- Article Summary

-

In today’s investment landscape, Environmental, Social, and Governance (ESG) considerations are no longer optional. Stakeholders are demanding transparency, and businesses are under increasing pressure to demonstrate their sustainability performance. Among the many frameworks developed to standardize ESG disclosure, the Sustainability Accounting Standards Board (SASB) Standards stand out for their industry-specific focus and investor relevance.

SASB, founded in 2011, developed standards designed to guide companies in disclosing financially material sustainability information to investors. In 2021, SASB was consolidated into the Value Reporting Foundation, which later merged with the IFRS Foundation to form the International Sustainability Standards Board (ISSB). Despite these structural changes, SASB Standards remain a vital tool for aligning sustainability reporting with investor needs.

”

This article explores the structure, purpose, and impact of SASB Standards across five major dimensions. It also compares SASB to other ESG frameworks, evaluates how companies integrate these standards, and forecasts the evolution of standardized ESG reporting in the coming years.

SASB Standards Structure and Materiality Map

The cornerstone of SASB’s approach is its Materiality Map, which identifies sustainability issues that are likely to affect the financial condition or operating performance of companies in a specific industry. Unlike broader ESG frameworks, SASB is industry-specific, covering 77 sectors.

Table 1: Key SASB Sectors and Sample Metrics

| Industry Sector | ESG Issue Category | Sample SASB Metric |

|---|---|---|

| Oil & Gas – Exploration | Environment | Greenhouse Gas Emissions Intensity |

| Food & Beverage | Social Capital | Supply Chain Labor Practices |

| Technology – Hardware | Business Model & Innovation | Product Lifecycle Environmental Impacts |

| Financials – Banking | Leadership & Governance | Business Ethics Violations |

SASB standards include five major ESG dimensions:

- Environment

- Social Capital

- Human Capital

- Business Model & Innovation

- Leadership & Governance

Each industry standard identifies which issues within these dimensions are most likely to be financially material. For example, water management is critical in agriculture but less so in software.

Graph 1: SASB Materiality Across Sectors (Blue Tone Heat Map)

plaintextコピーする編集する[Heat Map Graph Description: Each industry is represented on the Y-axis, and ESG categories are on the X-axis. Shades of blue indicate the degree of materiality. Darker blue = higher relevance.]

Highlights:

- Environmental issues (dark blue) dominate in energy, transportation, and manufacturing.

- Human capital (mid-blue) is key in healthcare and retail.

- Governance issues are highly relevant across all sectors.

The Materiality Map empowers both companies and investors to focus their attention on what truly matters—reducing the “noise” often associated with ESG reporting.

Comparing SASB with Other ESG Frameworks

Many ESG frameworks exist, including GRI (Global Reporting Initiative), TCFD (Task Force on Climate-Related Financial Disclosures), CDP (formerly Carbon Disclosure Project), and Integrated Reporting (<IR>). Each serves a different purpose. SASB focuses on financial materiality for investors, while GRI emphasizes stakeholder accountability.

Table 2: Comparative Overview of ESG Frameworks

| Framework | Primary Audience | Focus Area | Level of Industry Specificity |

|---|---|---|---|

| SASB | Investors | Financial Materiality | High (77 sectors) |

| GRI | Stakeholders | Societal Impact | Low to Medium |

| TCFD | Regulators/Investors | Climate-Related Risks | Sector-specific guidance |

| CDP | Investors | Carbon, Water, Forests | Thematic Focus |

This differentiation matters because companies often use multiple frameworks to satisfy varying stakeholder needs. For instance, a firm might use SASB for investor-facing reports and GRI for public-facing sustainability initiatives.

Graph 2: Use of ESG Frameworks by Fortune 500 Companies

plaintextコピーする編集する[Bar Chart – Blue Tones]

X-axis: Framework (SASB, GRI, TCFD, CDP)

Y-axis: % of Companies Using Framework

Results:

- GRI: 78%

- TCFD: 65%

- SASB: 60%

- CDP: 54%

SASB’s integration into the ISSB’s forthcoming sustainability disclosure standards suggests that its relevance will grow, especially under regulatory pressure in jurisdictions like the EU and Japan.

