- Article Summary

-

Introduction

In recent years, the intersection of climate policy and international development has taken on new dimensions. Governments are seeking innovative ways to meet ambitious climate targets while also delivering on global development commitments. According to Carbon Brief, the UK’s foreign aid spending on nature-based initiatives surged to nearly £800 million in 2024–25, largely driven by financing for carbon credit schemes. This unprecedented level of spending reflects a profound shift in the way overseas aid is being conceived and delivered. Instead of traditional models focused exclusively on poverty reduction, aid is increasingly directed toward projects that address climate change through nature-based solutions.

This article explores how nature-based foreign aid, particularly through carbon credit schemes, is reshaping the UK’s overseas development spending. We will examine the data behind this record investment, define what nature-based foreign aid entails, assess the implications of carbon credit mechanisms, and explore how this trend influences global climate finance and ESG practices.

The Data Behind the Record Spending

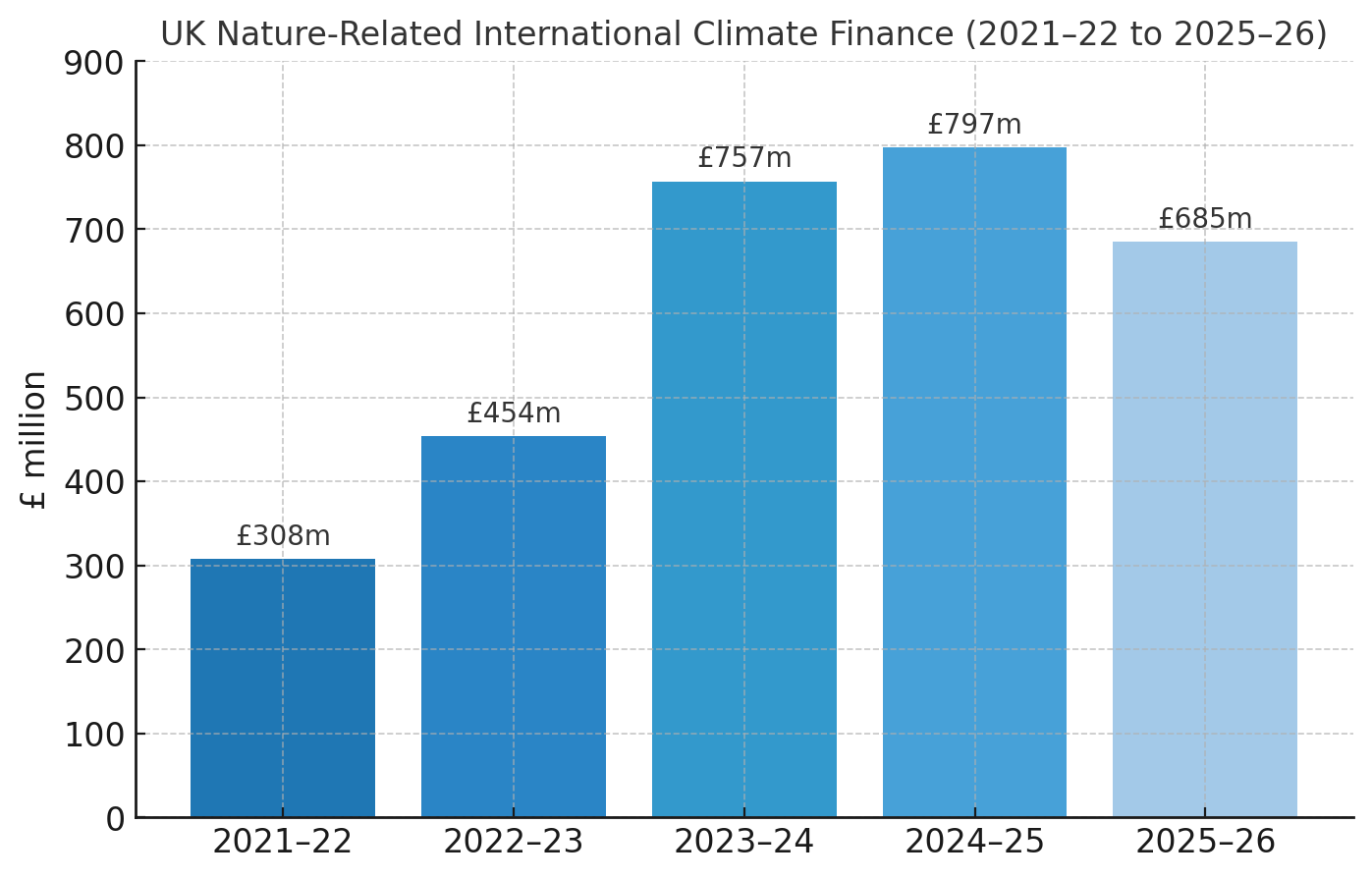

Carbon Brief’s analysis shows that the UK’s nature-focused foreign aid climbed steadily over recent years, reaching nearly £800 million in 2024–25, the highest level on record. This figure represents a significant increase compared to prior years and is primarily attributed to investments in carbon credits purchased from overseas projects. These credits, generated through activities like forest conservation or peatland restoration, allow the UK to count measurable emissions reductions toward its climate goals.

