- Article Summary

-

Introduction: A Day of Contradictions in Brussels

On November 13, 2025, the European Parliament sent two conflicting signals about the future of European climate and sustainability policy. In a single session, lawmakers voted to strengthen the bloc’s long-term climate ambition while simultaneously easing the regulatory burden on companies required to report and act on environmental risks.

In one vote, Members of the European Parliament (MEPs) approved a binding target to cut greenhouse gas emissions by 90 percent by 2040 compared to 1990 levels. In another, they supported a major simplification of corporate sustainability and due diligence requirements under the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD). The result was a political paradox: stronger climate ambition paired with weaker corporate accountability.

The 2040 Climate Target: Raising the Bar for Emission Cuts

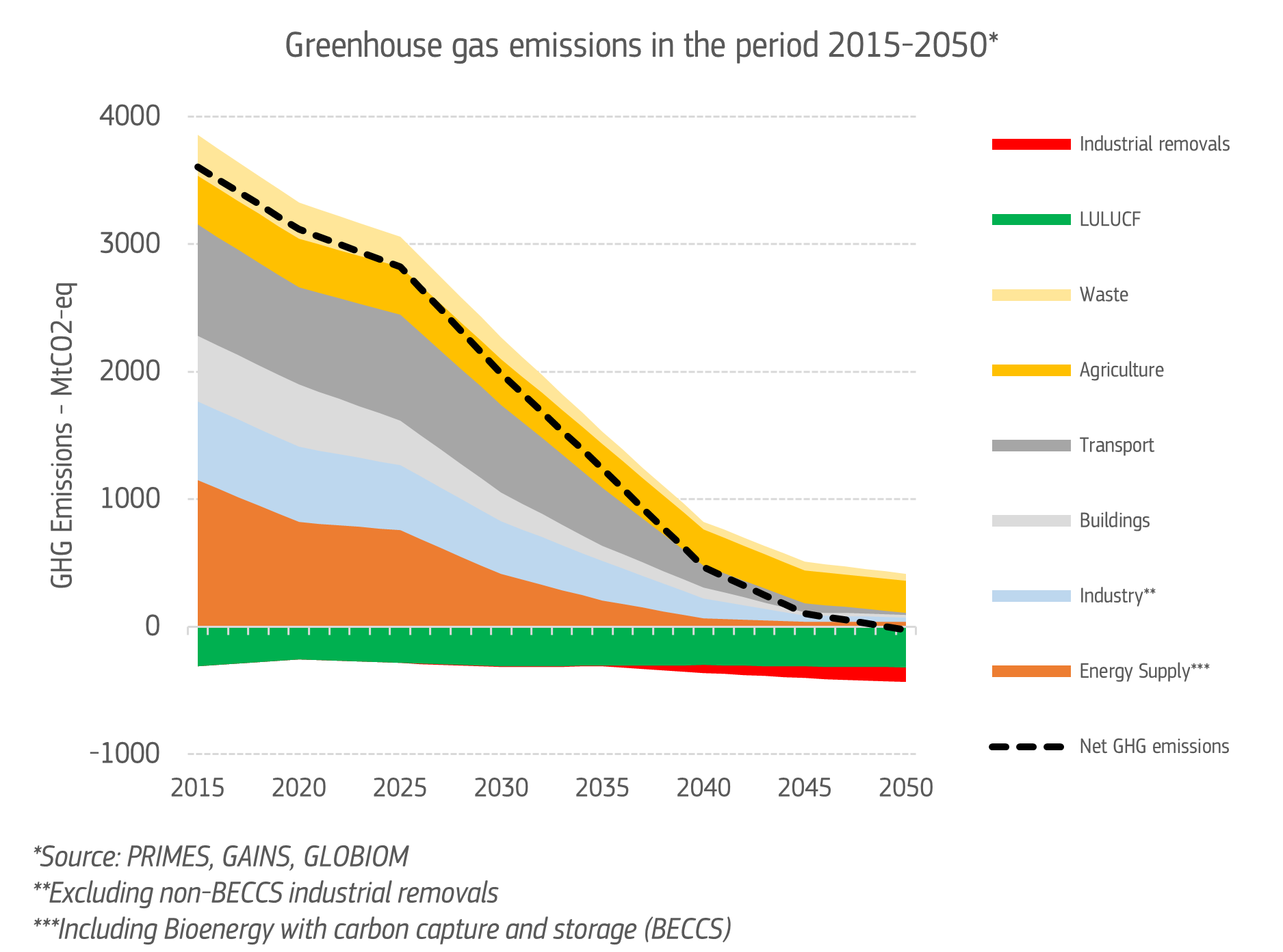

The first major vote amended the European Climate Law to establish a 2040 emissions target. The regulation sets a net 90 percent reduction in greenhouse gas emissions compared to 1990 levels. Up to five percent of this reduction may be achieved through international carbon credits, allowing companies and countries to offset a portion of their emissions abroad.

