- Article Summary

-

The retail industry—at the intersection of consumption, supply chains, and social impact—is undergoing a dramatic shift. In 2024, consumers, investors, and regulators are no longer just asking what companies sell, but how ethically and sustainably they operate. ESG (Environmental, Social, and Governance) principles are now deeply woven into the strategies of leading global retailers. This article explores five transformative trends reshaping the retail sector through an ESG lens.

Decarbonizing the Retail Value Chain

Environmental impact reduction is no longer limited to operational emissions. Retailers are tackling upstream and downstream Scope 3 emissions, particularly in their supply and logistics chains.

Key initiatives include:

- Setting science-based targets for net-zero by 2040 or earlier.

- Transitioning to low-emission fleets and warehousing powered by renewable energy.

- Requiring suppliers to report emissions under aligned ESG frameworks.

| Company | Net-Zero Target | Scope 3 Target | Renewable Energy Use |

|---|---|---|---|

| Walmart | 2040 | Yes | 46% |

| IKEA | 2030 | Yes | 67% |

| Target | 2040 | Yes | 52% |

| Uniqlo (Fast Retailing) | 2050 | Partial | 31% |

Retailers are increasingly publishing product-level carbon footprints, especially in apparel, electronics, and groceries.

Circularity and Sustainable Product Design

Circular business models are gaining momentum in the retail sector. Consumers are demanding products that are durable, repairable, and recyclable, prompting retailers to rethink design and post-consumer waste strategies.

Common practices:

- Expansion of resale and refurbishment platforms.

- Packaging reduction and elimination of single-use plastics.

- Take-back schemes for textiles and electronics.

