- Article Summary

-

Overview: Why RGGI Deserves a Second Look in ESG Strategy

The Regional Greenhouse Gas Initiative (RGGI) has often been overshadowed by federal climate policy debates and international carbon markets. However, in 2025 and beyond, this multistate cap-and-trade program in the Northeastern and Mid-Atlantic U.S. is becoming increasingly important, not only as a compliance tool, but as a strategic lever for ESG (Environmental, Social, and Governance) disclosure, investor communication, and emissions planning.

RGGI was launched in 2009 as the first mandatory market-based program in the U.S. to reduce greenhouse gas emissions. It applies primarily to power plants with a capacity of 25 megawatts or more, requiring them to hold tradable carbon allowances for every ton of CO2 emitted.

For ESG professionals, RGGI now intersects with several key priorities:

- Scope 1 emissions reductions for utilities and large emitters

- Energy price impacts for industrial manufacturers

- Carbon cost modeling and internal pricing strategy

- Regional carbon intensity comparisons for EU CBAM compliance

RGGI 2025 and Beyond: Regulatory Updates and Market Trends

Recent years have brought major reforms to RGGI through updated Model Rules that reflect new climate ambitions:

Model Rule Revisions

The RGGI cap is now set to decline by 3.5 percent annually through the year 2030, reflecting a sharper trajectory in emissions reduction aligned with recent climate targets. In addition, revised rules on allowance banking limit the amount of unused credits that entities can carry forward into future compliance periods, reducing the risk of market oversupply and preserving the integrity of the cap. Alongside these changes, the program also now features annually adjusted minimum and maximum allowance prices, helping to stabilize market expectations and encourage long-term investments in low-carbon technologies.

Market Expansion and Participation

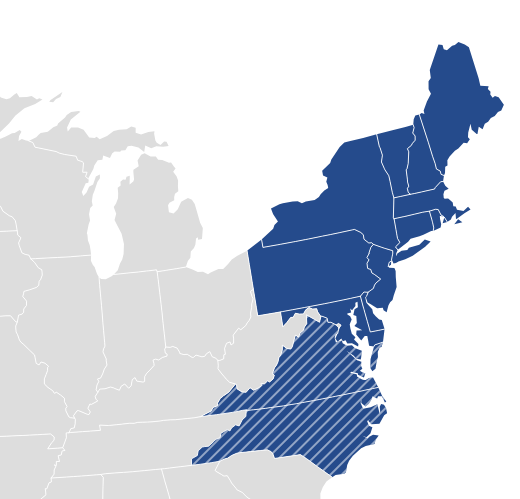

Current RGGI States (2025): Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, Vermont, and Virginia.

Pennsylvania: Officially joined RGGI in 2022; court challenges delayed enforcement but resumed in 2024.

Virginia: The state’s participation in RGGI remains in limbo due to pending court rulings regarding a 2023 attempt by the Governor to withdraw from the program, a move that has been legally contested and is awaiting a final decision in state court.

North Carolina: Efforts to join RGGI were effectively halted in 2024 when the state legislature passed a law prohibiting participation without explicit legislative approval, thereby blocking regulatory efforts that had been underway. As a result, North Carolina is no longer considered a likely near-term entrant.

Map: Participating States

Auction Prices

As of the most recent auction in March 2025, the clearing price for a RGGI carbon allowance reached $17.85 per short ton of CO2. This marks a significant rise from around $5.00 per ton in 2020, highlighting the market’s sensitivity to both regulatory tightening and growing investor interest. The steep upward trend over the last five years reflects how the implementation of stricter annual emissions caps has successfully increased the scarcity and value of allowances. At the same time, broader financial market awareness and the increasing use of carbon pricing in ESG strategy have further contributed to rising demand for RGGI credits.

Sectoral Impacts: How RGGI Compliance Affects Key Industries

Power Generation

The electricity sector has experienced the most direct and transformative effects under RGGI. Since 2009, CO2 emissions from power plants in participating states have declined by approximately 50 percent. This significant drop has been driven largely by the compliance cost associated with carbon allowances, which has prompted utilities to shift away from coal-fired power generation. The resulting transition has favored natural gas and renewable energy sources. Utilities operating in RGGI states frequently reflect this evolution in their ESG disclosures, often identifying Scope 1 emissions linked directly to RGGI obligations. These disclosures typically follow standardized reporting frameworks such as those set by the Task Force on Climate-related Financial Disclosures (TCFD).

