- Article Summary

-

SEC’s Approval Ushers in a New Era for U.S. Capital Markets

The U.S. Securities and Exchange Commission (SEC) has approved the launch of the Long-Term Stock Exchange (LTSE), the first U.S.-based stock exchange dedicated specifically to sustainability and long-term corporate growth. This decision marks a major milestone in the evolution of American capital markets, responding to rising investor demand for financial platforms that emphasize Environmental, Social, and Governance (ESG) values over short-term profits.

Unlike traditional exchanges such as the New York Stock Exchange (NYSE) and NASDAQ, the LTSE’s mandate centers on long-termism and corporate responsibility. The platform sets higher ESG transparency standards and obligates companies to disclose how they are creating enduring value. This approach caters to institutional investors like pension funds and endowments, which increasingly prioritize sustainability in their portfolios.

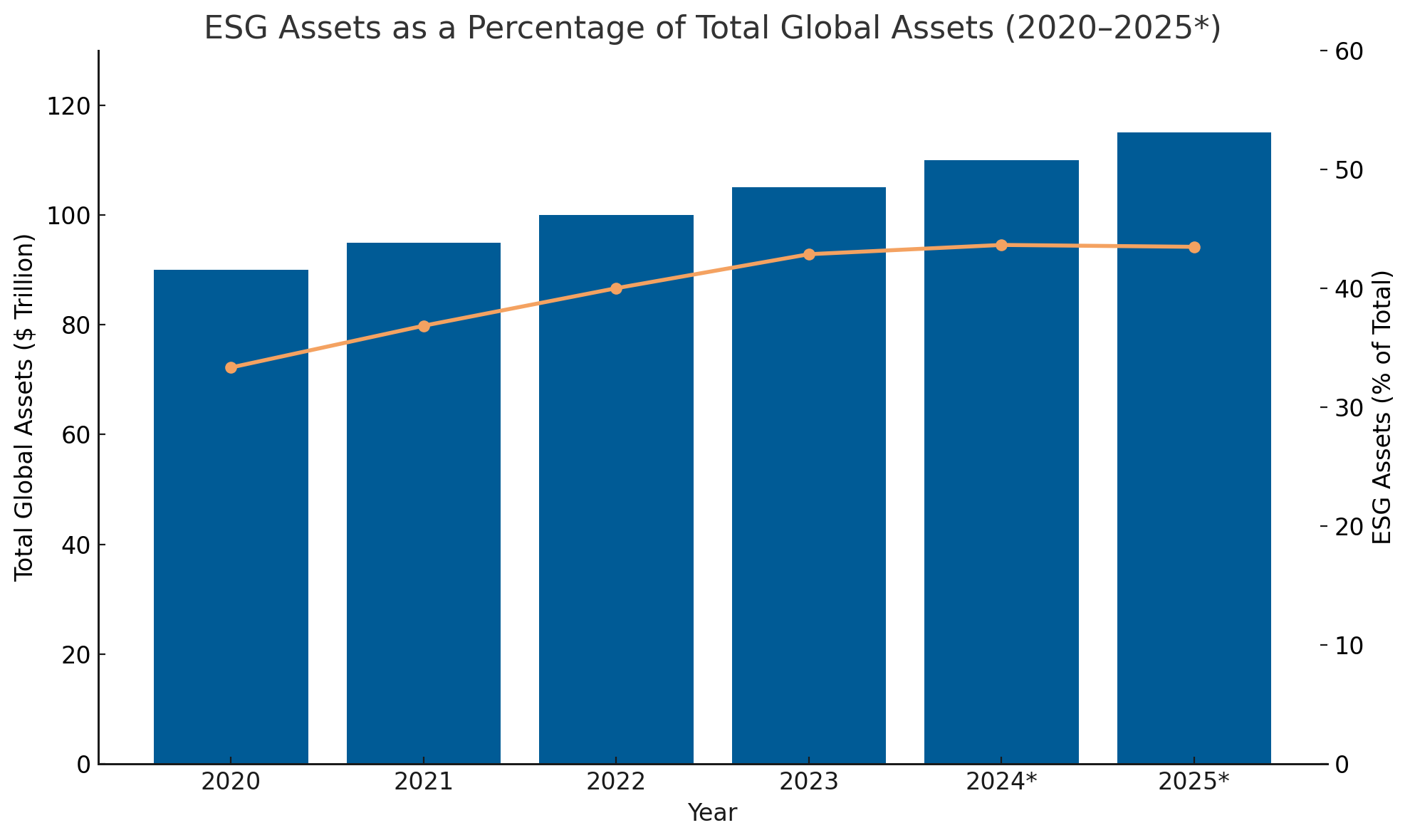

According to Bloomberg Intelligence, ESG assets under management are expected to exceed $50 trillion globally by 2025, comprising over one-third of all assets under management.