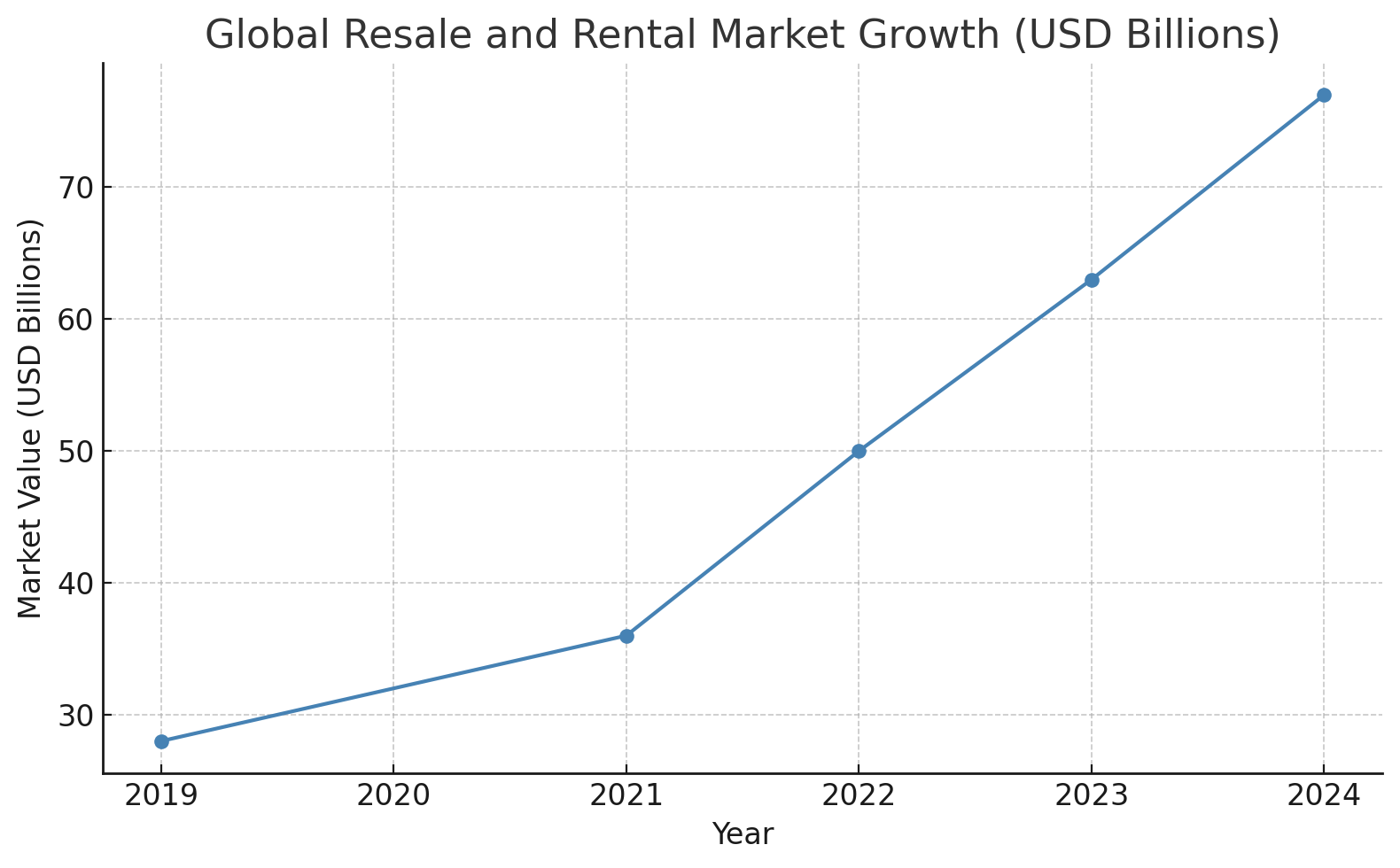

Resale and Rental Market Growth (Global, 2019–2024, USD Billions)

Year | Market Value

----------|--------------

2019 | 28

2021 | 36

2022 | 50

2023 | 63

2024 (E) | 77

This trend is reshaping not only customer behavior but also investor expectations, with circularity becoming a component of ESG ratings.

Inclusive Employment and Community Investment

Retail remains one of the largest global employers—and also one of the most diverse in terms of workforce composition. The sector faces increasing pressure to address wage equity, inclusion, and community impact.

Actions taken by industry leaders:

- Raising minimum wages above legal thresholds.

- Hiring targets for underrepresented groups.

- Local community reinvestment programs tied to store openings.

| Metric | Industry Average | ESG Leaders (Top 20) |

|---|---|---|

| Women in Retail Workforce | 56% | >60% |

| % with Living Wage Coverage | 34% | >75% |

| Community Impact Reporting | 22% | 100% |

ESG-conscious consumers now expect transparency not only on climate action but also on how companies treat their people.

Data Ethics and Responsible Technology Use

With digital retail platforms expanding rapidly, issues related to data privacy, algorithmic bias, and surveillance have become central to ESG governance.

Trends in responsible tech include:

- AI audits for recommendation engines and customer segmentation.

- Transparent data consent policies and opt-out mechanisms.

- Ethical sourcing of training datasets for retail AI applications.

