- Article Summary

-

ISSB Becomes the Global Baseline for Sustainability Disclosure

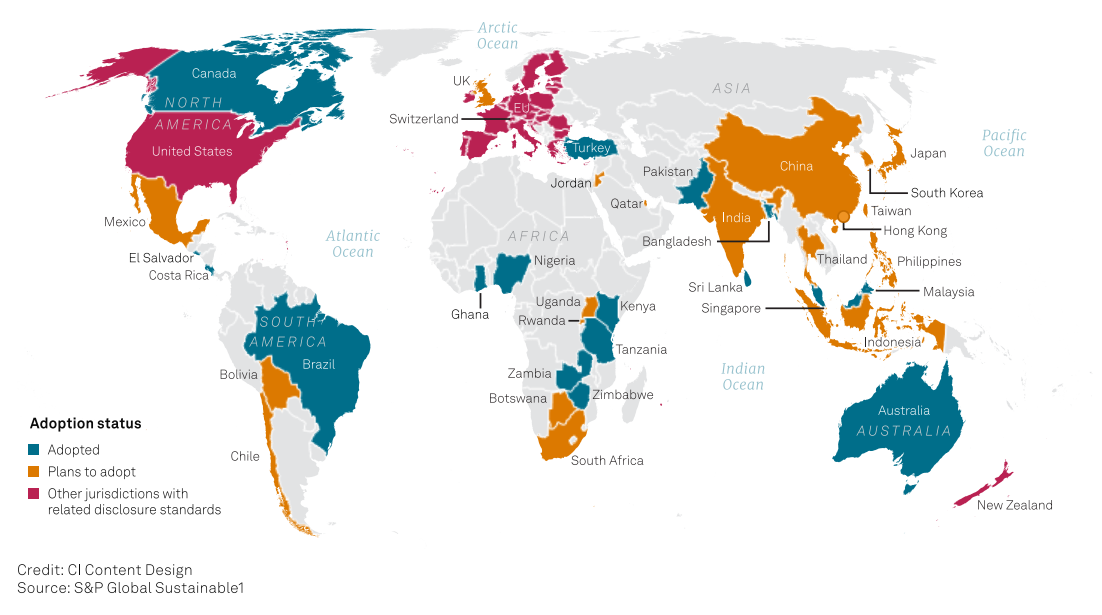

By January 2026, the International Sustainability Standards Board has moved from concept to cornerstone. What began as an effort to harmonize fragmented sustainability reporting frameworks is now shaping regulatory systems across major economies. Governments, regulators, and capital markets increasingly treat ISSB standards as the reference point for climate and sustainability related financial disclosure. While jurisdictions are taking different legal and institutional paths, the direction of travel is clear. Sustainability information is becoming standardized, decision useful, and embedded into mainstream corporate reporting.

This global shift reflects investor demand for comparable data, rising exposure to climate related financial risk, and the growing recognition that sustainability performance directly affects enterprise value. Rather than waiting for full global adoption, many countries are aligning national frameworks with ISSB principles. Recent developments in China and the Philippines illustrate how this convergence is unfolding in practice, while parallel progress in the European Union and the United States reinforces the momentum.

Global Momentum: Advances Across Major Economies

Sustainability momentum is best understood in the context of broader global regulatory change. In the European Union, the Corporate Sustainability Reporting Directive represents one of the most comprehensive sustainability disclosure regimes globally. CSRD requires in scope companies to report detailed information on climate, environmental, and social topics, supported by standardized data, governance oversight, and assurance. Its implementation has significantly raised the baseline for sustainability reporting expectations across global value chains.

In the United States, the regulatory landscape reflects a more fragmented approach. At the federal level, there is no single mandatory sustainability disclosure framework, and political resistance to ESG related regulation has slowed nationwide action. At the same time, individual states have moved forward. California has enacted landmark climate disclosure laws, including SB 253 on greenhouse gas emissions reporting and SB 261 on climate related financial risk disclosure. In parallel, regional initiatives such as the Regional Greenhouse Gas Initiative continue to shape emissions accountability at the state level.

These developments reinforce that sustainability disclosure is advancing even in the absence of uniform federal policy. Across Asia, Latin America, and other regions, regulators are converging around common disclosure pillars. Governance, strategy, risk management, and metrics related to climate and sustainability have become recurring themes. ISSB now functions as the connective tissue across these regimes, enabling jurisdictions to maintain local priorities while improving global comparability. Against this backdrop, developments in China and the Philippines stand out for their scale, clarity, and timing.

China: CSDS Introduces Double Materiality into National Sustainability Reporting

China’s introduction of the Corporate Sustainability Disclosure Standards marks a structural shift in how sustainability information is treated within the domestic regulatory system. CSDS represents the country’s first unified national sustainability disclosure framework, moving beyond fragmented voluntary guidelines toward a standardized approach.

One of the most significant aspects of CSDS is the explicit inclusion of double materiality. Companies are expected to consider not only how sustainability issues affect financial performance, but also how corporate activities impact the environment and society. This approach aligns China more closely with leading global practices and signals a recognition that sustainability risks and impacts are deeply interconnected.

CSDS places strong emphasis on climate related risks, transition planning, and environmental impacts, while also addressing governance structures and data credibility. Implementation is expected to follow a phased approach, beginning with large and listed companies and expanding over time. For many organizations, this will require new internal controls, improved emissions measurement, and closer coordination across finance, sustainability, and operations teams.

For multinational companies and global supply chains, CSDS has implications beyond China’s borders. Increased disclosure requirements will raise expectations for upstream and downstream data, particularly around emissions, energy use, and environmental impacts. Companies that already align with ISSB principles will be better positioned to adapt as CSDS requirements mature.

The Philippines: PFRS Alignment Integrates ISSB into Financial Reporting

The Philippines has taken a different but complementary approach by aligning sustainability disclosure with Philippine Financial Reporting Standards. By incorporating ISSB aligned standards into PFRS, sustainability reporting is anchored directly within the financial reporting ecosystem rather than treated as a standalone ESG exercise.

This integration sends a strong signal to capital markets. Sustainability information is positioned as decision relevant, subject to governance and control processes similar to financial data. Climate related risks, governance structures, and strategy disclosures are emphasized, reinforcing the link between sustainability performance and financial outcomes.

For listed companies and financial institutions, PFRS alignment introduces clearer expectations around data quality, consistency, and oversight. It also reduces long term reporting fragmentation by aligning domestic requirements with global investor expectations. As Southeast Asian markets attract increasing international capital, this alignment enhances credibility and comparability.

From an operational perspective, companies will need to strengthen cross functional collaboration between finance, risk, and sustainability teams. Carbon accounting, scenario analysis, and climate risk assessment will play a central role in meeting PFRS aligned disclosure expectations.

What ISSB Momentum Means for Companies in 2026

By January 2026, ISSB alignment has become a defining feature of global sustainability reporting. Developments in China and the Philippines demonstrate that convergence does not require identical rules, but it does require common principles. Double materiality, climate risk integration, and data credibility are becoming standard expectations rather than regional exceptions.

For companies operating across borders, this shift raises the bar for sustainability data management. High quality carbon accounting, robust governance, and audit ready processes are increasingly essential to meet overlapping regulatory requirements. Organizations that treat ISSB as a strategic foundation rather than a compliance afterthought will be better positioned to manage risk, maintain investor confidence, and adapt to future regulatory change.

As sustainability reporting continues to evolve, the direction is clear. ISSB aligned disclosure is becoming the baseline for global business, and preparation today will determine resilience tomorrow.

Why Work with ASUENE Inc.?

ASUENE is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. The company serves over 10,000 clients worldwide with an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.