- Article Summary

-

Introduction

California’s climate disclosure regulations—SB 253 and SB 261—represent a landmark shift in the way companies must report greenhouse gas (GHG) emissions and climate-related financial risks. With compliance deadlines quickly approaching, the California Air Resources Board (CARB) has released a new FAQ document in July 2025 that clarifies many of the uncertainties businesses faced. These regulations signal a broader trend toward mandatory climate accountability and mirror global movements like the EU’s CSRD and the SEC’s proposed climate rules.

This article breaks down the latest official guidance from CARB and provides actionable insights for companies preparing to comply. It aims to help business leaders navigate legal obligations, reduce reporting risk, and develop strategies that turn disclosure into a competitive advantage.

CARB’s July 2025 FAQ: Key Clarifications for SB 253 and SB 261

In July 2025, CARB issued a long-awaited FAQ document to clarify how businesses should approach SB 253 and SB 261. SB 253, also known as the Climate Corporate Data Accountability Act, mandates that companies disclose Scope 1, 2, and 3 GHG emissions. SB 261, the Climate-Related Financial Risk Disclosure Act, requires companies to submit biennial reports identifying and addressing material climate-related financial risks.

Key clarifications from the FAQ include:

| Topic | SB 253 | SB 261 |

|---|---|---|

| Applicability | Businesses with over $1 billion in revenue doing business in California | Businesses with over $500 million in revenue doing business in California |

| Deadline | First Scope 1 and 2 disclosure due 2026, Scope 3 due 2027 | First risk disclosure report due 2026 |

| Standards Referenced | GHG Protocol (Scope 1, 2, and 3) | TCFD and ISSB standards recommended |

| Assurance Requirement | Limited assurance for Scope 1 and 2 starting in 2026, reasonable assurance by 2030 | No third-party assurance required yet |

| Submission Platform | CARB will create a public portal (TBD) | Submissions to be posted publicly and submitted to CARB |

CARB emphasized that the disclosure rules will not impose emissions caps but will focus on transparency. Moreover, businesses must prepare to disclose emissions regardless of whether they are headquartered in California, as long as they meet the revenue threshold and conduct business in the state.

