- Article Summary

-

Introduction

As climate change policies intensify and supply chains come under greater scrutiny, the role of low-carbon materials is rapidly evolving from an innovation issue to a central pillar of risk management and strategy. With the rise of ESG disclosure frameworks such as TCFD, CDP, and SBTi, companies are expected not only to quantify their carbon footprint but also to address upstream and downstream environmental risks embedded in materials selection. This article explores the practical implications of integrating low-carbon and recycled materials into supply chains, the regulatory and reputational risks involved, and how companies are aligning these efforts with their climate disclosure and decarbonization strategies.

To set the stage, it’s essential to understand the scale of emissions from material production. For example, the production of virgin aluminum emits nearly 12 tons of CO2-equivalent per ton of metal, while recycled aluminum emits just 0.5 tons. As illustrated in Figure 1, similar disparities exist across other materials such as plastic, cement, and steel, underscoring the emissions reduction potential of circular procurement strategies.

Lifecycle CO2 Emissions of Key Materials (kg CO2e per kg material)

| Material | Virgin Material | Recycled Material |

|---|---|---|

| Aluminum | 12,000 | 500 |

| PET Plastic | 2,100 | 450 |

| Cement | 800 | 600 |

| Steel | 1,850 | 440 |

Rising Regulatory Pressure and Shifting Market Expectations

Governments around the world are enforcing stricter regulations on material use, with a particular focus on plastic, aluminum, cement, and textiles. The European Union’s Green Deal, for instance, includes mandatory recycled content targets and extended producer responsibility (EPR) schemes. In parallel, the U.S. is seeing increased state-level regulations on packaging materials and disclosure of lifecycle emissions. These changes not only present compliance risks but also create opportunities for businesses to lead in innovation.

At the same time, consumer and investor expectations are evolving. According to CDP’s 2024 supply chain report, 78% of global companies consider material efficiency and sustainable sourcing as high-priority areas for climate risk mitigation. This sentiment is reflected in procurement policies that increasingly require low-carbon certifications or circular economy practices. The transition to such materials is no longer just about sustainability marketing—it is a core aspect of long-term competitiveness.

