- Article Summary

-

Overview of Category 2: Capital Goods

Scope 3 Category 2—Capital Goods—covers the cradle-to-gate emissions from the production of long-term assets a company acquires to support its operations. These include buildings, machinery, equipment, and infrastructure. Although capital goods are not consumed directly during the reporting year, their embedded emissions can be significant due to the energy- and resource-intensive nature of their production.

This category is especially relevant for sectors such as construction, manufacturing, energy, and transportation—where infrastructure and equipment represent a sizable share of upstream emissions. With the growing pressure from investors and regulators to account for full lifecycle emissions, capital goods must be an integral part of any net-zero strategy.

Boundary and Scope Definition

Category 2 includes emissions from:

- Construction of buildings and facilities

- Manufacturing of machinery, vehicles, and production equipment

- Acquisition of IT hardware, medical devices, aircraft, ships, etc.

It excludes assets that are leased (Category 8 or 13) or goods consumed within a single year (Category 1).

The boundary aligns with international financial reporting standards and upcoming disclosure frameworks:

- EU CSRD and ESRS E1: Require CapEx climate alignment disclosures

- ISSB IFRS S2: Recommends inclusion of capital goods emissions in transition planning

Calculation Methodologies

Companies can use the following methods to calculate emissions:

- Spend-Based Method: Multiply capital expenditure by average emission factors (e.g., per € or $ spent on construction or equipment). Useful when detailed data are unavailable.

- Average Data Method: Use industry averages for emission-intensive assets (e.g., building materials, heavy machinery).

- Supplier-Specific Method: Collect cradle-to-gate data directly from manufacturers or conduct product-specific LCAs.

Best practice is to prioritize:

- Supplier-specific data for high-emission assets (e.g., steel structures, vehicles)

- Hybrid approaches when integrating with procurement and asset management systems

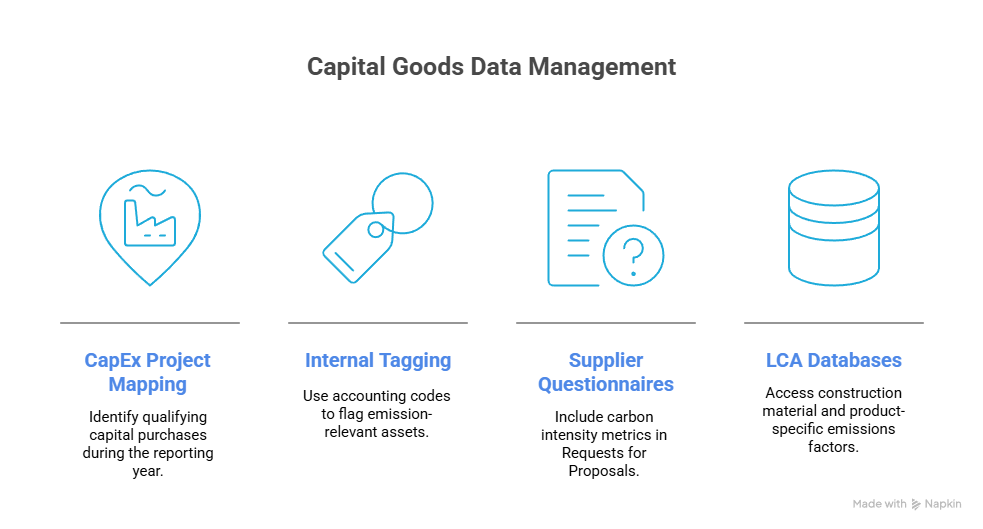

Data Collection Strategies

Effective data management for capital goods requires coordination across procurement, engineering, and sustainability teams:

- CapEx Project Mapping: Identify all qualifying capital purchases during the reporting year

- Internal Tagging: Use accounting codes to flag emission-relevant assets

- Supplier Questionnaires: Include carbon intensity metrics in RFPs

- LCA Databases: Access construction material and product-specific emissions factors

- Integrated Tools: Use internal systems to link asset registries and emissions factors

To prepare for regulatory audits, companies should implement a documentation trail that traces CapEx decisions to environmental performance.

Emission Reduction Approaches

Reducing emissions in Category 2 requires forward-thinking design and investment practices:

- Low-Carbon Material Substitution: Use green steel, low-carbon concrete, bio-based polymers

- Circular Procurement: Prioritize reused, recycled, or modular assets

- Supplier Requirements: Include carbon reduction plans in vendor evaluations

- Lifecycle Costing: Incorporate internal carbon pricing and maintenance emissions

- Innovation Partnerships: Collaborate with manufacturers on sustainable product development

Early design decisions—particularly in construction and manufacturing—can yield emission reductions of 30–70% over an asset’s lifecycle.

Case Studies: Leading Practices in Capital Goods Management

Microsoft

Microsoft integrates embodied carbon requirements into its real estate and data center projects. All new buildings are designed to meet LEED Platinum standards, and the company tracks embedded emissions in materials like steel and concrete. (Microsoft: Embodied Carbon Reduction Strategy)

Skanska

The construction firm Skanska uses its in-house carbon estimation tool to assess emissions across project phases. They offer clients carbon-optimized designs and report progress toward net-zero goals. (Skanska Sustainability Goals )

BMW Group

BMW evaluates cradle-to-gate emissions when selecting manufacturing equipment and tooling. It includes carbon footprint criteria in capital purchase decisions and works with equipment suppliers to reduce upstream impact. (BMW Sustainability Report 2023 )

These examples show how leading firms integrate climate objectives into capital investment, balancing functionality, financial return, and environmental performance.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.