- Article Summary

-

What Is Category 15?

Scope 3 Category 15 encompasses greenhouse gas (GHG) emissions associated with the reporting company’s investments. This applies primarily to financial institutions (e.g., banks, asset managers, insurers) but also to companies that hold equity or debt in other organizations. The emissions included are proportional to the ownership share of the investee and represent downstream, indirect impacts.

This category is a key component of financed emissions and often represents the largest portion of Scope 3 emissions for financial firms.

Why Category 15 Matters

Investments have a significant impact on global emissions. Financial institutions and companies with large investment portfolios are under increasing pressure to:

- Measure and disclose financed emissions

- Align portfolios with net-zero and 1.5°C pathways

- Support sustainable finance and impact investing

- Address climate-related financial risks and opportunities

Category 15 enables alignment with global frameworks such as:

- Task Force on Climate-related Financial Disclosures (TCFD)

- Net Zero Asset Owner Alliance (NZAOA)

- Partnership for Carbon Accounting Financials (PCAF)

How to Calculate Category 15 Emissions

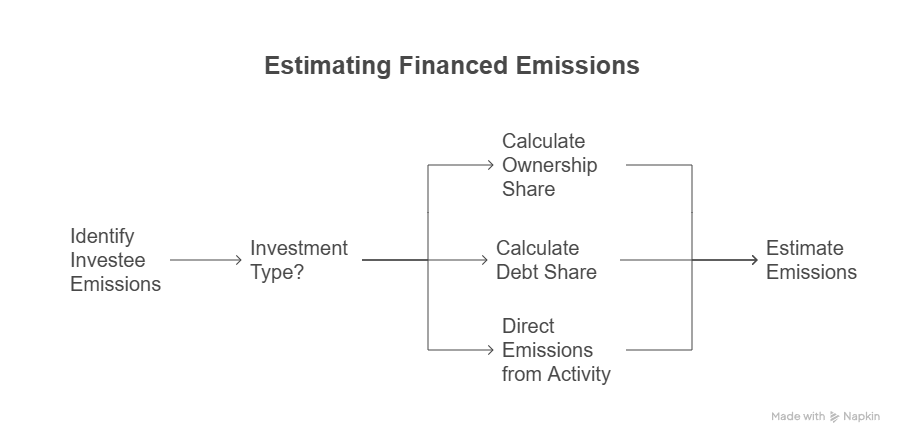

The basic formula for estimating financed emissions is:

Emissions = (Investee emissions) × (Ownership share or debt share)

Methodologies depend on investment type:

- Equity investments: based on share of enterprise value

- Corporate debt: proportional to outstanding loan or bond amount

- Project finance: based on direct emissions from the financed activity

PCAF provides standardized guidance and emission factors for calculating financed emissions across asset classes.

Regulatory Landscape (as of 2025)

Regulators and stakeholders are increasing pressure on financial actors to disclose and manage climate-related risks:

- EU Sustainable Finance Disclosure Regulation (SFDR) requires sustainability risk reporting and principal adverse impacts, including financed emissions

- SEC Climate Disclosure Rule (2025) may include Scope 3 emissions for publicly listed financial firms

- ISSB & IFRS Sustainability Standards advocate full portfolio-level GHG transparency

Global financial institutions are expected to integrate Category 15 into their ESG reporting and target-setting.

Case Studies: Real-World Examples

BlackRock: Portfolio Emissions Reduction Strategy

BlackRock measures financed emissions using the PCAF standard and sets portfolio-wide climate targets. It engages with high-emitting investees to drive decarbonization through active stewardship.

BNP Paribas: Aligning Investments with Net-Zero

BNP Paribas uses a science-based approach to align its investment portfolio with net-zero goals. The bank regularly publishes financed emissions metrics and reduction progress across asset classes.

CalPERS: Climate Risk Integration in Asset Management

CalPERS, a leading U.S. pension fund, incorporates climate risk into its investment decisions and discloses emissions intensity across its holdings. It participates in collaborative investor initiatives like Climate Action 100+.

Conclusion

Scope 3 Category 15 is essential for capturing the downstream emissions of capital allocation. As financial markets shift toward climate-resilient strategies, companies and institutions must integrate financed emissions into their ESG policies and practices.

Through transparent reporting, active engagement, and portfolio decarbonization, investors can play a decisive role in accelerating the transition to a net-zero economy.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.