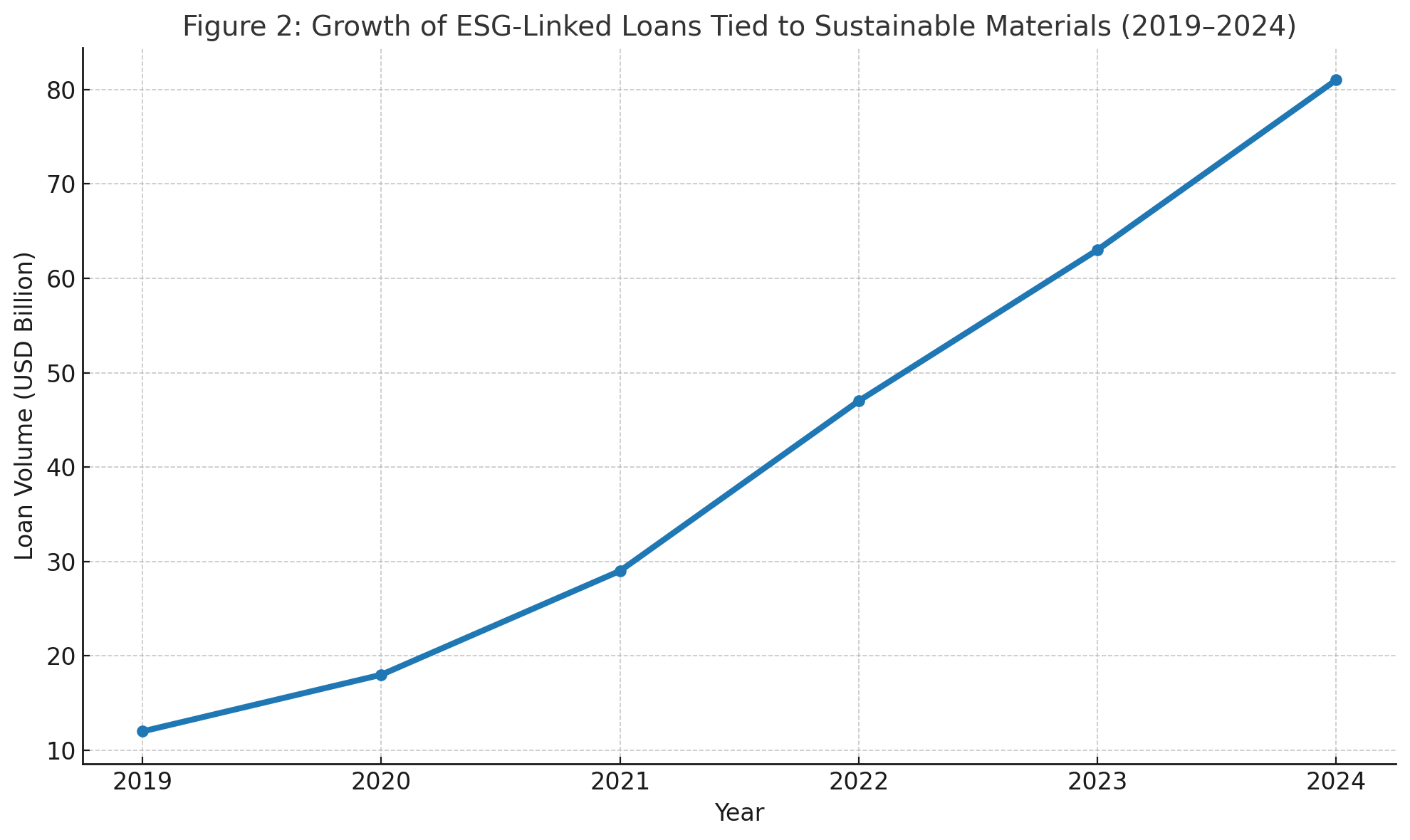

In practice, leading companies are creating detailed material transition plans and engaging with suppliers on compliance with EU Taxonomy criteria, which are increasingly influencing financial access and investor scrutiny. Figure 2 illustrates the growing volume of ESG-linked loans tied to material sustainability KPIs.

Growth of ESG-Linked Loans Tied to Sustainable Materials (2019–2024, in USD Billion)

Scenario Analysis and Material Risk under TCFD

The TCFD framework encourages companies to conduct scenario analyses that explore the impact of climate-related risks on financial performance. For material-intensive sectors, such as automotive, electronics, construction, and FMCG, this means considering how supply disruptions or carbon pricing may affect input costs, operational continuity, and product margins.

For example, under a 1.5°C scenario, companies heavily reliant on virgin plastic could face significant cost escalations due to carbon taxes or outright bans, whereas firms sourcing recycled polymers may experience supply volatility due to inconsistent collection and processing rates. Scenario analysis must thus incorporate both physical risks (such as droughts affecting biobased material yields) and transition risks (like new environmental legislation).

More advanced practitioners are leveraging TCFD to evaluate indirect impacts—such as brand reputation damage due to plastic backlash or investor divestment from carbon-intensive portfolios. These qualitative dimensions are now being quantified through shadow pricing, as shown in Figure 3.

Carbon Shadow Price Ranges Used by Global Companies (USD/tCO2e)

| Sector | Minimum Price | Maximum Price |

| Energy | $25 | $150 |

| Manufacturing | $30 | $200 |

| Consumer Goods | $20 | $100 |

| Technology | $15 | $80 |

Strategic Integration of Low-Carbon and Recycled Materials

Embedding low-carbon materials into procurement strategies requires cross-functional alignment between sustainability, R&D, and supply chain functions. Leaders in this space are adopting tools such as life-cycle assessment (LCA), supplier ESG scoring, and material flow analysis to quantify the carbon impact of their material choices. For example, Apple’s use of 100% recycled aluminum in certain product lines was enabled by its development of a low-carbon smelting process and long-term partnerships with certified suppliers.

Moreover, several companies are tying material choices directly to emissions reduction targets under the Science Based Targets initiative (SBTi). By defining material-related Scope 3 targets, firms can incentivize suppliers to shift toward greener inputs. However, data quality remains a major challenge, with many companies relying on industry averages or proxy data that may not accurately reflect supplier-specific emissions.

To tackle this, emerging digital platforms such as blockchain-based traceability tools and supplier carbon calculators are being piloted across sectors. Figure 4 provides a framework for material-level emissions management maturity.

Maturity Model for Low-Carbon Material Management

| Level | Description |

| 1 | Basic compliance and material tracking |

| 2 | LCA-based procurement integration |

| 3 | Supplier engagement with ESG KPIs |

| 4 | Full traceability and scenario stress test |

Transparency, Disclosure, and Competitive Differentiation

Transparent reporting of material sourcing strategies is becoming a critical component of climate-related disclosures. CDP questionnaires, for example, now ask for detailed information on recycled content percentages, supplier engagement, and material traceability. Similarly, under TCFD-aligned disclosures, companies are expected to articulate how materials-related risks are governed, managed, and factored into strategic decision-making.

