rising electricity demand. Increased space heating pushed up direct fuel use in buildings, while higher power demand led utilities to rely more heavily on coal when natural gas prices spiked.

Commercial electricity demand played a significant role. Data centers, digital infrastructure, and large facilities increased load in several regions, worsening grid carbon intensity at precisely the moment demand surged. For companies operating energy-intensive assets, this translated directly into higher Scope 2 emissions even without changes in internal operations.

This exposure matters because many corporate climate strategies assume grid emissions will steadily improve. The experience of 2025 shows that this assumption does not always hold, especially during periods of rapid demand growth.

The Emissions Visibility Gap: Why Reporting Is Struggling to Keep Up

Many organizations struggled to explain higher emissions in 2025 because their accounting systems were not designed for volatility. Annual emissions inventories often fail to capture how short-term factors such as weather, fuel switching, or regional grid shifts affect results.

Scope 2 accounting is particularly exposed. Location-based emissions can rise quickly when grids turn to fossil fuels, while market-based reporting may lag behind real-world conditions. Scope 3 data challenges compound the problem, as supplier emissions often reflect the same power and fuel dynamics with even less transparency.

As public emissions data becomes less consistent and policy signals weaken, companies increasingly need to rely on their own data infrastructure. Without stronger emissions visibility, sustainability teams risk losing credibility with internal stakeholders, investors, and customers.

From Measurement to Management: What Companies Can Do Now

The events of 2025 reinforce the need to move carbon accounting beyond compliance reporting. Companies can take several practical steps to improve resilience.

First, emissions data should be more frequent and granular. Monthly or quarterly tracking allows teams to distinguish between structural emissions trends and temporary shocks. Second, Scope 2 should be treated as a strategic risk. Understanding regional grid exposure and aligning renewable procurement with actual load growth can materially reduce volatility.

Third, Scope 3 engagement needs to deepen. Supplier emissions are increasingly influenced by the same energy system pressures. Companies that invest early in supplier data collection and collaboration will be better positioned as disclosure expectations rise.

Ultimately, carbon accounting should inform decisions about growth, procurement, and investment, rather than serving only as a year-end reporting exercise.

Conclusion: A New Reality for Corporate Emissions Management

The rise in US CO2 emissions in 2025 does not signal a failure of corporate climate action. It signals a shift in the challenge. Emissions are now shaped as much by system resilience and data visibility as by efficiency improvements.

For businesses, this new reality elevates the role of carbon accounting. Accurate, timely, and decision-ready emissions data is becoming foundational infrastructure for sustainable growth. Companies that strengthen their emissions visibility today will be better prepared to manage volatility, meet stakeholder expectations, and compete in an increasingly carbon-constrained economy.

Why Work with ASUENE Inc.?

ASUENE is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. The company serves over 10,000 clients worldwide with an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.