- Article Summary

-

ESG as a New Foundation for Procurement

Procurement is undergoing a profound transformation. Once focused primarily on cost, quality, and delivery, it now increasingly integrates ESG (Environmental, Social, and Governance) performance as a central decision-making factor. With global regulations like the EU’s CSRD and the SEC’s climate rules putting pressure on corporations to report their entire value chain’s sustainability metrics, ESG disclosure from suppliers has become a non-negotiable standard.

This article outlines how forward-thinking companies are redesigning their procurement systems around ESG transparency—from setting expectations to collecting and validating disclosures—and provides practical steps and case studies that demonstrate how to embed sustainability into the procurement DNA.

Why ESG Disclosure Must Be Embedded in Supplier Management

Regulations now demand value-chain-level transparency. For example, the CSRD requires reporting of Scope 3 emissions, which means buyers must collect data from their suppliers. Simultaneously, investors and consumers are pushing for greater supply chain accountability, such as ethical labor practices and low-carbon sourcing.

Ignoring ESG metrics can lead to:

- Disqualification from procurement lists

- Investor scrutiny and reputational damage

- Legal and compliance risks under new regulations

To remain competitive and future-proof, procurement departments must integrate ESG disclosure into supplier selection and evaluation processes.

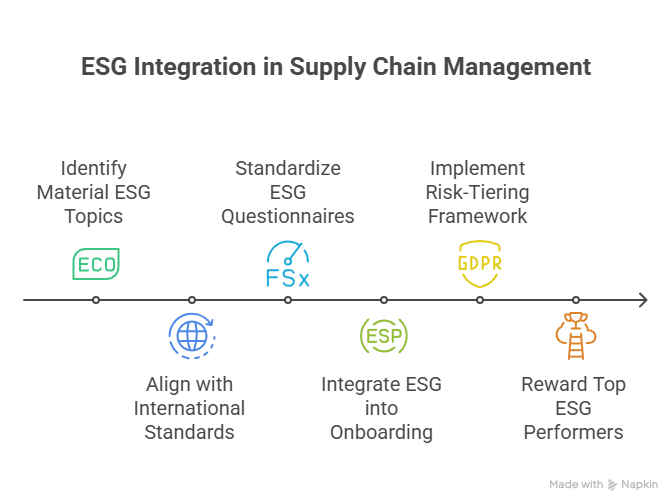

Step-by-Step Guide to ESG-Based Procurement System Design

Step 1: Define ESG Disclosure Requirements

- Identify material ESG topics relevant to your industry and region (e.g., GHG emissions, human rights, water use).

- Align with international standards (e.g., GRI, ISSB, TCFD, OECD Guidelines).

- Determine mandatory vs. voluntary disclosure items.

Step 2: Standardize ESG Questionnaires and Assessments

- Use digital platforms to issue structured ESG questionnaires (e.g., EcoVadis, IntegrityNext).

- Include qualitative (policy presence) and quantitative (emission values) data.

- Enable scorecards to benchmark supplier performance.

Step 3: Integrate ESG into Supplier Onboarding and RFx

- Make ESG disclosure a prerequisite in Requests for Proposal (RFPs) and supplier registration portals.

- Establish a minimum ESG score threshold for consideration.

- Provide guidance and templates to help suppliers comply.

Step 4: Implement a Risk-Tiering and Monitoring Framework

- Segment suppliers into ESG risk tiers based on industry, geography, and performance.

- Increase monitoring frequency and depth for high-risk suppliers.

- Leverage AI or analytics for red flag detection (e.g., human rights violations, fraud).

Step 5: Reward and Co-Develop with Top ESG Performers

- Offer preferred supplier status, longer contracts, or co-development projects to high ESG performers.

- Publicly recognize best-in-class ESG suppliers to incentivize improvement.

Tools and Technologies Powering ESG-Centric Procurement

Technology plays a critical role in scaling ESG integration across procurement systems. Key tools include:

- Supplier ESG Portals: Centralized platforms for data collection, reporting, and benchmarking.

- Carbon Accounting Software: Automates Scope 3 data collection (e.g., Asuene).

- Blockchain for Traceability: Ensures authenticity of sustainability claims (e.g., Everledger).

- AI-Powered Risk Engines: Scans external sources for compliance violations and ESG controversies.

Case Studies: How Leading Firms Are Reinventing Supplier ESG Management

Panasonic: Structured Supplier Surveys

Panasonic introduced standardized ESG surveys across its supplier base in Asia. The surveys included climate, labor, and governance questions and were scored to prioritize procurement decisions. Suppliers showing strong ESG performance received longer-term contracts.

European Automotive OEM: Blockchain for Material Traceability

A German carmaker used blockchain to trace ESG credentials of critical raw materials like lithium and cobalt. This ensured ESG compliance throughout the supply chain and enabled transparent reporting under CSRD.

Unilever: ESG as a Procurement KPI

Unilever embedded ESG metrics as a weighted criterion in all procurement evaluations. Over 60% of awarded contracts in 2023 went to suppliers scoring above average on ESG benchmarks.

Conclusion: From Reactive Compliance to Strategic Advantage

The integration of ESG disclosure into procurement is no longer a visionary goal—it’s a business imperative. Companies that embed ESG into their procurement processes not only meet compliance demands but also reduce risk, drive innovation, and build stronger supplier relationships.

As regulation intensifies and sustainability expectations grow, procurement leaders must act now. With the right framework, tools, and mindset, ESG-centric supplier management can evolve from a checkbox exercise into a true source of competitive advantage.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.