Key Differences Between LTSE and Traditional Stock Exchanges

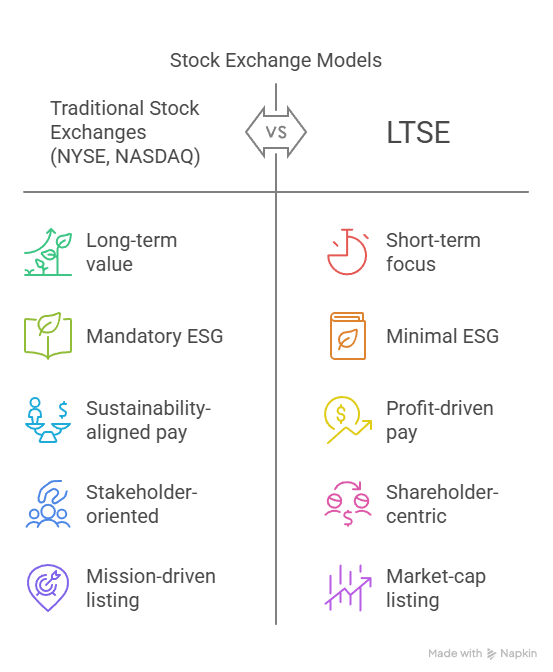

At the heart of the LTSE’s innovation lies its unique listing requirements that prioritize long-term thinking, sustainability, and stakeholder alignment—setting it apart from traditional exchanges.

Comparison of LTSE and Traditional Stock Exchanges

Traditional Stock Exchanges (NYSE, NASDAQ)

- Corporate Focus: Short-term performance

- ESG Disclosure: Minimal

- Executive Compensation: Profit-driven

- Stakeholder Inclusion: Shareholder-centric

- Listing Strategy: Market-cap focused

Long-Term Stock Exchange (LTSE)

- Corporate Focus: Long-term value

- ESG Disclosure: Mandatory

- Executive Compensation: Sustainability-aligned

- Stakeholder Inclusion: Stakeholder-oriented

- Listing Strategy: Mission-driven

These differences are more than procedural—they represent a philosophical departure from the shareholder primacy model. LTSE firms must adopt and disclose a long-term plan, detail how they consider a broad array of stakeholders, and publicly report on ESG metrics annually.

Why the LTSE Model Appeals to Modern Investors

The LTSE arrives at a time when institutional and retail investors alike are demanding more accountability and purpose from the companies they support. Recent data from PwC shows that:

- 79% of institutional investors include ESG factors in their investment decision-making.

- 72% are willing to divest from companies that don’t take ESG seriously.

This aligns well with the LTSE’s listing values, which are designed to attract companies that embrace environmental responsibility, diversity and inclusion, ethical governance, and long-term planning. Moreover, the LTSE offers these companies a platform that reduces the pressure for short-term earnings surprises and allows them to focus on systemic, sustainable growth.

2024 Institutional Investor ESG Sentiment (PwC)

PwC’s report indicates that 79% of investors consider ESG in their strategies, and 72% are ready to divest from companies that fail on ESG. Only 21% remain neutral.

By contrast, traditional exchanges often inadvertently encourage short-term risk-taking to meet quarterly expectations, even when those strategies might harm long-term environmental or social stability. The LTSE offers a welcome alternative by encouraging patience and responsibility.

Policy Alignment and Global Market Implications

LTSE’s mission is also closely aligned with emerging global regulatory standards. The EU has implemented the Corporate Sustainability Reporting Directive (CSRD), and international bodies like the ISSB (International Sustainability Standards Board) are pushing for unified ESG reporting.

Meanwhile, the SEC itself is considering new rules for climate-related disclosures, which would make reporting Scope 1, 2, and possibly Scope 3 emissions mandatory. These moves suggest a strong tailwind for LTSE’s ESG-focused structure.

ESG Disclosure Requirements by Region

| Region | Key ESG Policy | Disclosure Type |

|---|---|---|

| United States | SEC Climate Disclosure Proposal | Mandatory (pending) |

| European Union | CSRD (Corporate Sustainability Reporting Directive) | Mandatory |

| Japan | TCFD-aligned Voluntary Framework | Voluntary (recommended) |

| Canada | CSA Climate Guidelines | In Progress |

LTSE’s mandatory disclosures help companies prepare for these evolving regulatory landscapes, providing a transparent, standardized environment that reduces the friction of compliance in international markets.

Looking Ahead: LTSE’s Potential to Reshape the Investment Ecosystem

The LTSE is more than a new venue for IPOs—it’s a blueprint for how markets can evolve to meet the challenges of climate change, inequality, and resource scarcity. As more companies integrate ESG into their core operations, LTSE could become a hub for innovation in sustainable finance.

Here are a few ways LTSE might impact the broader ecosystem:

- Creation of ESG index funds based exclusively on LTSE-listed firms

- Greater interest in green and social impact bonds

- Alignment with Scope 3 emission tracking platforms

- Strengthened supply chain transparency

- Development of long-term shareholder coalitions

In contrast to traditional exchanges, which prioritize liquidity and short-term returns, LTSE is building a purpose-first financial system—one that prizes responsibility over reactivity and sustainability over speculation.

In the next decade, as ESG regulations tighten and investor expectations evolve, LTSE’s model may shift from “alternative” to “standard.” It offers a vision of capitalism not in conflict with the planet or people—but aligned with both.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.