- Article Summary

-

Introduction: Why TNFD Matters in 2025

The Taskforce on Nature-related Financial Disclosures (TNFD) launched its framework in 2023, and by 2025 more than 620 organizations representing over $20 trillion in assets under management have pledged to align. The TNFD 2025 Status Report demonstrates that global momentum is building. Investors, regulators, and markets increasingly expect nature-related disclosures to stand alongside climate reporting. Yet many companies remain stuck between ambition and execution. This article explores the three biggest barriers to TNFD reporting and provides practical solutions for overcoming them.

Barrier 1: Data Gaps and Supply Chain Complexity

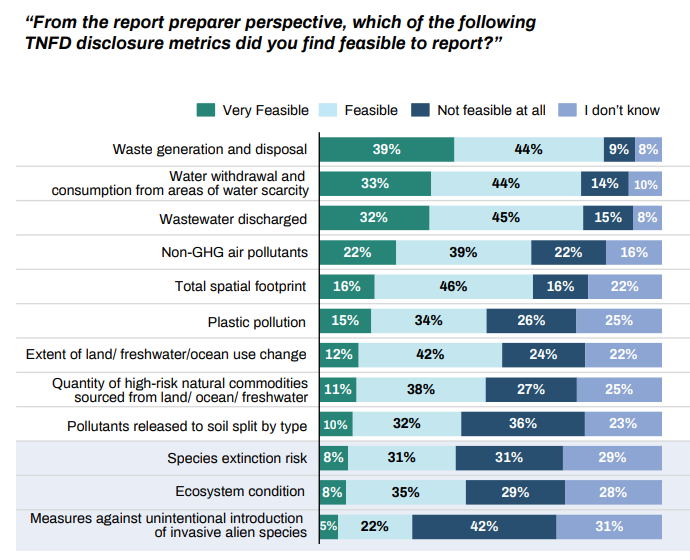

The TNFD 2025 Status Report highlights that many companies cite data availability as a major challenge, especially in areas such as biodiversity impacts, land-use change, and freshwater use. For most businesses, the greatest risks and impacts are hidden in Scope 3 supply chains. Agriculture, consumer goods, and textiles are especially exposed, with sprawling global networks that make it difficult to measure nature dependencies.

How to overcome it: Centralizing ESG and supply chain data is critical. Platforms like ASUENE make this possible by automating Scope 3 calculations, mapping biodiversity dependencies, and enabling supplier engagement. This creates a reliable foundation for TNFD disclosures.

Barrier 2: Lack of Internal Expertise and Governance Structures

According to the TNFD 2025 Status Report, most companies adapting TNFD rely on climate governance frameworks but lack nature-specific expertise. Many ESG teams are skilled in carbon accounting and TCFD alignment but underprepared for nature risk analysis. Without strong governance and board-level oversight, TNFD reporting often struggles to gain traction.

| Aspect | Traditional ESG Governance | TNFD-Ready Governance |

|---|---|---|

| Focus | Primarily on climate and carbon reporting | Broader coverage including nature and biodiversity |

| Committees | Climate or Sustainability Committee only | Dedicated Nature/Biodiversity Committee or integrated cross-functional team |

| Board Oversight | Limited discussion of nature risks | Explicit oversight of climate and nature-related risks |

| Expertise | Carbon accounting, TCFD alignment | Nature-related risk assessment, biodiversity expertise |

| Cross-functional Involvement | ESG team driven | Involves procurement, operations, risk, finance, and supply chain management |

How to overcome it: Companies need to build internal capability and align governance around nature-related risks. This includes creating cross-functional committees, training ESG teams, and ensuring that boards understand biodiversity and ecosystem dependencies. ASUENE provides advisory support to help organizations develop governance structures and embed TNFD reporting into decision-making.

Barrier 3: Perceived Complexity of Frameworks

TNFD builds on TCFD but introduces additional elements such as the LEAP approach: Locate, Evaluate, Assess, Prepare. For many companies, this framework feels too technical or resource-intensive. The Status Report shows that most early adopters began with pilot disclosures to test feasibility. The perception of complexity often delays action, but pilots prove that progress is possible.

How to overcome it: Start small with a materiality assessment or a pilot disclosure, then scale over time. The key is not perfection, but progress. ASUENE simplifies TNFD alignment by mapping LEAP into practical steps, enabling businesses to integrate nature-related disclosures with existing ESG and climate reports.

Conclusion: Turning Barriers into Opportunities

TNFD adoption is accelerating, but companies still face three main barriers: data gaps, lack of expertise, and perceived complexity. The TNFD 2025 Status Report proves that momentum is here and expectations are rising. Businesses that act now will gain trust from investors, regulators, and consumers.

ASUENE helps companies overcome these barriers by centralizing ESG and supply chain data, providing advisory expertise, and simplifying the LEAP approach into actionable steps. Do not wait until regulations force your hand. Talk to ASUENE today and start your TNFD journey with confidence.

Why Work with ASUENE Inc.?

ASUENE is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. ASUENE serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.