- Article Summary

-

The Financial Stability Board (FSB) created the TCFD to develop recommendations on the types of information that companies should disclose to support investors, lenders, and insurance underwriters in appropriately assessing and pricing risks related to climate change. The TCFD was committed to market transparency and aimed for widespread adoption of its recommendations to make climate-related financial risks and opportunities a natural part of companies’ risk management and strategic planning processes.

Important Update on TCFD Status

Concurrent with the release of its 2023 status report on October 12, 2023, the TCFD has fulfilled its remit and disbanded. The FSB has asked the IFRS Foundation to take over the monitoring of the progress of companies’ climate-related disclosures.

As of November 2023, this website will no longer be updated or monitored but will remain available to serve as a resource for materials developed by the Task Force. The Task Force is deeply grateful to all parties involved for their input, support, and adoption of the TCFD recommendations.

Task Force Members

On request of G20 Finance Ministers and Central Bank Governors, the FSB convened a Task Force of industry experts from various organizations, including:

- Large banks

- Insurance companies

- Asset managers

- Pension funds

- Large non-financial companies

- Accounting and consulting firms

- Credit rating agencies

These Task Force members voluntarily dedicated their time and expertise to the work of the TCFD, which was chaired by Michael R. Bloomberg, founder of Bloomberg L.P., and U.N. Special Envoy on Climate Ambition and Solutions.

We are grateful to Task Force members, members of the Secretariat, and observers, past and present, for their invaluable contributions to the success of the TCFD’s recommendations.

TCFD Recommendations

In 2017, the TCFD released climate-related financial disclosure recommendations designed to help companies provide better information to support market transparency and more informed capital allocation.

Core Elements

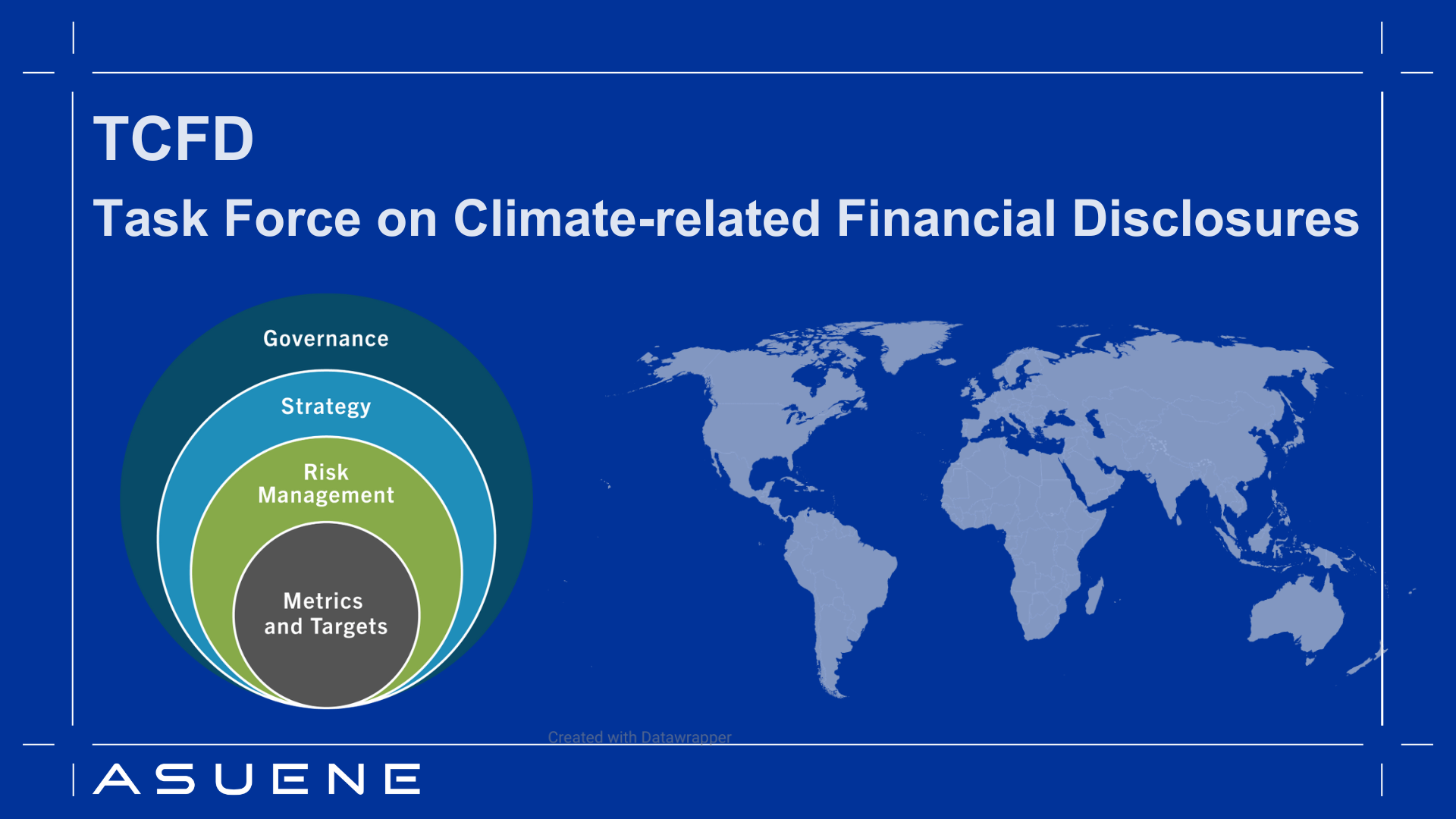

The disclosure recommendations are structured around four thematic areas that represent core elements of how companies operate:

- Governance

- Strategy

- Risk management

- Metrics and targets

Framework

The four recommendations are interrelated and supported by 11 recommended disclosures that build out the framework with information that should help investors and others understand how reporting organizations think about and assess climate-related risks and opportunities.

Asuene provides Climate Tech solutions to help businesses comply with sustainability regulations like the EU Deforestation Regulation (EUDR) and align with Environmental, Social, and Governance (ESG) goals.

What Asuene Can Assist

| Service | Description |

| Supply Chain Transparency | Identify and monitor deforestation risks across supply chains. |

| Carbon Footprint Analysis | Measure and report emissions to align with ESG and TCFD requirements. |

| Due Diligence Support | Automate data collection and documentation for compliance. |

| Sustainability Consulting | Provide expert advice on aligning sourcing practices with regulations. |

| Regulatory Compliance | Ensure adherence to TCFD and other sustainability standards. |

Why Choose Asuene?

- Comprehensive EUDR Solutions – End-to-end support from risk assessment to compliance.

- Efficiency & Scalability – Automate compliance processes and reduce costs.

- Global Expertise – Experience with 10,000+ clients worldwide in sustainability and ESG.

By partnering with Asuene, businesses can ensure regulatory compliance, improve sustainability performance, and enhance market credibility.