- Article Summary

-

Introduction

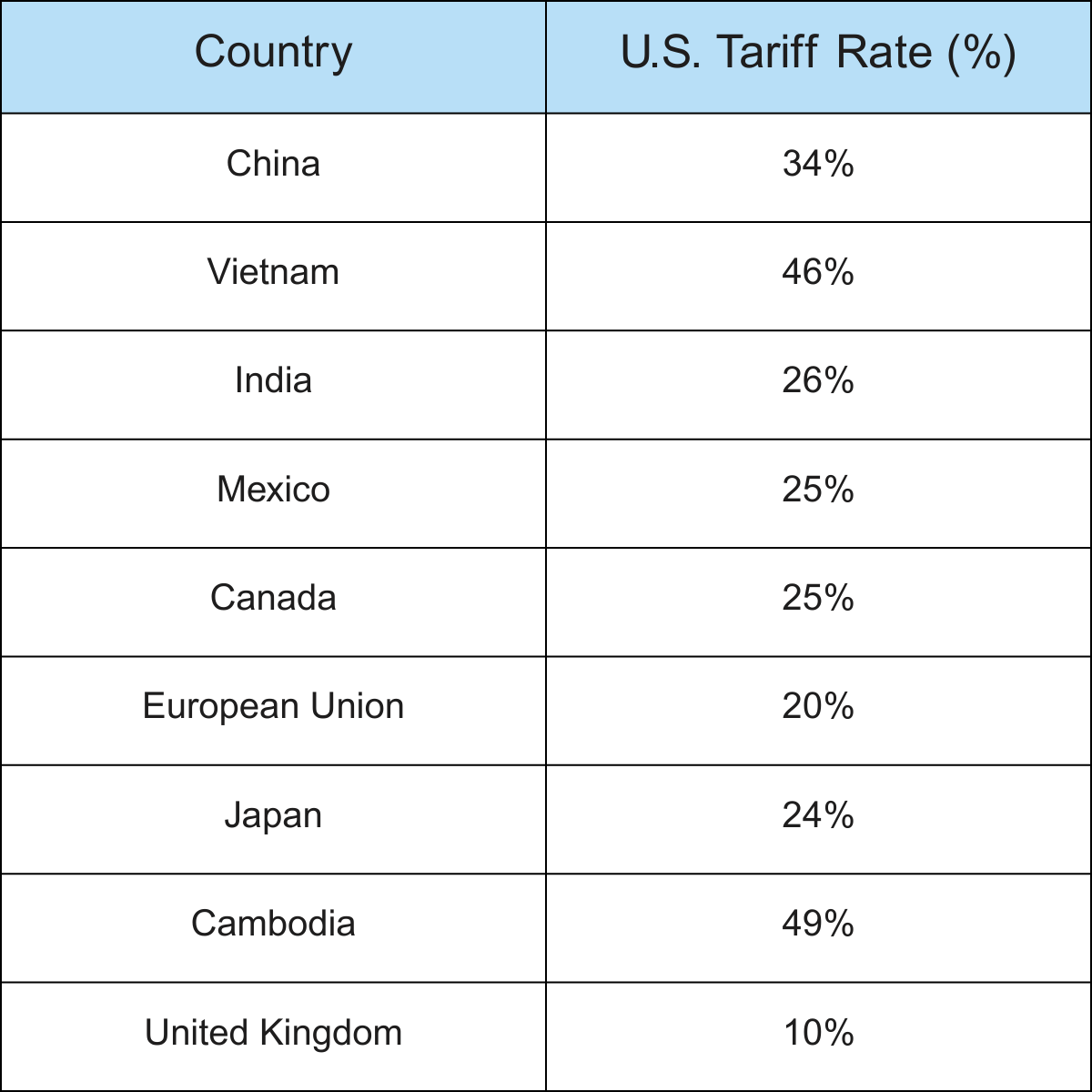

The Trump administration’s aggressive tariff strategy, revived again in the 2024 campaign and partially reinstated in early 2025, has not only disrupted global trade flows but also reshaped the landscape of Environmental, Social, and Governance (ESG) strategies for multinational corporations. Aimed at promoting economic independence and countering trade deficits, these tariffs—some reaching as high as 49%—have catalyzed unintended consequences that ripple through corporate sustainability programs and ESG investment frameworks. In this article, we explore how the Trump-era tariffs are influencing ESG activities, drawing from recent macroeconomic data, global case studies, and investment trends to provide a forward-looking analysis.

Supply Chain Shocks and Environmental Trade-Offs

The reintroduction and expansion of tariffs have prompted companies to reroute their global supply chains away from traditional hubs like China. While these moves are designed to sidestep punitive import duties, they often lead to increased carbon footprints due to longer transportation routes and less efficient manufacturing standards in the new host countries.