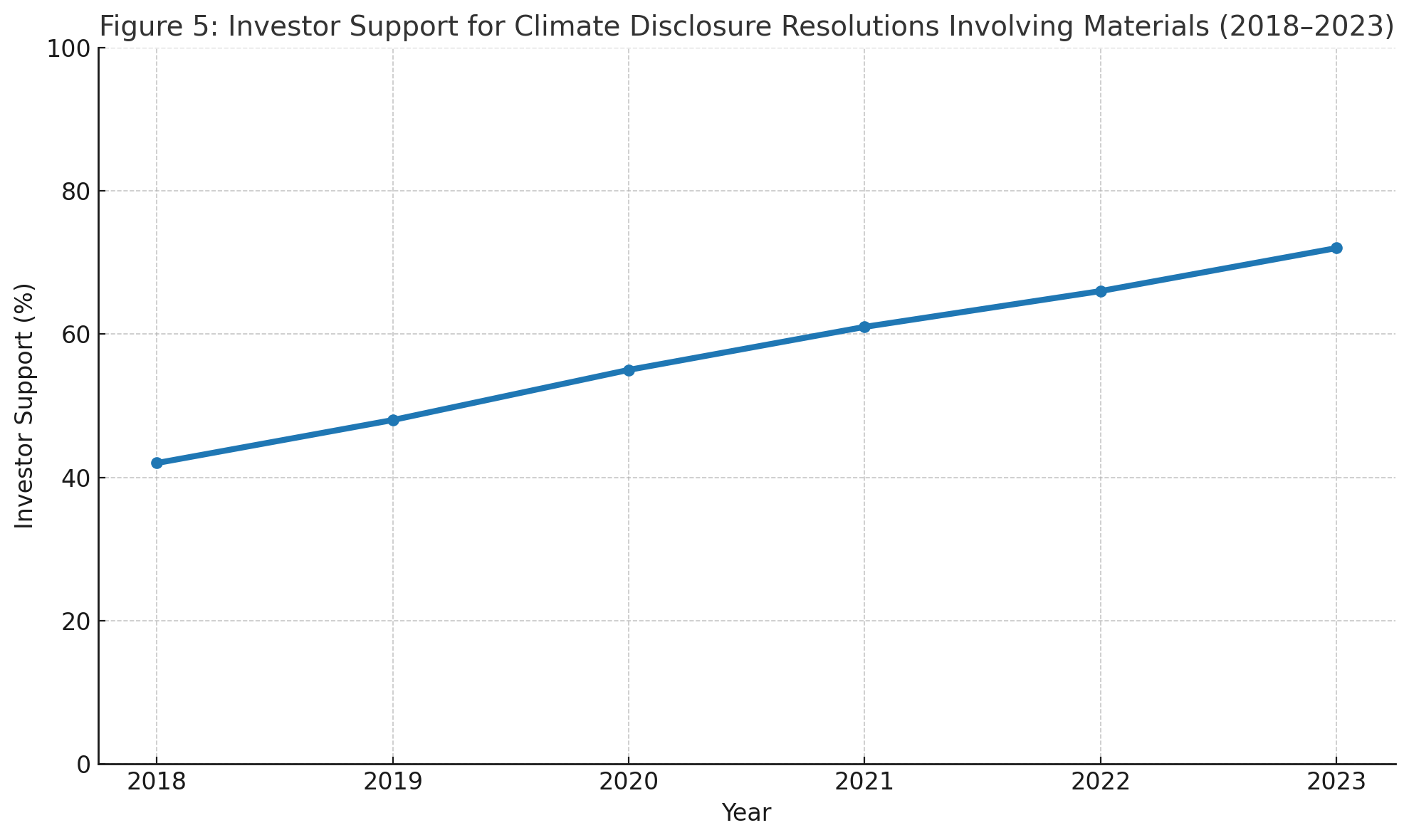

This trend is fostering a race toward higher transparency and standardization. Companies that lead in disclosing high-quality, verifiable data on low-carbon materials not only reduce reputational risks but also strengthen stakeholder trust. Increasingly, such disclosures are influencing ESG ratings and investor decision-making, creating tangible financial incentives for sustainable materials management.

As shown in Figure 5, investor support for shareholder resolutions demanding low-carbon material disclosures has grown steadily.

Investor Support for Climate Disclosure Resolutions Involving Materials (2018–2023)

Conclusion

As ESG disclosure frameworks become more integrated and rigorous, the use of low-carbon and recycled materials is shifting from a niche concern to a mainstream business imperative. Companies that proactively assess regulatory, reputational, and operational risks tied to material use—and align their strategies accordingly—will be better positioned to thrive in a low-carbon economy. Through scenario analysis, transparent reporting, and strategic supplier engagement, material choices can evolve from a passive footprint to an active force in corporate climate resilience and differentiation.

Low-carbon material integration is no longer optional; it is the cornerstone of future-fit supply chain design and investor trust. The sooner companies adapt, the more resilient and competitive they will become in the era of carbon accountability.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.