The measure passed with 379 votes in favour, 248 against, and 10 abstentions. Support came mainly from the Socialists and Democrats (S&D), the Greens, and Renew Europe, while the European Conservatives and Reformists (ECR) and Identity and Democracy (ID) groups opposed it.

This new target is meant to serve as a bridge between the 2030 climate objectives and the 2050 goal of climate neutrality. It will guide future updates to the EU Emissions Trading System, industrial policy, and funding under the Green Deal framework. However, questions remain about implementation and reliance on offsets. Environmental groups warned that counting international credits risks weakening real domestic decarbonisation efforts.

The Sustainability Rollback: Simplifying or Diluting Corporate Responsibility

The second key vote concerned the Omnibus I package, a set of amendments to simplify the EU’s sustainability reporting and due diligence framework. The package modifies both the CSRD and the CSDDD, which together form the foundation of corporate accountability for environmental and social impacts.

With 382 votes in favour, 249 against, and 13 abstentions, Parliament adopted its negotiating position on simplified sustainability reporting and due diligence duties for businesses. The new text reduces the reporting scope, narrows due diligence obligations, and removes key accountability measures.

Under the amended framework, sustainability reporting duties under the CSRD are limited to:

- Companies employing more than 1,750 people

- Companies with a net turnover above 450 million euros

Sector-specific reporting becomes voluntary rather than mandatory, and smaller companies are shielded from additional data requests that exceed voluntary standards. In addition, a new digital portal will centralise templates, guidelines, and information related to all EU reporting obligations.

Due diligence obligations under the CSDDD are limited to:

- Companies with more than 5,000 employees

- Companies with a net turnover exceeding 1.5 billion euros

Under the amended framework, these companies are expected to follow a risk based approach rather than conducting full supply chain audits, and they are no longer required to prepare a transition plan aligned with the Paris Agreement. Liability and enforcement shift to the national level, meaning that victims of corporate harm must pursue redress through domestic courts.

Supporters, led by Rapporteur Jörgen Warborn (EPP, Sweden), argued that these changes strike a balance between sustainability and competitiveness by cutting costs and providing regulatory clarity. Critics from the Greens and Socialists warned that the reform undermines corporate transparency and weakens Europe’s leadership on responsible business conduct.

Policy Paradox: Ambition Without Accountability

Taken together, these two votes reveal a deeper inconsistency in Europe’s sustainability policy direction. The EU has reaffirmed its ambition to lead global climate action, yet it has also rolled back the mechanisms designed to track, measure, and enforce corporate contributions to that goal.

For investors and regulators, this inconsistency creates uncertainty. Companies are expected to decarbonise faster while facing fewer requirements to disclose their progress. For policymakers, it exposes a growing divide between high-level political commitments and the detailed governance structures needed to achieve them.

The votes also reflect shifting political dynamics within the European Parliament. The alliance between the centre-right and far-right groups has succeeded in weakening or delaying several environmental files this year. With the 2026 European elections approaching, economic competitiveness and regulatory fatigue have become dominant narratives.

Conclusion: Can the EU Stay Credible as a Climate Leader?

The events of November 13 highlight the complexity of balancing climate ambition with political and economic realities. On paper, the EU remains committed to deep emissions cuts and global climate leadership. In practice, the rollback of corporate sustainability rules risks undermining transparency, investor confidence, and long-term alignment with the Paris Agreement.

As negotiations continue over other key files, such as the EU Deforestation Regulation and the future of the CSDDD, Europe’s ability to maintain policy coherence will be tested. The credibility of the EU’s climate leadership now depends not only on the ambition of its targets but also on the strength of the systems that hold both governments and corporations accountable.

Why Work with ASUENE Inc.?

ASUENE is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. The company serves over 10,000 clients worldwide with an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

Through its energy management system NZero, ASUENE provides SMEs with the practical tools to make the most of EU funding for energy efficiency. NZero combines advanced technology, consulting services, and an extensive partner network to help companies achieve their net-zero goals. By choosing ASUENE, SMEs gain not only access to reliable carbon accounting but also a powerful EMS platform designed to unlock energy savings and long-term sustainability success.