- Article Summary

-

Overview

In recent years, interest in ESG (Environmental, Social, and Governance) has rapidly increased, prompting companies to disclose information related to these factors. However, if the disclosed information lacks credibility, it cannot gain the trust of investors and stakeholders. In response, the International Auditing and Assurance Standards Board (IAASB) has developed a new assurance standard, ISSA 5000, aimed at enhancing the reliability of ESG information. This standard is scheduled to take effect from December 15, 2026. Notably, ISSA 5000 exhibits a high level of compatibility with the EU’s Corporate Sustainability Reporting Directive (CSRD). As a result, companies are expected to streamline regulatory compliance and improve investor confidence.

This article provides an overview of ISSA 5000, exploring how companies can leverage this standard, its benefits, and the challenges involved. In particular, it focuses on the relationship with CSRD, offering detailed information to help enhance regulatory compliance and the credibility of ESG disclosures.

After reading the article you will be able to…

- Understand the overview and purpose of ISSA 5000

- Reconfirm the relationship with CSRD

- Learn specific steps to enhance the reliability of ESG disclosures

- Streamline regulatory compliance and gain investor trust

What is ISSA 5000?

ISSA 5000 (International Standard on Sustainability Assurance 5000) is an international standard for assurance engagements on sustainability information, developed by the International Auditing and Assurance Standards Board (IAASB). Effective from December 15, 2026, it is used by third parties to verify the reliability of Environmental (E), Social (S), and Governance (G) information disclosed by companies.

Purpose

ISSA 5000 aims to improve the reliability and transparency of ESG (Environmental, Social, and Governance) information disclosed by companies. Its core objectives are:

- Enhancing the Reliability of ESG Information

Ensuring that the ESG information disclosed by companies is accurate and reliable, enabling investors and stakeholders to make informed decisions with confidence. - Ensuring Transparency

Improving the verifiability and comparability of disclosed ESG information to ensure transparency. - Providing a Global Assurance Standard

Offering a unified international standard to enhance the quality of assurance engagements on sustainability reporting. - Supporting Decision-Making

Facilitating appropriate decision-making by investors and stakeholders through reliable and transparent ESG information.

ESG Items Covered by ISSA 5000

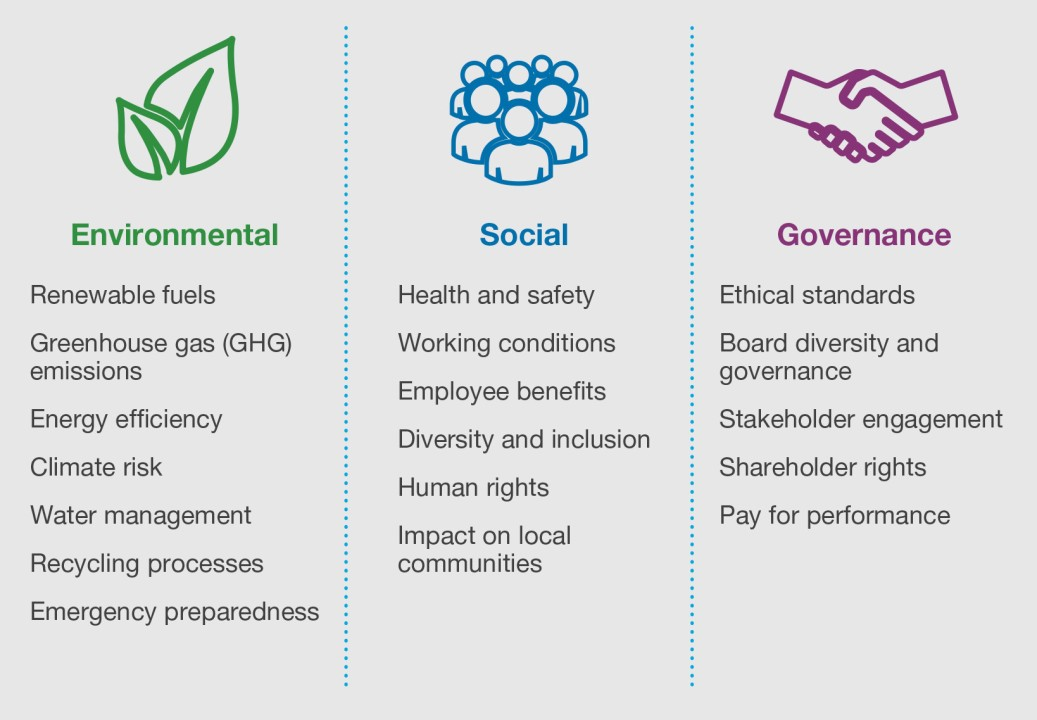

ISSA 5000 comprehensively covers Environmental (E), Social (S), and Governance (G) factors:

- Environmental (E): Information on the impact of corporate activities on the environment, such as greenhouse gas emissions, resource management, and biodiversity.

