- Article Summary

-

Introduction – The Ambition Gap Becomes a Data Problem

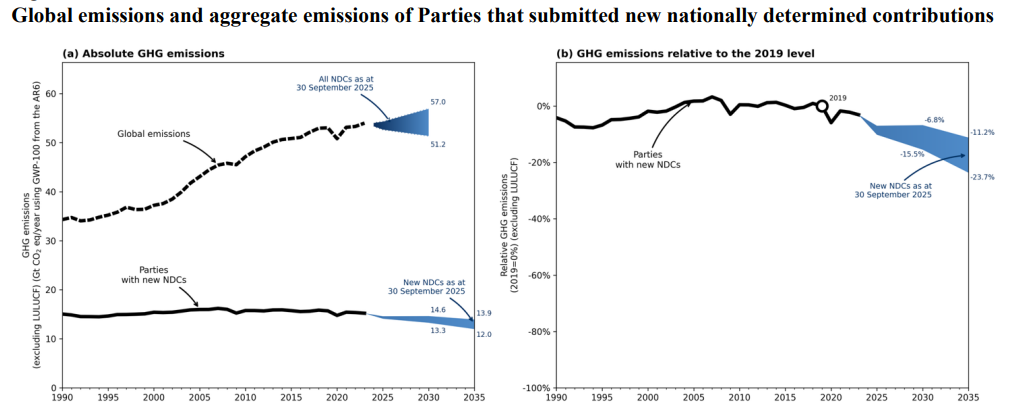

The latest UNFCCC 2025 NDC Synthesis Report (FCCC/PA/CMA/2025/8) provides a stark reality check. Ten years after the Paris Agreement, the world’s collective ambition is still far behind what climate science demands. The 64 new nationally determined contributions (NDCs) analyzed cover about 30% of 2019 global emissions. Even if fully implemented, they would reduce emissions only 17% below 2019 levels by 2035 – less than one-third of what is required to stay below 1.5°C. The report concludes that countries are “bending the emissions curve”, but nowhere near fast enough.

For corporations, this is no longer a policy problem; it is a data problem. Governments can set targets, but businesses drive the measurable progress. Investors, lenders, and customers now treat verified emissions data as the new currency of credibility. The companies that can prove what they emit – and how fast they are reducing it – will shape the next decade of competitiveness.

This chart vividly shows the 17% reduction achieved under current pledges versus the 60% required for a 1.5°C trajectory. It visually defines the ambition–execution gap that business leaders must now fill.

Where Policy Leaves Off, Corporate Measurement Begins

The report reveals that the 2025 NDCs cover only 31% of global emissions, leaving 69% of the world’s emissions outside national plans. This gap is particularly relevant for multinational firms operating in fragmented regulatory environments. As national targets diverge in scope and pace, companies need to establish internal systems that maintain consistency, accuracy, and comparability across jurisdictions.

For sustainability and energy executives, this translates into one priority: own your data before regulation does. Carbon accounting has evolved from an ESG reporting task to a core risk management function. Firms that can deliver assured, activity-level emissions data can manage exposure to future carbon pricing, comply with upcoming ISSB and CBAM requirements, and demonstrate operational resilience to investors.

Reading the NDCs as a Corporate Roadmap

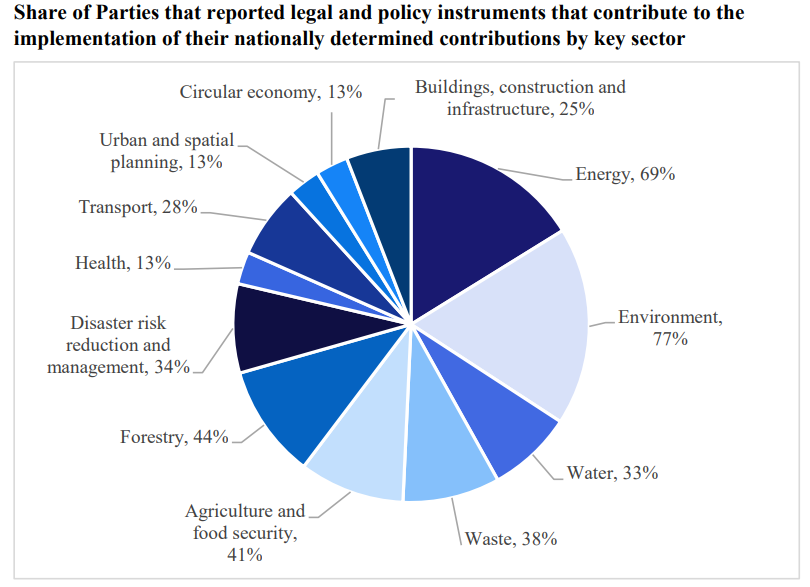

The NDC synthesis offers valuable signals for corporate strategy. It identifies where governments are investing, where regulation will tighten, and where disclosure expectations are likely to expand. Understanding these sectoral cues helps sustainability and energy leaders anticipate future data demands.

- Energy: 69% of Parties reference energy legislation in their NDCs, focusing on renewable energy, electrification, and efficiency. Companies must strengthen Scope 2 tracking and renewable procurement traceability.

- Transport: 28% of Parties have transport decarbonization strategies, pointing to upcoming regulations on fleet electrification and fuel intensity disclosures.

- Forestry and Land Use: 84% include land use, land-use change, and forestry (LULUCF) in mitigation targets, indicating future expectations for nature-based solution accounting and removals verification.

For corporate sustainability heads, this figure effectively doubles as a policy risk map – showing which sectors will face increasing pressure for auditable carbon data.

Financing, Just Transition, and the Data Advantage

The 2025 NDCs also quantify the scale of finance needed: developing countries alone report USD 1.97 trillion in climate finance requirements. Yet access to this capital depends on proof – proof of emissions reductions, adaptation outcomes, and credible governance. Investors and multilateral funds now require verifiable, auditable data trails.

Simultaneously, 70% of Parties reference the concept of a just transition, embedding social and labor dimensions into climate action. For businesses, this means reporting systems must integrate both environmental and social performance indicators, ensuring climate action delivers measurable benefits to workers, suppliers, and communities.

For corporate readers, it highlights the growing intersection between emissions data integrity and access to green capital. Firms that can produce enterprise-grade, third-party-assured carbon ledgers will not only meet regulatory disclosure needs but also unlock financing advantages. Verified data opens doors to sustainability-linked loans, carbon market participation, and supply chain partnerships that prioritize transparency.

Conclusion – Turning Pledges into Proof

The UNFCCC report leaves no doubt: global ambition has improved, but execution lags. For companies, this gap is an opportunity. The future of competitiveness will hinge on the ability to generate, verify, and communicate precise carbon data.

Executives leading sustainability, finance, or energy functions must treat carbon accounting not as a compliance cost, but as strategic infrastructure. Data accuracy and assurance will shape credit ratings, supply-chain eligibility, and investor trust.

As the world moves toward COP30 and beyond, ASUENE and other enterprise-grade platforms are equipping corporations to close the ambition gap with real evidence. Turning pledges into proof will not only advance global goals – it will define who leads in the next low-carbon economy.

Why Work with ASUENE Inc.?

ASUENE is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. ASUENE serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.