According to April 2025 data, the U.S. has implemented a baseline 10% tariff on nearly all imports, with significantly higher rates on specific countries:

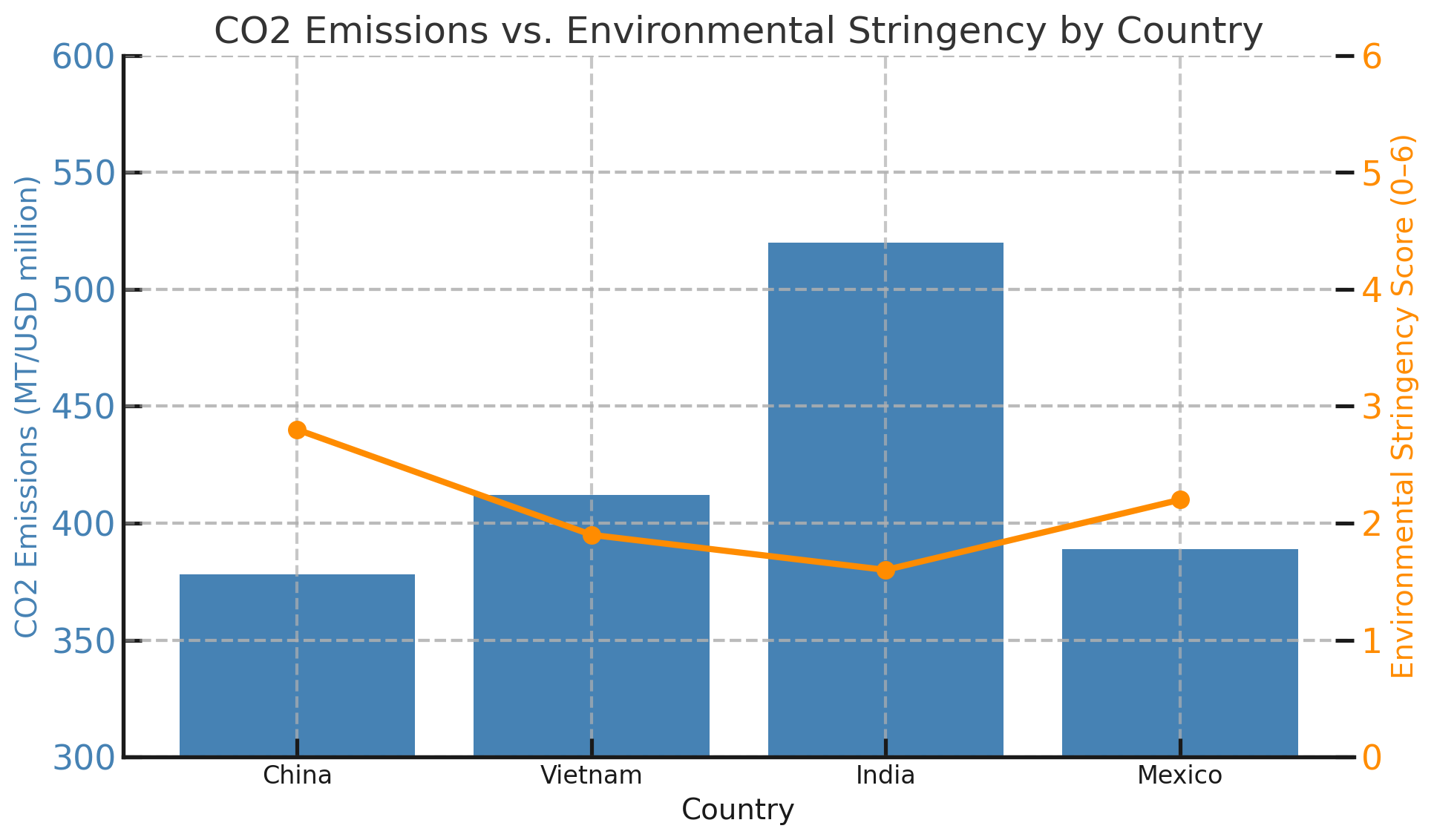

Shifting production from China to Vietnam or Cambodia, for example, exposes companies to weaker environmental regulations. The environmental policy stringency index published by the OECD shows lower scores for these alternative nations, which translates to less control over carbon emissions and hazardous waste management.

Furthermore, greenhouse gas emissions per unit of output tend to be higher, complicating ESG reporting for companies under scrutiny from investors and regulators.