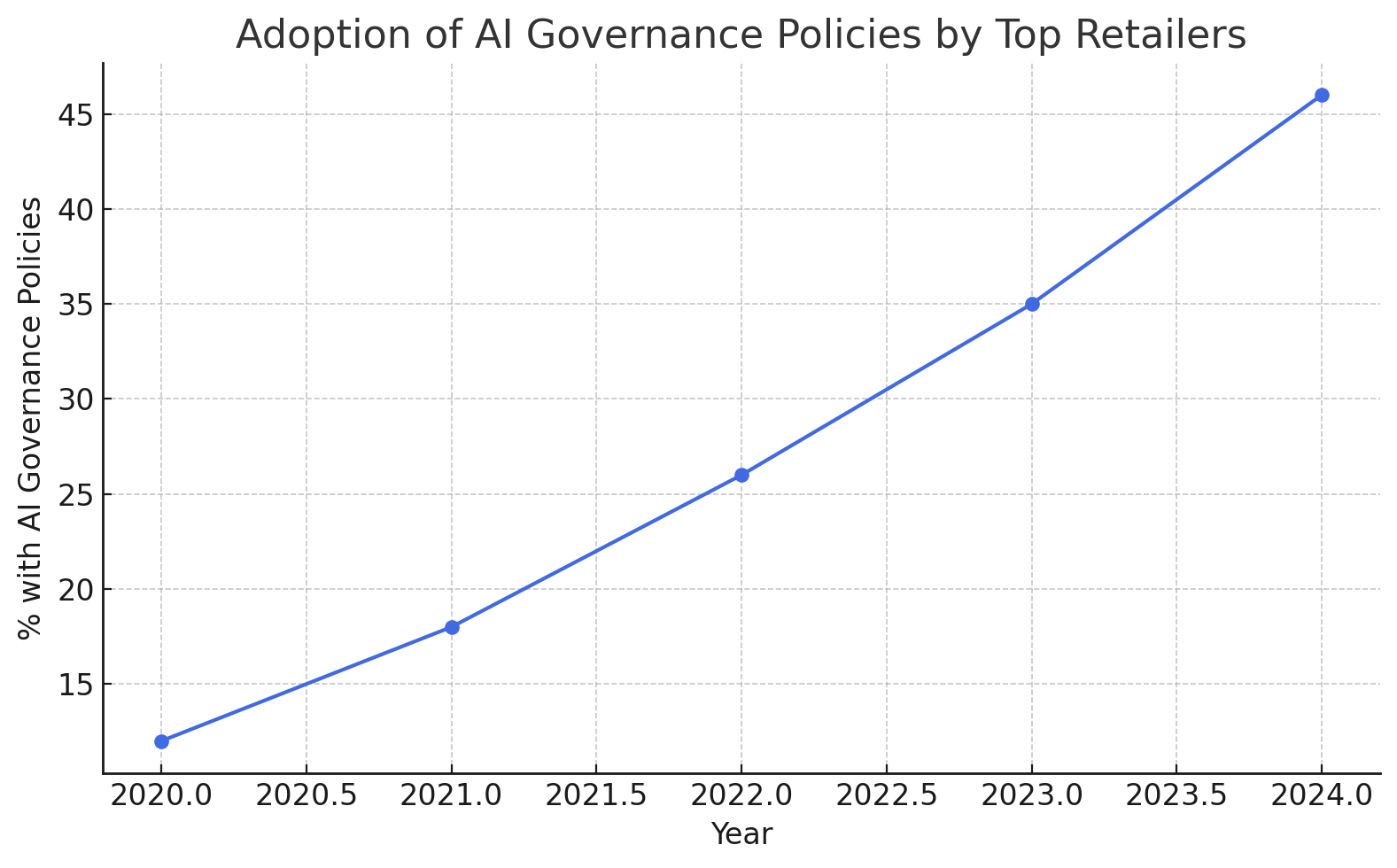

Share of Top 50 Retailers with AI Governance Policies (2020–2024)

Year | Adoption Rate

----------|---------------

2020 | 12%

2021 | 18%

2022 | 26%

2023 | 35%

2024 (E) | 46%

Governance failures in digital ethics can lead to regulatory penalties and consumer distrust, making proactive ESG oversight vital.

Standardized Reporting and Sustainable Finance Alignment

As ESG disclosure requirements evolve, retailers are integrating sustainability metrics into their investor communications, particularly as they access green finance or seek inclusion in ESG indices.

Recent developments include:

- Reporting aligned with CSRD, SASB, and ISSB.

- Integrated financial and sustainability reporting.

- Use of sustainability KPIs in executive pay and investor guidance.

| Reporting Standard | Adoption by Top 100 Retailers |

|---|---|

| GRI | 78% |

| SASB | 52% |

| TCFD | 43% |

| ISSB-aligned (2024) | 34% |

Retailers that transparently disclose ESG performance are more likely to attract impact investors and qualify for ESG-linked financing.

Conclusion: The Future of Ethical Retail

Retail is no longer just a matter of price and convenience. ESG has become a competitive differentiator that shapes brand loyalty, investment, and long-term resilience. Companies that embrace sustainability, inclusion, and transparency not only future-proof their business—but also align with the values of the customers and communities they serve.

The most successful retailers of the future won’t just sell—they will stand for something.

Why Work with ASUENE Inc.?

ASUENE USA Inc., a subsidiary of Asuene Inc., is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.