- Article Summary

-

Introduction

As the United States races toward its climate and energy independence goals, solar power is emerging as a cornerstone of the nation’s renewable energy strategy. Solar installations have grown exponentially over the past decade, driven by falling costs, supportive policies, and growing corporate and consumer demand for clean energy. However, this momentum is now under serious threat. A new wave of trade restrictions—including tariffs and Foreign Entity of Concern (FEOC) rules—are disrupting the solar supply chain and casting doubt on whether the U.S. can sustain its growth trajectory. These policies, while intended to promote national security and domestic industry, may unintentionally stall progress by choking off access to critical components still predominantly sourced from China.

The Current State of the U.S. Solar Supply Chain

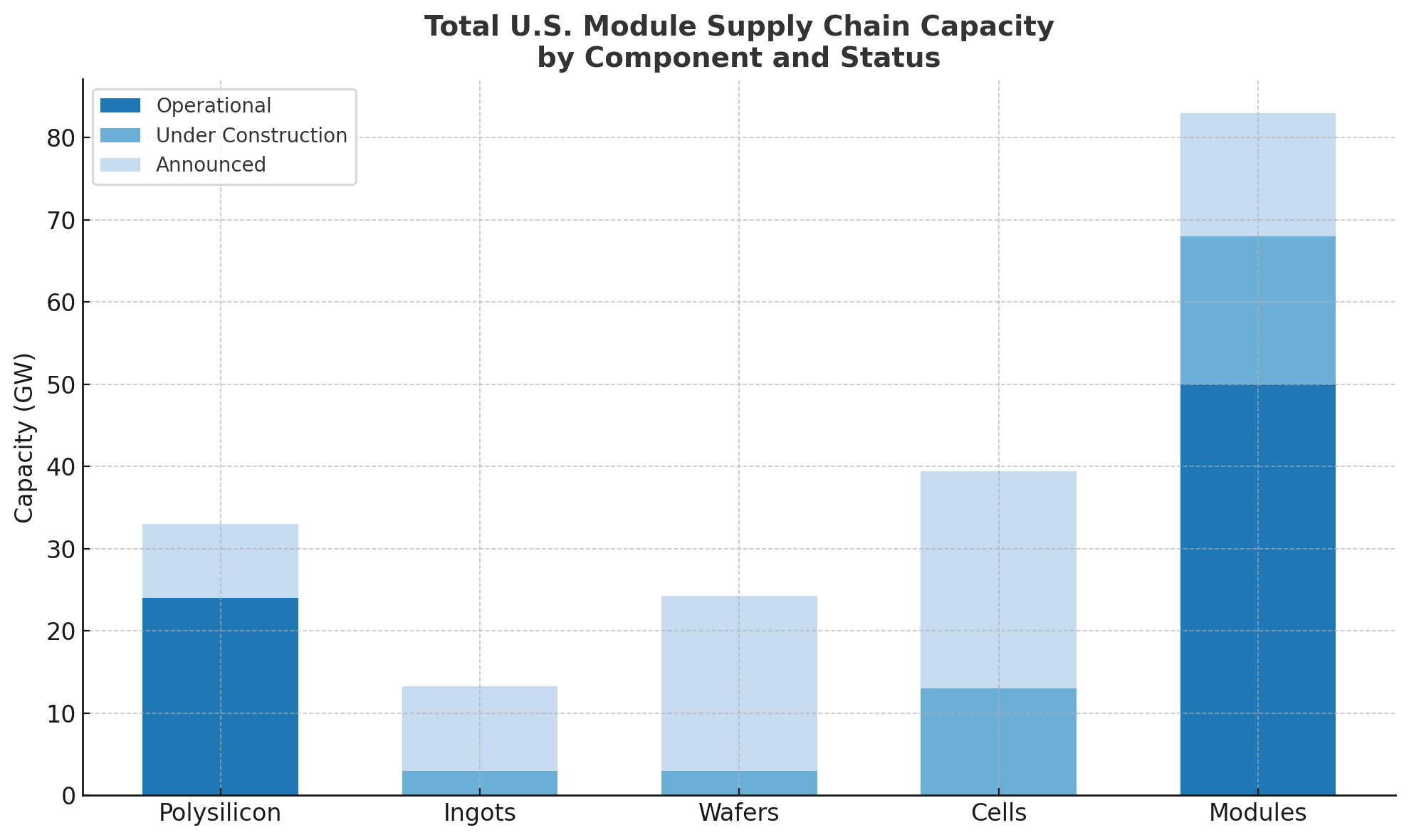

Today, the U.S. solar market depends significantly on imports, particularly from Asia. China controls over 80% of the global supply of wafers and more than 95% of key solar materials such as polysilicon and solar-grade ingots.