A real-world example is seen in the electronics sector. Apple, in response to tariffs, diversified its production base from China to Vietnam and India. However, its 2024 ESG report noted a temporary increase in Scope 3 emissions attributed to transportation and facility upgrades in these countries. This presents a clear case of how tariff-induced reshuffling can temporarily reverse environmental progress.

Another notable case involves Tesla, which had planned to use a localized supply network in China for its Asian EV models. Due to high U.S. tariffs, Tesla announced in Q1 2025 a shift of some battery sourcing to South Korea and Indonesia—regions where mining-related emissions and labor compliance concerns are more pronounced. This pivot may complicate Tesla’s carbon-neutral goals for 2030.

Social Risks in New Manufacturing Frontiers

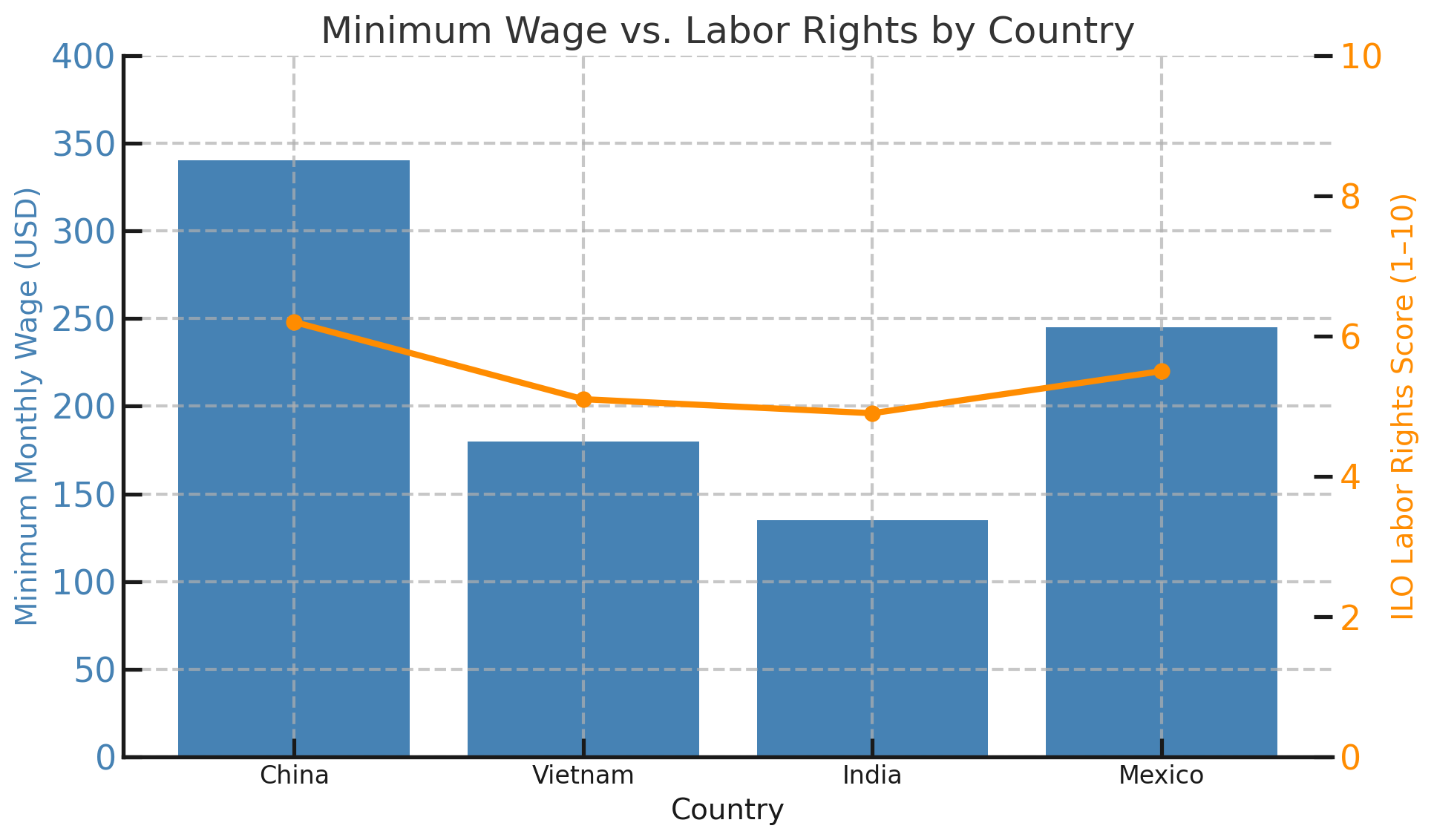

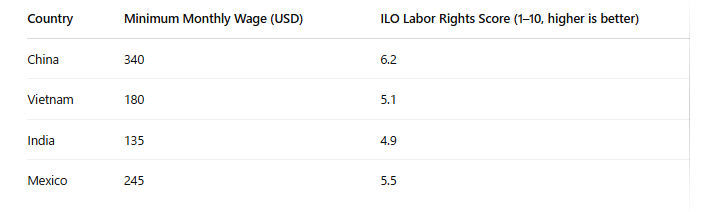

The social dimension of ESG also faces pressure under this new tariff regime. Moving supply chains to lower-tariff countries often means engaging with labor markets that have weaker protections, lower wages, and a higher risk of human rights violations.

These shifts expose companies to reputational risks, particularly when incidents of labor exploitation come to light. For example, a 2023 investigation found that several garment factories in northern Vietnam—benefiting from diverted orders post-tariffs—lacked proper fire exits and paid below legal minimum wages. Brands sourcing from these facilities faced immediate backlash from consumers and ESG ratings agencies.

To visualize the ESG trade-offs:

Domestically, while the tariffs were intended to reshore jobs, the net effect has been ambiguous. Sectors like U.S. steel did see modest gains, but downstream manufacturers, which rely on affordable imports, suffered cost hikes that led to layoffs. The Peterson Institute estimated a net loss of 300,000 jobs between 2018 and 2020 due to retaliatory tariffs and supply chain instability—undermining the “social” promise of protectionism.