How Businesses Can Prepare for SB 253 Compliance

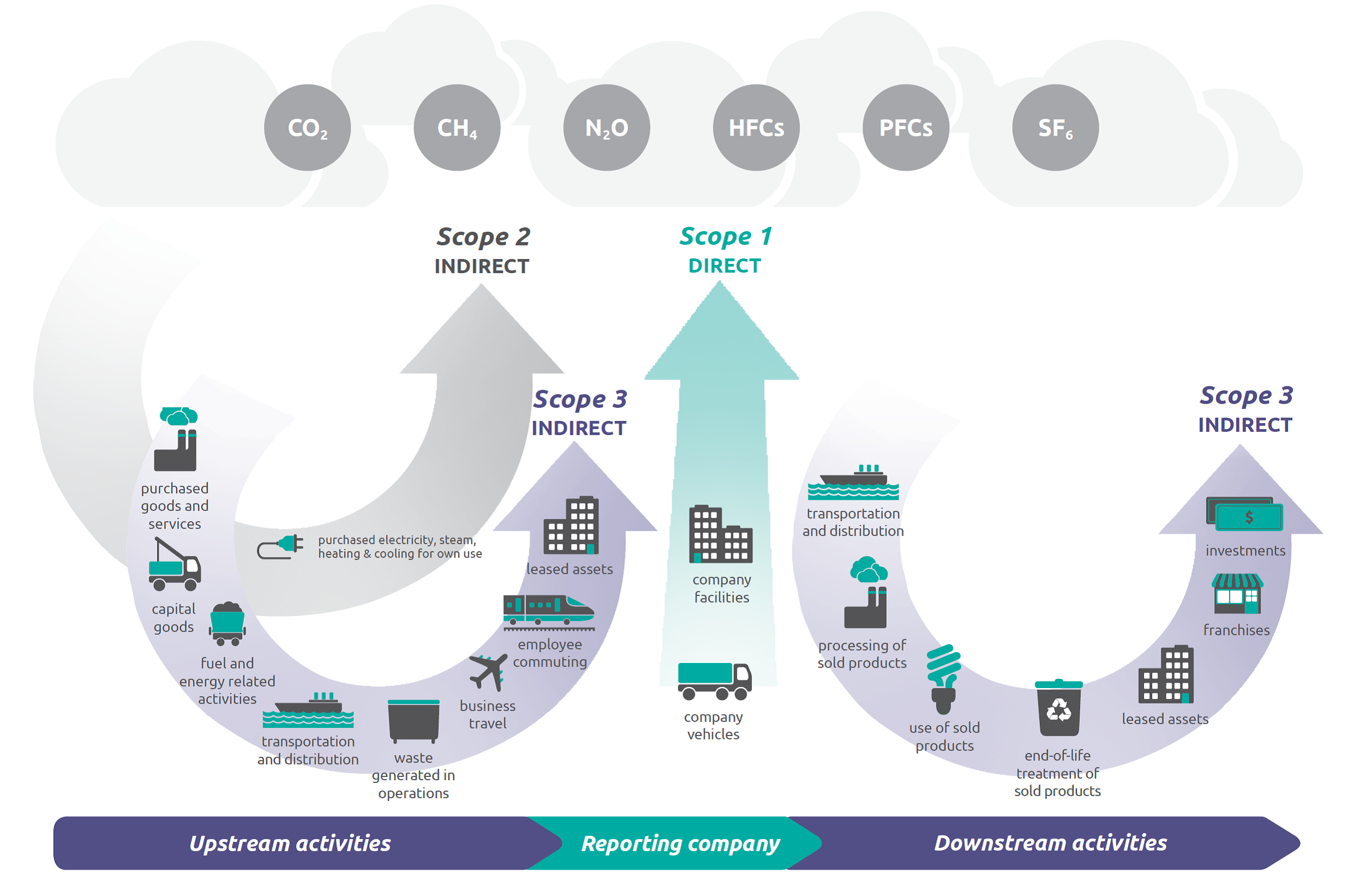

Preparation for SB 253 starts with robust emissions data collection. While most large firms already track Scope 1 and 2 emissions, Scope 3—indirect emissions from supply chains, product use, and waste—poses a more complex challenge.

Here’s a structured approach to preparing for SB 253:

- Inventory Your Emissions Sources:

Categorize your operations under Scope 1 (direct emissions), Scope 2 (electricity), and Scope 3 (value chain). - Leverage Existing Frameworks:

Use the GHG Protocol as your methodology backbone. Consider using established software platforms or working with ESG consultants to automate and streamline data collection. - Engage Your Supply Chain:

Scope 3 emissions often make up over 70% of a company’s total footprint. Proactively collaborate with suppliers to improve emissions estimates and promote emissions-reduction practices. - Establish Internal Controls and Data Governance:

CARB emphasized the importance of audit-ready data. Establish clear processes for data quality, documentation, and internal review. - Prepare for Third-Party Assurance:

Even though only limited assurance is required initially, developing assurance-ready systems now will prevent costly rework later.

Scope 3 Emissions: A Deep Dive

Getting Ready for SB 261: Climate Risk Reporting

SB 261 focuses not on emissions but on climate-related financial risks. Companies must describe both the risks they face due to climate change and how they are managing them. The July 2025 CARB FAQ suggests aligning with the Task Force on Climate-Related Financial Disclosures (TCFD) and ISSB’s IFRS S2 standards.

Steps to comply with SB 261:

- Conduct a Materiality Assessment:

Identify climate risks that could significantly affect your financial performance, such as transition risks (regulatory changes, market shifts) and physical risks (wildfires, droughts, floods). - Model Financial Impacts:

Use scenario analysis to estimate how climate scenarios could affect assets, liabilities, and earnings. - Integrate Risk Into Governance:

CARB encourages firms to describe board-level oversight and management responsibility for climate risks. - Use Existing Reporting to Inform Disclosures:

Firms already reporting under TCFD or CDP will have a strong foundation. Use those structures to build out SB 261 compliance.

Climate Risk Example Table

| Risk Type | Example | Financial Impact |

| Transition | California carbon pricing increases | Higher operating costs |

| Physical | Heatwave damages data centers | Business interruption |

| Reputation | Backlash from unsustainable practices | Revenue loss |

While CARB will not require a specific format for SB 261 reports, companies must publicly post the disclosures and send them to CARB for compliance purposes. Stakeholders—investors, regulators, and the public—will scrutinize this information.