- Social (S): Information on the impact of corporate activities on society, including working conditions, human rights, and community impact.

- Governance (G): Information on corporate governance, such as transparency, risk management, and ethics.

CSRD Compatibility with ISSA 5000

The requirements of CSRD and the standards of ISSA 5000 are closely linked. While CSRD mandates the disclosure of sustainability information, ISSA 5000 provides a framework to ensure the reliability of that information. Compliance with ISSA 5000 allows companies to meet CSRD requirements and enhance the credibility of their ESG information.

About CSRD:

Reasonable Assurance vs. Limited Assurance

ISSA 5000 offers two levels of assurance: Reasonable Assurance and Limited Assurance.

Reasonable Assurance is provided when the assurer has obtained sufficient and appropriate evidence to conclude that there are no material misstatements in the ESG information. On the other hand, Limited Assurance is a lower level of assurance, provided when the assurer concludes that there is no reason to believe that there are material misstatements in the ESG information. In general, reasonable assurance requires more rigorous assurance procedures, making it more costly and time-consuming. The choice between these levels of assurance depends on the company’s needs and risk profile.

| Aspect | Reasonable Assurance | Limited Assurance |

| Level of Assurance | High | Low |

| Evidence Requirement | Requires more extensive and appropriate evidence | Relies on a limited scope of evidence |

| Assurance Procedures | Detailed tests (interviews, document reviews, data verification) | Limited tests (interviews and reviews with a narrower scope) |

| Reporting Example | “No material misstatements found.” | “No reason to believe there are material misstatements.” |

| Cost and Time | High | Low |

| Suitable For | Large companies or high-risk industries | SMEs or low-risk industries |

| Merits | High trust from investors and regulators | Cost-effective, provides basic trust |

| Risks | High cost and complexity | Perceived lower reliability |

| Selection Criteria | Based on company size, risk level, and investor demands | Cost-focused, suitable for SMEs or low-risk industries |

Choosing between these levels depends on a company’s needs and risk profile. By adhering to ISSA 5000, companies can enhance the credibility of their ESG information, align with CSRD requirements, and build stronger trust with investors.

Benefits and Challenges of Certification

Benefits

- Streamlined Regulatory Compliance:

Adhering to international standards simplifies compliance with regulations across different countries. - Gaining Investor Trust:

High-quality, reliable reporting enhances the confidence of investors and stakeholders. - Competitive Advantage:

Obtaining certification showcases a company’s commitment to sustainability, differentiating it from competitors.

Challenges

- Implementation Costs:

Adapting to the new standards may require significant investments in system upgrades and employee training. - Complexity of Data Collection:

Comprehensive management and collection of a wide range of sustainability information are necessary. - Lack of Expertise:

A shortage of professionals with expertise in sustainability assurance may pose a challenge. - Global Application:

Ensuring alignment with various national regulations and existing standards is a complex task. - Choice of Assurance Level:

Balancing cost and reliability when deciding between limited and reasonable assurance is a challenge.

Considering these benefits and challenges, companies need to evaluate their situation carefully and plan for the implementation of ISSA 5000.

ISSA 5000 Certification Process

- Preparation:

・Collect sustainability information and establish internal control systems. - Planning:

・Conduct risk assessments to decide between reasonable assurance and limited assurance. - Execution of Procedures:

・Reasonable Assurance: Involves detailed procedures.

・Limited Assurance: Involves simplified procedures. - Evaluation and Conclusion:

・Assess the evidence and verify compliance with reporting standards. - Report Preparation:

・Include the assurance level, conclusions, and suggestions for improvement. - Publication:

・Release the assurance report to stakeholders.

Future Trends and Outlook

ESG regulations are expected to strengthen not only in the EU but also in the United States and Asia. Companies need to monitor these trends closely and begin preparations now.

Key preparations for companies:

- Data Management: Organize and systematize data effectively.

- Consider Assurance Services: Evaluate assurance requirements based on risk and cost.

- Strengthen Internal Controls: Enhance internal systems for reliable ESG reporting.

Why Collaborate with ASUENE USA Inc.?

To navigate the complex climate disclosure requirements, appropriate tools and expertise are essential. This is where ASUENE USA Inc. comes in.

Carbon Accounting: Our advanced software solutions automate emissions tracking across Scopes 1, 2, and 3, integrating with existing ERP systems to reduce manual data entry errors. Proprietary algorithms align with GHG Protocol standards, ensuring compliance with ESG reporting mandates.

Third-Party Verification: ASUENE’s network of accredited auditors provides ISO 14064-compliant verification services, a critical step for companies seeking to validate their disclosures.

By partnering with ASUENE USA, businesses can transform regulatory obligations into strategic advantages, enhancing sustainability performance while minimizing compliance costs.

So, why not partner with us to streamline your reporting and environmental efforts? Let ASUENE USA Inc. help you stay ahead of the curve while making a positive impact on both your business and the planet.

Talk to us today for your sustainable transformation!