Moreover, U.S. companies with sustainability-linked KPIs often saw disruptions in workforce diversity and safety initiatives when operations were scaled back due to rising costs. This paradoxically led to lower ESG ratings for firms meant to benefit from nationalist trade policy.

Governance Pressure and Strategic ESG Realignment

The unpredictable nature of tariff policies has underscored the need for robust governance systems that can integrate ESG considerations into real-time strategic decisions. However, a KPMG study in 2024 revealed that only 37% of large firms had formal mechanisms to assess trade policy risks within their ESG frameworks.

Firms that reacted swiftly and transparently maintained higher ESG ratings. HP Inc., for example, responded to tariff shifts by immediately auditing new suppliers in Southeast Asia using blockchain traceability. This not only ensured compliance with ESG standards but also bolstered investor confidence during a volatile period.

On the other hand, some firms attempted to circumvent tariffs through controversial means, such as mislabeling country-of-origin or using shell companies. These tactics, while legally ambiguous, raised red flags about corporate governance and undermined long-term ESG credibility.

To counteract these risks, forward-looking companies are revising their procurement policies to include ESG risk scoring that accounts for both tariff exposure and ethical practices. Integration of geopolitical intelligence with ESG data analytics is emerging as a key trend among industry leaders.

ESG-inclusive trade risk modeling: 38%

Blockchain supplier verification: 42%

Country-of-origin compliance: 56%

These practices are now being incorporated into ESG audit protocols and annual sustainability reporting standards.

