- Article Summary

-

Introduction

Article 6.4 of the Paris Agreement establishes a centralized mechanism to promote greenhouse gas mitigation while supporting sustainable development. Often described as the successor to the Kyoto Protocol’s Clean Development Mechanism (CDM), this UN-supervised system aims to issue high-integrity carbon credits with standardized rules for accounting, verification, and global market participation.

This article analyzes the key features, design principles, and governance challenges of the Article 6.4 mechanism, as well as its role in shaping the future of international carbon markets.

Core Objectives and Functions of the Article 6.4 Mechanism

The mechanism, overseen by the Supervisory Body established under the UNFCCC, has three primary objectives:

- Deliver real, measurable, and long-term emission reductions

- Support achievement of host country NDCs

- Contribute to global net mitigation

Unlike the CDM, Article 6.4 introduces more stringent rules and broader applicability. Projects or programs in developing and developed countries may generate credits if they meet integrity and transparency requirements.

Figure 1: Comparative Overview – CDM vs. Article 6.4 Mechanism

| Feature | CDM (Kyoto) | Article 6.4 (Paris) |

|---|---|---|

| Supervisory Body | CDM Executive Board | Article 6.4 Supervisory Body |

| Project Geography | Developing countries only | All Parties |

| Net Mitigation | Not required | Mandatory |

| Corresponding Adjustment | No | Yes |

| Sustainable Dev. Link | Encouraged | Required |

Operational Architecture and Participation Framework

The Article 6.4 mechanism involves several key actors:

- Host Party: Approves projects and applies corresponding adjustments.

- Activity Participants: Project developers and private sector actors.

- Supervisory Body: Oversees methodology development, credit issuance, and reporting.

- Designated Operational Entities (DOEs): Conduct validation and verification.

Participation requires alignment with national climate plans and submission of reports under the Enhanced Transparency Framework.

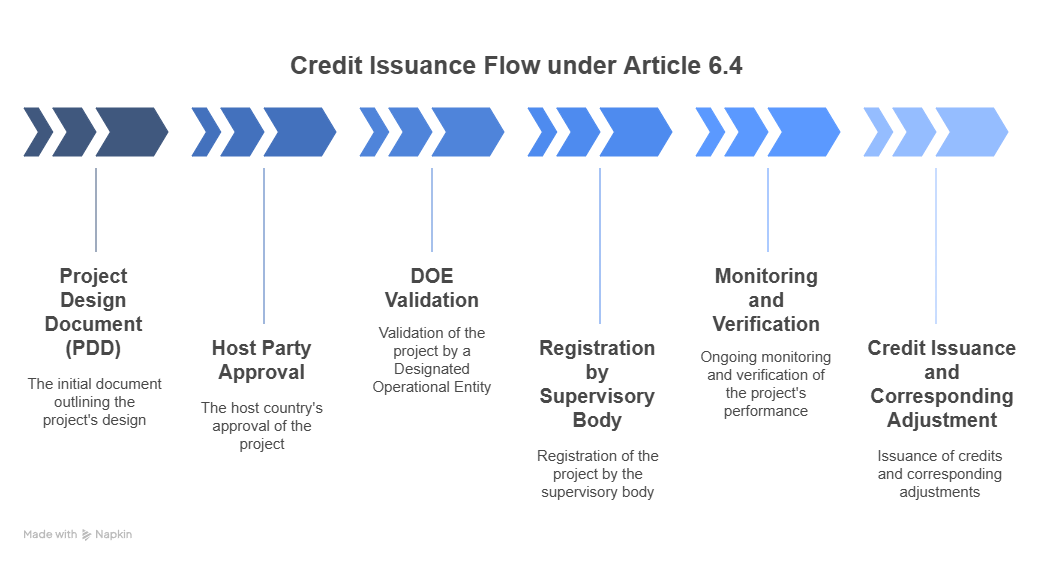

Figure 2: Credit Issuance Flow under Article 6.4

- Project Design Document (PDD)

- Host Party Approval

- DOE Validation

- Registration by Supervisory Body

- Monitoring and Verification

- Credit Issuance and Corresponding Adjustment

Integrity Standards and Methodology Development

To ensure environmental and social integrity, the mechanism incorporates:

- Additionality Tests: Activities must go beyond business-as-usual scenarios.

- Robust Baselines: Dynamic or standardized baselines required for credibility.

- Sustainable Development Safeguards: Projects must meet minimum social and environmental criteria.

- Net Mitigation Contribution: A portion of credits may be canceled to ensure overall atmospheric benefit.

These provisions aim to enhance trust in UN-certified credits and differentiate them from lower-quality offsets in voluntary markets.

Challenges and Criticisms

Despite its promise, the Article 6.4 mechanism faces several hurdles:

- Delayed Rule Finalization: Ongoing negotiations around methodologies and supervisory procedures.

- Complex Corresponding Adjustments: Host countries must manage inventory impacts and transparency.

- Overlap with Voluntary Markets: Unclear market segmentation and interaction with private certification standards.

Figure 3: Risks in Article 6.4 Implementation

| Risk Category | Issue | Potential Impact |

| Governance | Slow rulemaking | Market uncertainty |

| Integrity | Weak additionality enforcement | Credit oversupply, greenwashing |

| Compatibility | Confusion with voluntary schemes | Double counting, loss of trust |

Future Outlook and Strategic Implications

The Article 6.4 mechanism is expected to become operational by 2025, offering a standardized alternative to fragmented voluntary markets. Companies and investors will likely prefer its transparency and governance guarantees—especially as regulators, including the EU and Japan, consider restrictions on low-integrity credits.

In this context, firms should monitor Supervisory Body developments, assess eligibility of current projects, and evaluate strategic use of 6.4 credits in net-zero strategies.

Conclusion

The Article 6.4 mechanism represents a critical evolution in international carbon markets, introducing a higher bar for environmental integrity, transparency, and sustainable development alignment. While practical implementation remains complex, the mechanism has the potential to restore confidence in carbon markets and support global decarbonization with clear and enforceable rules. Stakeholders who engage early and invest in high-quality mitigation projects will be best positioned to benefit from this next generation of UN-led carbon credits.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.