- Article Summary

-

Overview of Category 8: Upstream Leased Assets

Scope 3 Category 8 includes emissions from the operation of assets leased by the reporting company, when those assets are not already included in the company’s Scope 1 or 2 inventory. These are typically upstream leases, where the company is the lessee rather than the lessor.

As leasing becomes more common for offices, machinery, IT equipment, and vehicles, understanding the embedded emissions from leased assets is essential for accurate value chain reporting—particularly under double materiality principles embedded in EU regulations.

Boundary and Scope Definition

Included:

- Emissions from buildings, facilities, and vehicles leased from third parties

- Energy use and related emissions that are outside the company’s direct control

- Long-term or short-term operating leases

Excluded:

- Assets reported in Scope 1 or 2 (i.e. if the company controls the energy use)

- Downstream leased assets (Category 13)

Clarifications:

- If a lease gives operational control and the company reports Scope 1/2 for the asset, it is excluded from Category 8.

- Reporting aligns with GHG Protocol’s control approach and IFRS/ESRS guidelines

Calculation Methodologies

The two main methods include:

- Metered Energy Use (Preferred): If energy use data is available from landlords or facility managers

- Average Building or Asset Emission Factors: Use area (m²), operating hours, and average energy intensity per asset type

Key variables:

- Asset type and usage profile

- Regional electricity grid emission factors

- Duration of lease and intensity of use

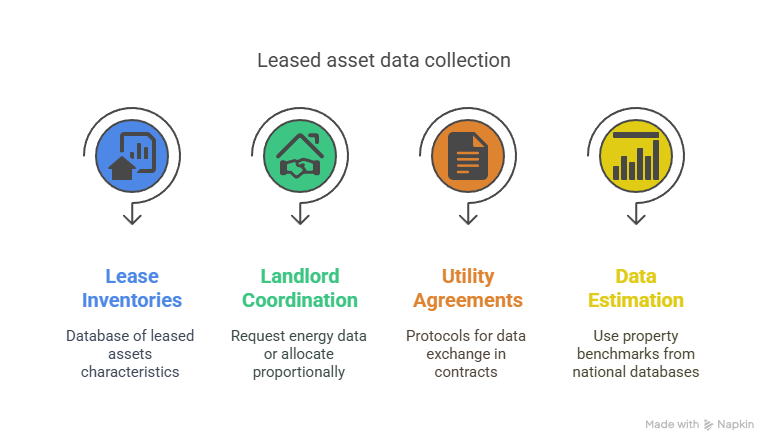

Data Collection Strategies

Collecting reliable upstream leased asset data may require facility management and real estate coordination:

- Lease Inventories: Maintain a database of all leased assets and their characteristics (size, function, location)

- Landlord Coordination: Request actual energy data or allocate based on lease proportion

- Utility Sharing Agreements: Establish protocols for energy and emissions data exchange in lease contracts

- Data Estimation: Where actual data isn’t available, use property type benchmarks from national databases

Digital solutions (e.g. building management platforms) can facilitate asset-level tracking in multi-tenant arrangements.

Emission Reduction Approaches

Emission reductions in Category 8 often rely on landlord-tenant collaboration and lease structuring:

- Green Leasing: Include sustainability clauses in lease agreements (e.g. energy targets, renewable procurement)

- Energy Efficiency Retrofits: Work with lessors on HVAC, lighting, and insulation upgrades

- Shared Carbon Goals: Align climate targets with property managers or asset owners

- Office Consolidation or Relocation: Optimize space use to reduce overall footprint

- Behavioral Measures: Engage employees in energy-saving behaviors within leased facilities

Proactive collaboration with landlords can significantly influence indirect energy emissions.

Case Studies: Managing Leased Asset Emissions Effectively

Unilever

Unilever includes emissions from leased offices and R&D facilities in its Scope 3 reporting. It negotiates green lease clauses and prioritizes properties that use certified renewable electricity. (Unilever Climate Transition Action Plan)

ING Bank

ING monitors emissions from its leased branches and office spaces globally, aligning real estate strategy with its science-based targets. It uses landlord energy data wherever possible. (ING Sustainability Report)

Vodafone

Vodafone tracks energy use in leased retail outlets and facilities, using data-sharing agreements with landlords and optimizing store layouts to reduce energy demand. (Vodafone ESG Resources)

These examples demonstrate how upstream leased assets, while indirect, can be addressed through structured engagement and smart leasing strategy.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.