Heavy Industry

Although not directly covered by RGGI regulations, industrial manufacturers—particularly those in the cement and chemical sectors—are indirectly affected by the program. The primary impact comes through increased electricity prices, which reflect the cost of carbon allowances passed through from power providers. Many large-scale manufacturing operations have started incorporating RGGI-related pricing into their operational planning and long-term risk assessments. A notable example is a cement facility in New York that procures electricity from renewable and low-carbon sources and includes its RGGI-adjusted emissions profile in its annual CDP submission.

Natural Gas Utilities

Natural gas providers are also feeling the pressure to adapt to the evolving carbon pricing environment shaped by RGGI. While they are not yet directly required to purchase allowances under the program, many utilities are adjusting their procurement strategies in anticipation of future regulatory changes. Several are revising their rate structures to reflect RGGI-related costs, and some are reinvesting portions of auction revenues into energy efficiency initiatives for residential and commercial customers. These trends indicate a growing alignment between RGGI compliance and utility ESG goals, particularly in relation to reducing emissions and improving community access to clean energy solutions.

ESG Reporting Implications: How to Account for RGGI in Climate Disclosures

Companies operating in or sourcing from RGGI-covered areas face specific ESG reporting challenges and opportunities.

Scope 1 Emissions Accounting

Companies should report their actual emissions alongside the number of RGGI allowances surrendered to cover those emissions. In addition, they are encouraged to incorporate the prevailing auction prices into their internal carbon pricing models to provide a more accurate and forward-looking estimate of climate-related financial exposure.

Alignment with ESG Standards

The integration of RGGI into ESG reporting aligns with several key disclosure frameworks. Under CDP, companies are expected to report on carbon pricing mechanisms and outline how they influence business strategy. The GRI 305 standard calls for organizations to disclose greenhouse gas emissions in a way that contextualizes them within the applicable regulatory environment, including programs like RGGI. Similarly, the ISSB and TCFD frameworks encourage companies to account for regulatory carbon costs as part of their analysis of climate-related risks and opportunities, further reinforcing the importance of transparent and comprehensive emissions accounting.

Social and Governance Metrics

RGGI revenue is often reinvested in community programs, energy efficiency, and low-income support. This reinvestment contributes meaningfully to the social and governance dimensions of ESG reporting. From a social perspective, many states use RGGI proceeds to fund programs that benefit underserved communities, thereby improving energy access and reducing inequality. On the governance side, companies that actively participate in or align with these programs can demonstrate a proactive approach to carbon accountability and regulatory engagement. These actions reinforce a broader commitment to responsible climate governance and equitable environmental outcomes.

Chart: RGGI Auction Revenue Allocation (NY, MA, MD)

| State | % to Efficiency | % to Equity/Access | % Other |

|---|---|---|---|

| NY | 55% | 30% | 15% |

| MA | 50% | 35% | 15% |

| MD | 60% | 25% | 15% |

Conclusion: RGGI as a U.S. Case Study for Scalable, Transparent Carbon Markets

RGGI offers lessons that go far beyond the Northeastern U.S. Its auction system is transparent and auditable, enabling both regulators and market participants to track progress with credibility. Emission reductions achieved through RGGI are measurable and enforceable, providing a concrete example of how carbon trading can contribute to decarbonization goals. Moreover, the initiative strikes a balance between environmental integrity and economic reinvestment, with auction revenues being directed into energy efficiency programs, renewable energy deployment, and support for low-income communities.

For ESG teams, RGGI serves as more than a regional policy mechanism, it represents a model for how carbon tracking, investor-grade climate data, and equity-focused reinvestment can all function together. Organizations are increasingly factoring RGGI prices into their internal carbon models, reflecting these in their Scope 1 emissions disclosures, and monitoring legal developments in states like Pennsylvania and North Carolina. These actions are helping companies stay ahead of regulatory trends and prepare for future international alignment pressures, such as those introduced by the EU Carbon Border Adjustment Mechanism.

In a fragmented U.S. policy landscape, RGGI demonstrates that regional carbon markets can be both scalable and impactful. Its structure and outcomes provide valuable insights for companies and policymakers looking to implement or improve market-based climate strategies, not just domestically but as part of a globally interconnected ESG framework.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.