To put this shift in perspective, UK foreign aid for nature had been much lower in earlier years, with a marked rise beginning around 2022–23. The surge in 2024–25 underscores the government’s prioritisation of climate and environmental objectives within its aid strategy. This reallocation of resources is part of a broader UK effort to align with the Paris Agreement, the Global Biodiversity Framework, and international climate finance pledges. While the move is welcomed by many climate advocates, it also sparks debates about the purpose and priorities of aid.

Understanding Nature-Based Foreign Aid

Nature-based foreign aid refers to funding directed toward ecosystem restoration, biodiversity conservation, and climate adaptation initiatives in recipient countries. These projects are designed not only to deliver carbon sequestration but also to support local livelihoods, protect biodiversity, and reduce climate vulnerabilities.

Examples include:

- Forest conservation in sub-Saharan Africa, which prevents deforestation while providing sustainable income opportunities for communities.

- Mangrove restoration in South and Southeast Asia, which strengthens coastal resilience against flooding and stores significant amounts of carbon.

- Peatland protection in Latin America, which reduces emissions from degraded wetlands while preserving biodiversity hotspots.

Nature-based foreign aid therefore represents a dual-purpose approach. It addresses the urgent need to cut greenhouse gas emissions while also aligning with the Sustainable Development Goals (SDGs). This duality is what makes it appealing for donor governments like the UK, as it allows them to demonstrate leadership in both climate and development spheres.

Carbon Credits and the Changing Landscape of Aid

Carbon credits have become the central mechanism through which the UK channels much of its nature-based foreign aid. These credits represent verified emissions reductions from projects abroad and can be used by governments or companies to offset their own emissions. In the UK’s case, aid budgets are increasingly being deployed to purchase such credits from the Global South.

From a policy perspective, this approach serves several purposes:

- It helps the UK meet domestic climate targets by securing cost-effective emissions reductions abroad.

- It demonstrates climate leadership on the global stage, particularly in the run-up to key international negotiations.

- It ensures that aid spending delivers measurable outcomes, which can be tracked through the carbon accounting framework.

However, this model is not without controversy. Critics argue that:

- Diverting aid toward carbon credits risks shifting resources away from poverty alleviation and humanitarian priorities.

- Projects may create land-use conflicts, where local communities are displaced or restricted from using natural resources.

- Transparency and accountability in carbon markets remain uneven, raising concerns about the integrity of the credits purchased.

These criticisms highlight the need for robust safeguards and governance frameworks to ensure that nature-based aid delivers equitable and sustainable outcomes.

Implications for Global Climate Finance and ESG

The UK’s record investment in nature-based foreign aid reflects more than a domestic policy choice; it signals a broader reconfiguration of global climate finance. Donor countries are under increasing pressure to mobilise the promised $100 billion annually for climate action in developing nations. By leveraging aid budgets for carbon credits, the UK sets a precedent that other countries may follow.

For businesses, the rise of nature-based aid also carries important lessons. Many companies are engaging in voluntary carbon markets or investing in nature-based solutions to meet net-zero commitments. The UK’s approach underscores the importance of ensuring high-integrity offsets, where projects deliver genuine emissions reductions and co-benefits for biodiversity and communities.

(graph)

For ESG reporting, this trend signals that both governments and investors are scrutinising the quality and integrity of nature-based investments. Companies that align their strategies with these expectations can strengthen credibility with stakeholders and position themselves as leaders in sustainable finance.

Conclusion

According to Carbon Brief, the UK’s near-£800 million in foreign aid for nature in 2024–25 demonstrates a transformative shift in international development strategy. By tying aid spending to carbon credit schemes, the UK is redefining what it means to deliver overseas assistance in the context of climate change. Nature-based foreign aid offers the promise of addressing global warming while supporting development goals, but it also raises complex questions about priorities, equity, and accountability.

Looking ahead, the effectiveness of this model will depend on how well it balances climate and development objectives, safeguards the rights of local communities, and maintains the integrity of carbon markets. If implemented responsibly, the UK’s approach could become a template for aligning aid with global sustainability ambitions, shaping the future of both climate finance and ESG standards.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.