Currently, the U.S. has some capacity in module assembly and limited presence in polysilicon production, but it lacks sufficient capabilities in wafer and cell manufacturing. This overreliance on Chinese supply chains is exactly what the FEOC designation seeks to address. Starting in 2024, FEOC rules will begin disqualifying tax credits for projects using Chinese-affiliated components, with full enforcement by 2026. Combined with ongoing tariffs on imported modules and cells, these rules could severely limit the availability of critical inputs, threatening to derail projects already in the pipeline.

Policy Push: IRA Incentives vs. FEOC Restrictions

The Inflation Reduction Act (IRA), passed in 2022, includes substantial incentives to accelerate domestic solar manufacturing. The goal is to build a resilient, homegrown supply chain.

To clarify how these policies interact, the table below outlines key tools:

| Policy Tool | Type | Target Stage | Impact on Solar Supply Chain |

|---|---|---|---|

| IRA Section 45X | Incentive | Manufacturing | Boosts module, cell, and polysilicon production |

| Investment Tax Credit (ITC) | Incentive | Facility development | Encourages U.S.-based solar factory buildouts |

| Bonus for Domestic Content | Incentive | All components | Rewards use of U.S.-made parts in solar projects |

| FEOC Restriction | Restriction | All components | Disqualifies Chinese-affiliated content |

| Import Tariffs (e.g. AD/CVD) | Restriction | Modules, cells | Raises cost of imported solar components |

However, the FEOC restrictions under the IRA present a paradox. While the act promotes domestic production, it also disqualifies projects from receiving tax credits if they use components from Chinese-affiliated entities. This tension is particularly acute because the U.S. currently lacks sufficient upstream capabilities.

States like Texas, Georgia, and Ohio are stepping up, with announcements of new factories for modules and cells. Still, wafer and ingot production remain bottlenecks, with only a handful of facilities under development. The time it takes to permit, finance, and build these facilities means the industry could face a short-term supply crunch, exacerbated by the looming policy deadlines.

Domestic Capacity Outlook and the Road Ahead

According to Wood Mackenzie, the U.S. could see solar deployment drop by up to 30% in 2025 if FEOC rules are enforced without sufficient domestic manufacturing in place. While over 80 GW of new module assembly capacity has been announced, cell and wafer production are lagging. For example, only 20 GW of cell capacity is currently under development, compared to an expected demand of over 50 GW annually by 2030.

Challenges include:

- Lengthy permitting and siting processes

- Shortage of skilled labor for solar manufacturing

- Limited domestic supply of metallurgical-grade silicon

- Capital constraints for upstream investment

These issues are compounded by the fact that FEOC and tariff policies are being enforced faster than new manufacturing facilities can come online. Without a realistic transitional plan, these restrictions could freeze parts of the solar pipeline.

Despite these hurdles, there is room for optimism. Federal funding from the Department of Energy, as well as growing private investment in advanced technologies like thin-film and perovskite solar cells, could help the U.S. leapfrog traditional supply chains. To bridge the gap, policymakers and industry leaders must coordinate on permitting reform, workforce development, and targeted support for upstream components. Public-private partnerships and robust trade agreements with allied nations could also help diversify the supply base while reducing dependence on China.

Conclusion: The Need for Strategic Alignment

The future of U.S. solar hinges on the country’s ability to rapidly scale domestic manufacturing while navigating complex and sometimes contradictory trade restrictions. The Inflation Reduction Act provides a robust policy foundation, but FEOC enforcement and escalating tariffs risk undermining its benefits unless upstream capacity is developed in parallel.

Without strategic alignment between policy, industry, and investment, the U.S. could face a slowdown in solar deployment just as climate goals become more urgent. To succeed, the nation must invest in every layer of the solar supply chain, from raw materials to finished modules, and ensure traceability, transparency, and resilience.

In this high-stakes moment, the question is not just whether the U.S. can reduce reliance on China, but whether it can avoid a looming solar supply crisis that could jeopardize its climate and energy security ambitions.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.