- Article Summary

-

Introduction

As global carbon markets expand and environmental regulations tighten, the cost of emitting greenhouse gases is increasing rapidly. For companies committed to climate goals, this trend presents both a financial risk and a strategic opportunity. Internal carbon pricing (ICP) has emerged as a vital tool for incorporating the cost of carbon into corporate decision-making. By assigning a monetary value to each ton of CO2 equivalent emitted, companies can better anticipate regulatory changes, drive low-carbon investments, and align with disclosure frameworks such as TCFD, CDP, and the Science Based Targets initiative (SBTi).

This article examines the drivers behind rising carbon prices, how internal carbon pricing systems are being adopted across industries, and the practical steps for designing and integrating these systems into business operations.

Global Carbon Price Trends and Market Pressures

The World Bank’s State and Trends of Carbon Pricing 2024 report highlights that over 70 carbon pricing instruments are currently in place worldwide, including emissions trading systems (ETS) and carbon taxes. The average global carbon price has more than doubled in the past five years, reaching over $40 per tCO2e, with several EU markets exceeding $100.

Notably, in 2024, the EU ETS reached $105/tCO2e, while Canada’s federal carbon tax rose to $65. California’s cap-and-trade price hit $38, and China’s national ETS—though still modest—reached $10. These increases reflect growing momentum behind carbon accountability.

Figure 1: Evolution of Carbon Prices in Key Markets (2019–2024)

| Year | EU ETS | California | China ETS | Canada (Fed Tax) |

|---|---|---|---|---|

| 2019 | $25 | $17 | $7 | $15 |

| 2021 | $60 | $20 | $8 | $30 |

| 2023 | $95 | $32 | $9 | $50 |

| 2024 | $105 | $38 | $10 | $65 |

Rising prices reflect increasing regulatory ambition, including the EU’s Carbon Border Adjustment Mechanism (CBAM), Japan’s GX League, and proposed U.S. carbon border legislation. These mechanisms incentivize companies to decarbonize and penalize carbon-intensive supply chains, making carbon costs an urgent financial concern.

Strategic Rationale for Internal Carbon Pricing

Internal carbon pricing allows companies to assign a cost to emissions within their own operations—even in jurisdictions without formal carbon taxes. This enables more informed capital allocation, improved risk management, and progress tracking against SBTi or net-zero goals.

Companies use internal pricing in three primary ways:

- Shadow Pricing: Used in scenario analysis to assess investment risks under different carbon price assumptions (common in TCFD disclosures).

- Internal Fees: Departments are charged per tCO2e emitted, creating incentives to reduce emissions (used by Microsoft, Novartis).

- Implicit Pricing: Built into procurement or R&D decisions without a formal fee.

Figure 2: Common Internal Carbon Pricing Models and Use Cases

| Model | Function | Examples |

| Shadow Price | Investment evaluation | Shell, TotalEnergies |

| Internal Fee | Emissions reduction incentive | Microsoft, Swiss Re |

| Implicit Price | Sustainable procurement | Unilever, IKEA |

Designing and Implementing an ICP System

The successful implementation of an internal carbon price requires alignment with financial planning, climate strategy, and governance processes. Key steps include:

- Determine Price Level: Many firms use $30–$100 per tCO2e. Prices should reflect expected regulatory trends.

- Set Boundaries: Define which emissions (Scope 1, 2, or 3) and business units are covered.

- Integrate into Budgets: Link ICP to capital expenditure, product design, and procurement decisions.

- Establish Governance: Assign oversight to sustainability or finance teams with board-level review.

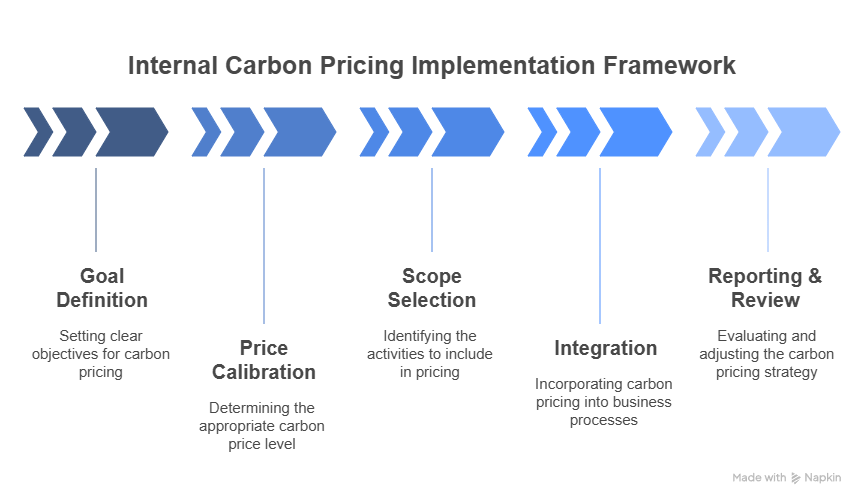

Figure 3: Internal Carbon Pricing Implementation Framework

- Goal Definition → 2. Price Calibration → 3. Scope Selection → 4. Integration → 5. Reporting & Review

Transparency is key. Companies disclosing internal pricing through CDP or TCFD reports often earn higher ESG ratings due to perceived climate readiness.

Conclusion

As carbon pricing becomes a core element of the global climate policy toolkit, companies that adopt internal carbon pricing systems position themselves for long-term advantage. Beyond compliance, ICP can act as a catalyst for innovation, risk mitigation, and stakeholder trust. By simulating carbon cost impacts in financial models and everyday decisions, businesses align operational behavior with a decarbonizing economy. In the face of rising carbon costs, internal carbon pricing is not just a best practice—it is a strategic necessity.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.