- Article Summary

-

Introduction

Article 6.2 of the Paris Agreement enables countries to cooperate in achieving their nationally determined contributions (NDCs) by transferring carbon mitigation outcomes through Internationally Transferred Mitigation Outcomes (ITMOs). This bilateral or plurilateral mechanism allows governments and, in some cases, private entities to engage in cross-border carbon transactions, creating a decentralized carbon market ecosystem.

While the promise of ITMOs includes greater flexibility, cost efficiency, and innovation in emissions reduction, their implementation raises complex governance, transparency, and accounting challenges. This article examines the practical aspects of Article 6.2 mechanisms, including legal infrastructure, data systems, and safeguards against double counting, as well as emerging case studies.

Key Features of Article 6.2 Mechanisms

Under Article 6.2, countries can generate and trade ITMOs from climate mitigation projects that are authorized and reported in their national registries. ITMOs can be measured in CO2-equivalent and used toward the NDC of the acquiring country.

Key principles include:

- Authorization: Both host and acquiring countries must authorize the transaction and its use.

- Corresponding Adjustment: Emission reductions transferred abroad are subtracted from the host’s GHG inventory.

- Transparency: Parties must report ITMO transfers through biennial transparency reports (BTRs) under the Enhanced Transparency Framework.

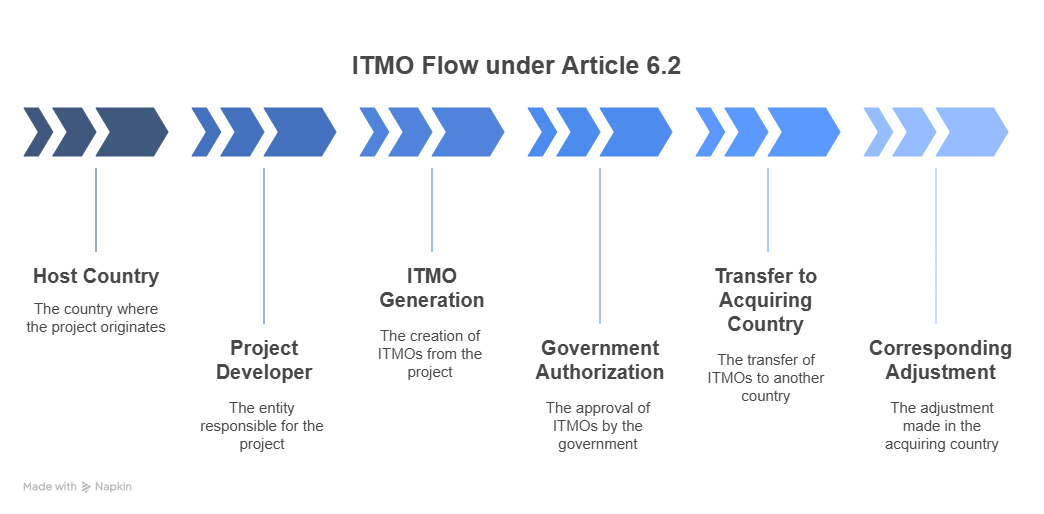

Figure 1: Flow of ITMO under Article 6.2 (Simplified)

Host Country → Project Developer → ITMO Generation → Government Authorization → Transfer to Acquiring Country → Corresponding Adjustment

Legal and Technical Infrastructure Requirements

Implementing Article 6.2 requires robust institutional and digital systems. Key components include:

- National Carbon Registry: Tracks generation, transfer, and retirement of ITMOs.

- Authorization Protocols: Defines how and when a mitigation activity is eligible for ITMO generation.

- Reporting Interfaces: Aligned with UNFCCC reporting standards to enable submission of BTRs.

- ITMO Units Accounting System: Ensures consistent tracking across jurisdictions and avoids double counting.

Some countries, such as Switzerland and Peru, have piloted Article 6.2 agreements with systems in place, serving as early models. Japan’s Joint Crediting Mechanism (JCM) is another structured example, although it predates the finalization of Article 6 rules.

Governance and Market Oversight Challenges

The flexibility of Article 6.2 also creates challenges, particularly in ensuring environmental integrity, fairness, and equity:

- Double Counting Risks: Inaccurate corresponding adjustments or poor registry design could lead to both countries claiming the same emission reduction.

- Transparency Gaps: Bilateral deals may lack public disclosure, limiting civil society oversight.

- Market Fragmentation: Without international coordination, a patchwork of standards and ITMO types may reduce fungibility.

Figure 2: Governance Risk Map in ITMO Implementation

| Risk Area | Description | Example |

|---|---|---|

| Double Counting | Emission reductions claimed by both parties | Lack of registry harmonization |

| Authorization Ambiguity | Undefined or inconsistent approval processes | No clear project eligibility criteria |

| Data Inconsistency | Divergent MRV systems and methodologies | Different baselines for same activity |

Emerging Practices and Case Studies

Several countries have initiated ITMO pilot projects. Notable examples include:

- Switzerland–Peru: First bilateral agreement under Article 6.2 with agreed authorization and adjustment protocol.

- Japan’s JCM: Applies Article 6 principles with detailed project approval and MRV procedures.

- Ghana–Sweden: Exploring mutual MRV system compatibility and benefit-sharing mechanisms.

These cases emphasize the importance of aligning ITMO design with national climate laws, community safeguards, and credible monitoring systems.

Conclusion

As Article 6.2 moves from framework to implementation, countries and corporate actors must balance flexibility with rigor. Building credible governance systems, transparent reporting channels, and harmonized accounting tools is essential to avoid undermining climate integrity. With the right structures, ITMOs can serve as a powerful engine for global cooperation, emissions trading, and sustainable development. But without them, risks of greenwashing and market fragmentation could jeopardize the mechanism’s credibility.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.