- Article Summary

-

Introduction: A Historic Energy Shift

In 2024, the global energy landscape underwent a dramatic transformation. For the first time in history, renewable energy became the dominant source of new electricity capacity worldwide. According to the United Nations and corroborated by the International Energy Agency (IEA), wind and solar power alone accounted for an astonishing 92.5% of all new electricity generation capacity. More than just a statistical milestone, this marks a definitive tipping point in the world’s transition away from fossil fuels.

This shift is driven not only by environmental imperatives but also by compelling economics. These changes are reshaping the investment landscape, compelling businesses to rethink energy procurement strategies and prompting policymakers to accelerate green infrastructure. The age of renewables is no longer just a vision.

The Numbers Behind the Breakthrough

The data from 2024 tells a powerful story. The IEA reports that renewables constituted 74% of overall power growth, with wind and solar alone delivering nearly all new capacity. This marks a sharp acceleration from previous years and signals that clean energy has decisively overtaken fossil fuels in new generation buildout.

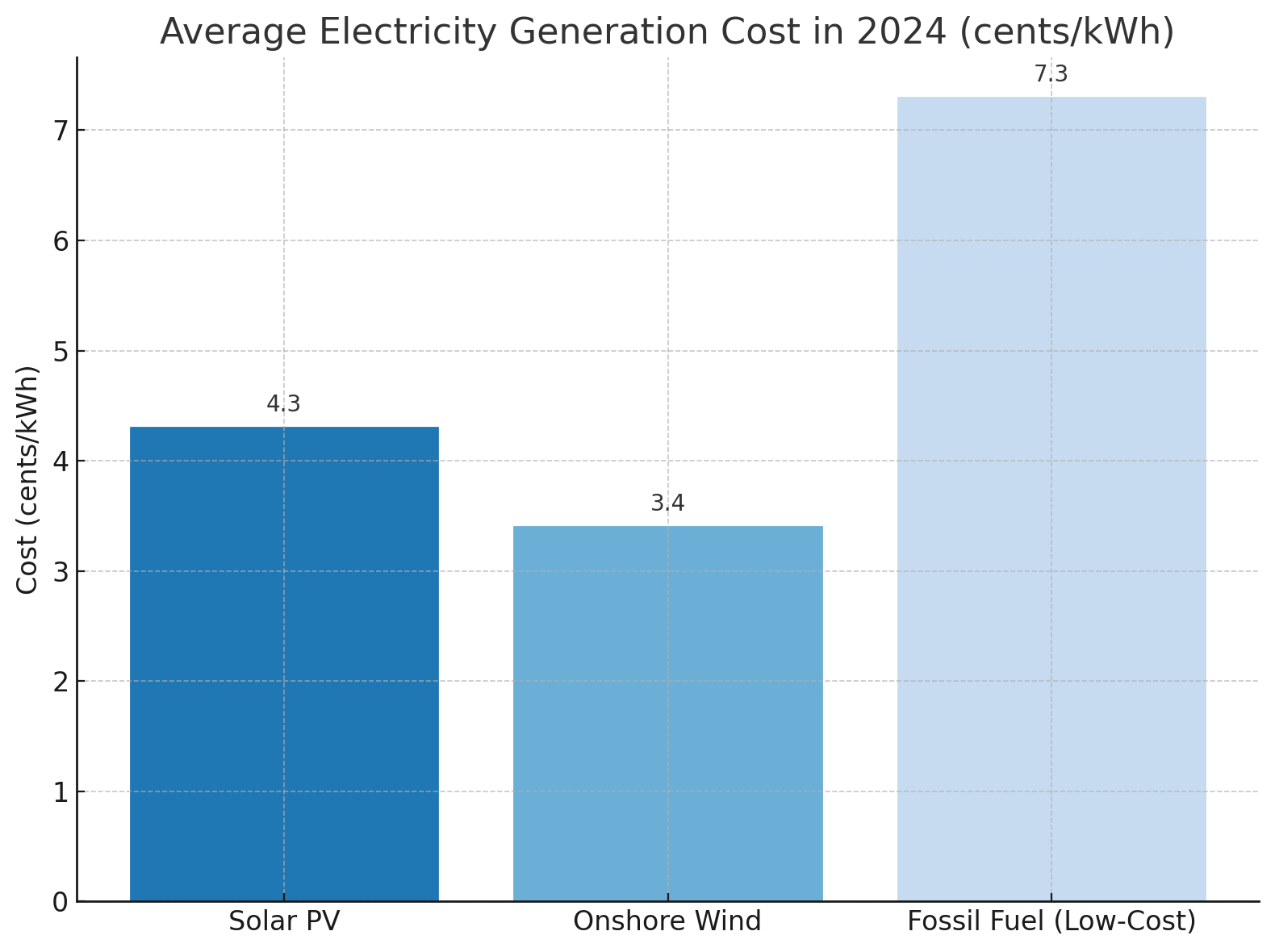

A key driver of this momentum is the dramatic reduction in cost. Technological improvements, economies of scale, and competitive supply chains have pushed down prices:

- Solar PV: 41% cheaper than coal or gas.

- Onshore wind: 53% cheaper than fossil sources.

These cost declines make renewables not just environmentally preferable but also financially superior. The global levelized cost of electricity (LCOE) for wind and solar has reached unprecedented lows, enabling countries to scale up clean energy without heavy subsidies.

Organizations such as the World Economic Forum have emphasized that this price parity is a game-changer. It renders the argument for new fossil fuel infrastructure increasingly untenable, both financially and politically.

Global Momentum: Leaders and Laggards

While the global picture is overwhelmingly positive, progress is uneven. Leading the charge are China, the United States, India, and key European nations. China alone accounted for nearly half of all new solar capacity in 2024, driven by ambitious government targets and robust manufacturing capabilities. The U.S. has also accelerated its clean energy buildout, aided by the Inflation Reduction Act and corporate procurement strategies.

India’s aggressive push for solar and wind, backed by public-private partnerships, has made it a renewable energy hotspot. Meanwhile, countries in the European Union continue to lead on per capita installations, thanks to cohesive regulatory frameworks and public support.

