- Article Summary

-

What Is Category 13?

Scope 3 Category 13 refers to greenhouse gas (GHG) emissions from the operation of assets that are owned by the reporting company but leased to other entities (i.e., downstream in the value chain). These emissions are included when the company does not already report them as Scope 1 or 2. The category typically applies to real estate, vehicles, machinery, or other equipment that remains owned by the company while operated by a lessee.

Understanding Category 13 is important for lessors who retain responsibility for the environmental performance of their leased products or facilities, even when used by others.

Why Category 13 Matters

Downstream leased assets can represent a significant portion of a company’s value chain emissions, especially when the lessee’s operations are energy-intensive or the lease agreements are long-term. Companies must consider this category to:

- Gain a complete picture of their indirect emissions

- Meet regulatory and investor expectations for Scope 3 transparency

- Incentivize sustainable leasing practices and efficient asset design

Examples of affected sectors include:

- Real estate (e.g., commercial office landlords)

- Vehicle leasing companies

- Industrial equipment suppliers

- Technology firms leasing data center infrastructure

How to Calculate Category 13 Emissions

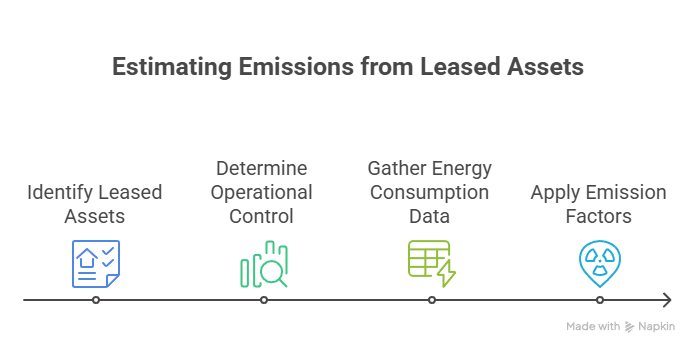

To estimate emissions from downstream leased assets, companies can use the following approach:

Emissions = Σ (Energy consumption of leased asset × Emission factor)

Calculation steps:

- Identify the number and types of assets leased to external users

- Determine the operational control and usage pattern by the lessee

- Gather energy consumption data (metered or estimated)

- Apply region-specific emission factors (e.g., electricity grid data)

Where direct data is not available, companies may use industry benchmarks or modeled assumptions.

Regulatory Landscape (as of 2025)

While specific regulations on Category 13 remain limited, broader mandates are encouraging disclosure of material Scope 3 emissions:

- EU CSRD calls for full Scope 3 reporting, including leased asset emissions where material

- IFRS Sustainability Disclosure Standards emphasize complete value chain transparency

- Science Based Targets initiative (SBTi) requires companies to account for downstream emissions for Scope 3 targets

Leading real estate and asset management firms are already responding with enhanced data tracking and climate-related lease clauses.

Case Studies: Real-World Examples

Prologis: Emissions Transparency in Real Estate Leases

Prologis, a global leader in logistics real estate, reports emissions from leased industrial properties under Scope 3 Category 13. It provides tenants with energy-efficiency resources and integrates sustainability clauses into lease agreements.

LeasePlan: Accounting for Emissions from Leased Vehicles

LeasePlan, a major vehicle leasing firm, calculates emissions based on mileage and fuel efficiency of leased fleets. The company uses this data to promote EV adoption and fleet decarbonization among clients.

Cisco: Managing Emissions from Leased Network Equipment

Cisco tracks emissions associated with leased networking hardware and collaborates with clients to optimize power usage during operation. These insights feed into circular economy metrics and product redesign efforts.

Conclusion

Scope 3 Category 13 highlights the responsibility companies hold for emissions from downstream leased assets. As expectations for full value chain reporting grow, lessors must measure and manage these emissions to remain competitive and compliant.

By embedding climate considerations into leasing strategies and enabling more sustainable asset use, companies can advance toward net-zero goals while delivering value across stakeholder groups.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.