ESG Investing in the Tariff Era

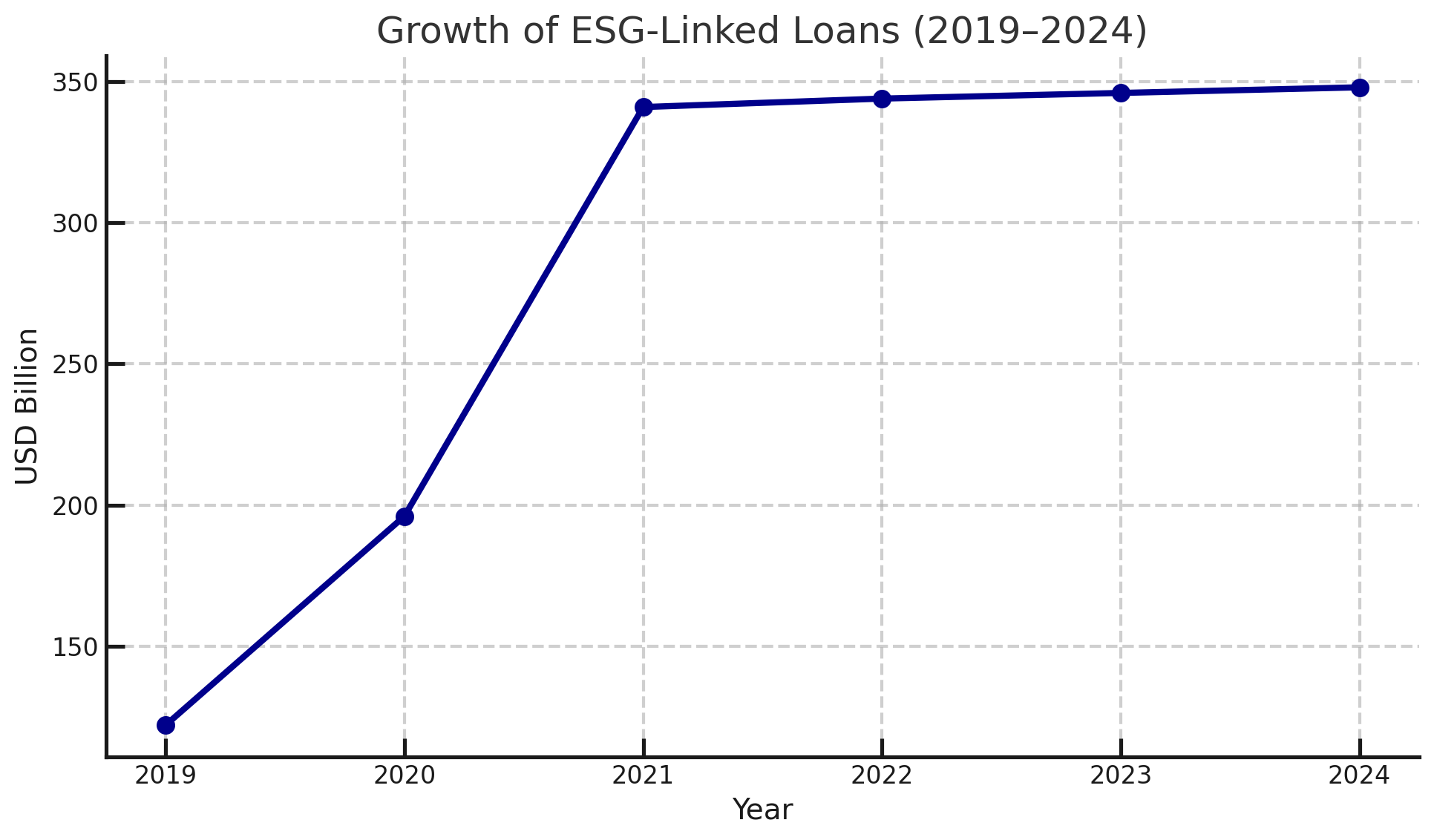

Despite the headwinds, the ESG investment landscape remains resilient. Institutional investors continue to demand transparency and sustainability, with ESG-linked loans (SLLs) and green bonds increasingly incorporating clauses related to geopolitical risk management. The number of SLLs surged from $122 billion in 2019 to over $340 billion in 2024.

Investors are also asking tougher questions about how companies adapt to tariffs while upholding ESG standards. BlackRock and Vanguard have issued new stewardship guidelines that require portfolio companies to disclose ESG risks related to trade disruptions.

This dynamic is fostering a new era of ESG investing—one that not only evaluates carbon footprints or board diversity but also how firms navigate geopolitical uncertainty without compromising values. Companies that demonstrate resilience in ESG performance under tariff-induced stress are likely to enjoy a valuation premium and greater capital access.

A growing number of ESG rating agencies have also introduced metrics on trade adaptability, tariff risk exposure, and the ethical composition of shifted supply chains. This reflects a broader market shift from static ESG evaluations to dynamic, context-sensitive assessments.

Future Outlook

The Trump-era tariff policies, both in their original incarnation and recent revival, have reshaped how corporations think about sustainability. While these tariffs were meant to protect domestic industry, they have introduced significant challenges to maintaining robust ESG performance.

Going forward, we can expect a new equilibrium where ESG strategies are more closely tied to geopolitical intelligence. Companies will increasingly invest in adaptive supply chains, predictive analytics, and compliance mechanisms to buffer against future trade shocks. ESG reporting will also evolve to reflect these multidimensional risks, moving beyond carbon metrics to include social and governance indicators that capture the full spectrum of tariff impacts.

Geopolitical scenario planning: High

ESG-integrated procurement models: Moderate

Relocation with ESG safeguards: Low to Moderate

In conclusion, tariffs are no longer just trade instruments—they are ESG variables. For companies committed to long-term sustainability and ethical governance, adapting to this new reality is not optional; it is essential. Firms that succeed will be those that approach ESG as a cross-functional, risk-aware strategy—not just a compliance checklist.

By aligning ESG goals with geopolitical foresight, companies can not only maintain their commitments amid uncertainty but also seize competitive advantage in a world where both sustainability and resilience are paramount.

Why Work with ASUENE Inc.?

ASUENE USA Inc., a subsidiary of Asuene Inc., is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.