However, several regions in Africa, Southeast Asia, and parts of Latin America still lag. Infrastructure constraints, limited financing, and policy uncertainty have slowed progress. These disparities pose a risk to global climate goals and underline the need for targeted international support.

Governments that proactively embrace this shift are poised to reap economic and environmental benefits, while those that resist risk being left behind in the global green economy.

What This Means for Business and Investment

For ESG investors, 2024 is a clear signal: the era of renewable dominance is here. The financial community is beginning to treat clean energy not as an alternative asset but as a core growth sector. Renewable projects now offer predictable returns, lower risk profiles, and alignment with sustainability mandates.

Corporations are also stepping up. Power Purchase Agreements (PPAs) have surged, with companies like Amazon, Google, and Microsoft securing gigawatts of clean energy to meet climate commitments. These moves are not just good PR, they’re essential for long-term competitiveness.

UN Secretary General Antonio Guterres has specifically called on tech giants to operate 100% on renewable energy by 2030. This adds pressure to digital infrastructure providers, particularly data centers, to overhaul their energy strategies.

Moreover, businesses are integrating renewables into broader ESG strategies, including Scope 3 emissions reduction and green supply chains. Early movers are building brand equity, customer loyalty, and operational resilience.

Conclusion: A Tipping Point with Global Consequences

2024 will be remembered as the year the world crossed a critical threshold in the energy transition. The dominance of renewables in new capacity, the steep cost declines, and the surge in global installations are not isolated events, they are the result of years of innovation, policy alignment, and shifting market dynamics.

For governments, this moment demands stronger policy signals, grid modernization, and climate finance for emerging economies. For businesses, it necessitates bold investments in clean energy and alignment with science-based targets. For investors, it’s time to shift capital decisively toward sustainable assets.

The renewable revolution is not a distant goal, it is now the foundation of global energy growth. The momentum is undeniable, and the path forward is clear. The only question that remains is: who will lead, and who will be left behind?

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.