Strategic Advantages of Early Compliance

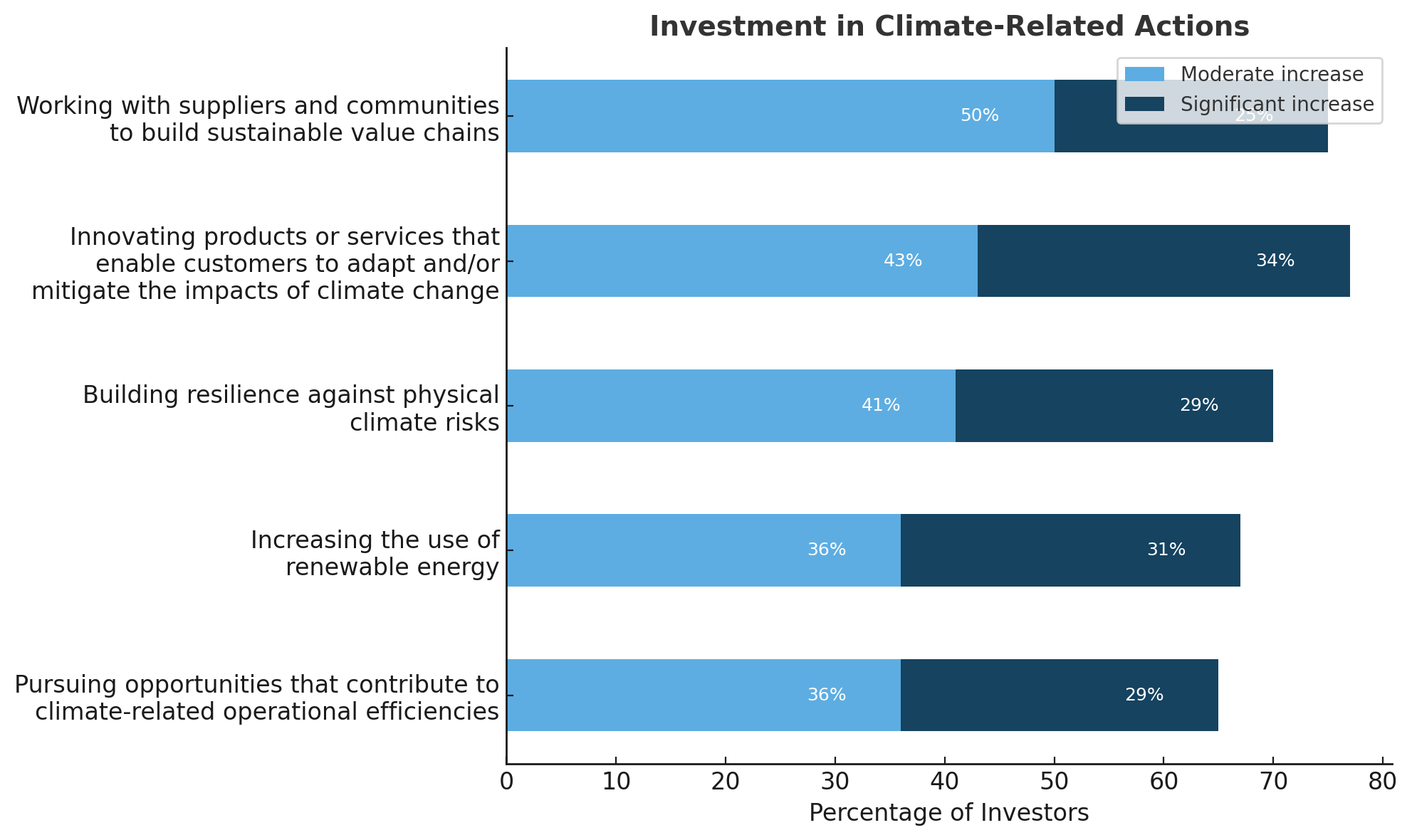

Beyond legal requirements, early compliance offers strategic benefits. Companies that build climate reporting infrastructure now will be better positioned to:

- Access Green Capital: Investors are increasingly favoring companies with transparent climate strategies.

- Win Sustainable Contracts: Major buyers are integrating climate risk into procurement.

- Enhance Brand Trust: Proactive disclosures can strengthen customer and stakeholder confidence.

- Preempt Global Regulations: California’s rules may serve as a model for U.S. federal policy or international mandates.

This stands in stark contrast to growing political resistance to ESG in other parts of the United States. In many states, policymakers have rolled back or opposed ESG-related investment strategies and reporting frameworks, citing concerns about regulatory overreach. Yet California has pushed forward undeterred, reinforcing its role as a climate policy leader. The state’s success in passing and implementing SB 253 and SB 261 illustrates a different trajectory—one where climate transparency is seen as essential to long-term economic stability.

A survey by PwC (2025) showed that 74% of institutional investors would divest from companies lacking climate risk transparency. Compliance is a baseline expectation.

Investor Expectations on Climate Disclosure

Conclusion

CARB’s July 2025 FAQ provides critical clarity on California’s climate disclosure laws, but the responsibility to act remains with businesses. SB 253 and SB 261 will soon require thousands of companies to collect data, evaluate risk, and publish their climate exposures.

The most resilient companies will treat these obligations as a strategic catalyst, not a compliance burden. Early movers are already investing in emissions tracking systems, training sustainability teams, and engaging with suppliers and boards to build robust climate governance.

For firms operating in California or doing business in the state, the message is clear: prepare now—or risk falling behind.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.