- Article Summary

-

Introduction

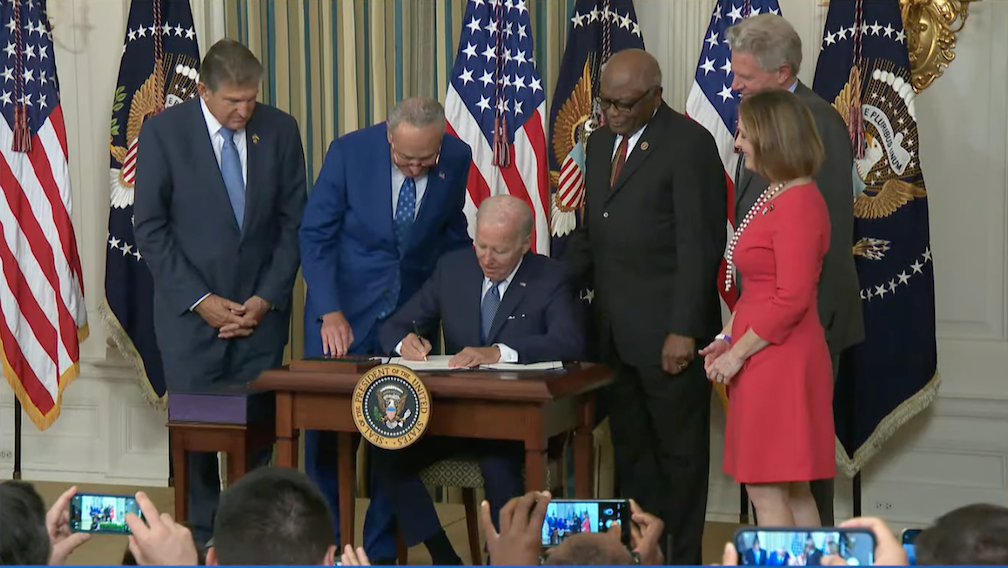

The Inflation Reduction Act (IRA), signed into law in August 2022, is the United States’ most comprehensive climate and industrial policy to date. With $369 billion earmarked for clean energy and climate initiatives, the IRA aims to accelerate decarbonization, stimulate domestic manufacturing, and reduce dependence on foreign supply chains. Its impact spans multiple industries—from electric vehicles and solar panels to hydrogen production and carbon capture.

Yet, with the 2024 U.S. presidential election approaching, and the potential return of Donald Trump to the White House, the future of these policies is uncertain. This article examines which sectors have benefited most from the IRA so far and analyzes how a change in political leadership could reshape the U.S. industrial and ESG landscape.

The IRA’s Multi-Sector Strategy

Unlike earlier climate legislation focused narrowly on emissions targets, the IRA is structured as a broad-based industrial stimulus, combining climate policy with economic revitalization.

Key targeted sectors include:

| Sector | Policy Mechanisms | Goal |

|---|---|---|

| Electric Vehicles (EVs) | Consumer tax credits, battery sourcing rules | Electrify transport; build local supply chains |

| Solar and Wind Energy | Production & investment tax credits (PTC/ITC) | Boost domestic renewable capacity |

| Battery Manufacturing | Advanced Manufacturing Production Credits (45X) | Incentivize U.S.-based gigafactories |

| Hydrogen Economy | Clean Hydrogen Production Credit (45V) | Support green and blue hydrogen |

| Carbon Capture (CCUS) | Enhanced 45Q tax credits | Reduce industrial carbon emissions |

| Grid & Transmission | Grants and loans for infrastructure upgrades | Modernize energy systems |

| Building Efficiency | Rebates and loans for retrofits and heat pumps | Cut residential/commercial energy use |

| Sustainable Agriculture | USDA funding for climate-smart practices | Lower emissions in food systems |

Economic Impact So Far: Investment and Jobs

The IRA has unleashed a wave of clean energy investments across the U.S., particularly in the Midwest and the Southeast—regions once struggling with industrial decline.

As of early 2024:

- Over $300 billion in private-sector investments have been announced.

- More than 270 clean energy projects launched or expanded.

- Estimated 170,000+ jobs created or committed, including in traditionally conservative states like Georgia, Texas, and South Carolina.

Selected Major Announcements:

| Company | Sector | Location(s) | Investment Amount |

|---|---|---|---|

| First Solar | Solar Manufacturing | Ohio & Alabama | $1.2 billion |

| Tesla & Panasonic | Battery Production | Nevada (Gigafactory expansion) | $3.6 billion |

| Plug Power | Hydrogen | Georgia | $1 billion |

| ExxonMobil | Carbon Capture | Louisiana | $2 billion |

What Happens if Trump Returns?

Donald Trump has criticized the IRA as “a disaster” and repeatedly questioned the viability of clean energy. If re-elected in 2024, a Trump administration is expected to dismantle or defund key elements of the act, even without repealing it outright—especially if Republicans do not control both chambers of Congress.

Possible scenarios include:

- Delays or cancellation of tax credit disbursements via bureaucratic slowdown or reinterpretation.

- Regulatory rollback of EPA rules that complement IRA goals (e.g., power plant CO₂ limits).

- Termination of grant programs administered by the Department of Energy and EPA.

- Shift back to fossil fuel development, including expanded drilling on federal lands.

While the law itself may be difficult to repeal legislatively, its implementation could be effectively paralyzed.

Biden’s Industrial Policy vs. Trump’s Likely Approach

| Policy Domain | Biden Administration | Likely Trump Administration |

|---|---|---|

| Clean energy subsidies | Expanded tax credits across sectors | Budget cuts, credit delays |

| Industrial reshoring | Incentives for U.S. production (e.g. 45X) | Less emphasis on green industry |

| Fossil fuel stance | Gradual phase-out, emissions restrictions | Aggressive expansion of oil & gas |

| Hydrogen economy | Prioritized as clean tech frontier | Less federal support |

| Carbon capture | Strategic tool for industrial decarbonization | Support only if aligned with oil/gas use |

| ESG alignment | Strong integration in federal procurement | Potential rollback of ESG disclosures |

Implications for ESG and Investors

The IRA has significantly improved the ESG profiles of U.S.-based manufacturers and utilities, providing:

- Clear long-term policy signals for clean tech investment.

- Lower transition risk via incentives rather than penalties.

- Transparency and localization, key for supply chain ESG ratings.

A political shift in 2025 could:

- Introduce policy volatility, discouraging long-term ESG investments.

- Disrupt climate-aligned capital flows from institutional investors.

- Widen the gap between federal and state climate policies, forcing companies to navigate fragmented regulatory environments.

The IRA’s Legacy Hangs in the Balance

The Inflation Reduction Act has already reshaped the U.S. industrial base and positioned the country as a serious contender in the global clean energy race. Yet its future depends not only on market dynamics but also on political will. For companies, investors, and ESG professionals, 2025 could mark either the acceleration—or the unraveling—of America’s green industrial revolution.

Download Our Expert Publications!

Why Work with ASUENE Inc.?

ASUENE USA Inc., a subsidiary of Asuene Inc., is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.