Corporate Implementation of SASB Standards

Many leading companies have adopted SASB Standards to increase transparency, build investor trust, and future-proof their reporting against regulatory changes. Companies such as Nike, Apple, and General Motors have integrated SASB metrics into their sustainability and annual reports.

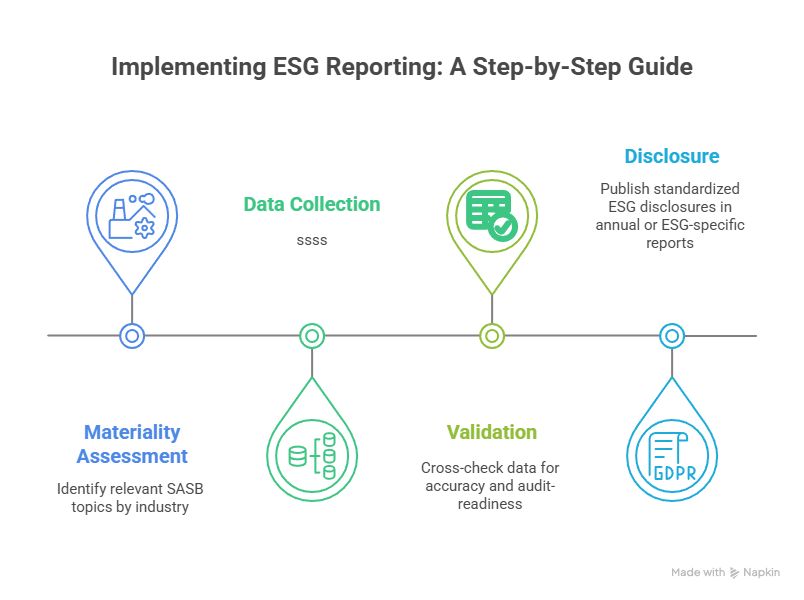

Key Implementation Steps:

- Materiality Assessment: Identify relevant SASB topics by industry.

- Data Collection: Aggregate internal and external data for each metric.

- Validation: Cross-check data for accuracy and audit-readiness.

- Disclosure: Publish standardized ESG disclosures in annual or ESG-specific reports.

Case Example: General Motors

- Industry: Auto Manufacturing

- SASB Topic: Fuel Efficiency & Emissions in Vehicles

- Metric: Sales-weighted fleet fuel economy (mpg)

- Action: GM discloses targets and progress on electric vehicle integration to reduce long-term environmental risks.

Graph 3: SASB Adoption by Industry (2024 data)

plaintextコピーする編集する[Stacked Bar Graph – Blue Scale]

Y-axis: % Adoption of SASB Standards

X-axis: Industries (Finance, Energy, Tech, Consumer Goods)

Highlights:

- Finance: 72%

- Energy: 64%

- Tech: 55%

- Consumer Goods: 48%

This trend reveals growing recognition that SASB not only improves ESG credibility but also enhances internal decision-making processes.

Challenges and Opportunities Ahead

While SASB Standards have gained significant traction, challenges remain in implementation, standard harmonization, and regulatory alignment.

Key Challenges:

- Data Gaps: Many companies lack internal systems to collect granular ESG data.

- Complexity: Industry-specific standards require specialized knowledge.

- Regulatory Uncertainty: Global convergence on ESG standards is still evolving.

However, opportunities outweigh challenges:

- Investor Demand: ESG-oriented investing is now over $40 trillion globally.

- ISSB Integration: SASB’s alignment with IFRS S1/S2 is positioning it for broader global adoption.

- Tech Enablement: New ESG software solutions are simplifying data collection and reporting.

Table 3: SASB Future Readiness Matrix

| Factor | Current Status | Future Outlook (2026) |

|---|---|---|

| Investor Relevance | High | Very High |

| Regulatory Alignment | Medium | High |

| Data Infrastructure | Low to Medium | Medium to High |

| Framework Integration | Medium | High |

As regulators push for mandatory climate and ESG disclosures (e.g., SEC’s Climate Disclosure Rule in the U.S.), SASB’s structured, sector-specific metrics will likely become a baseline expectation for corporate ESG communication.

Conclusion: SASB’s Role in the Future of ESG Reporting

SASB Standards are reshaping how companies communicate their sustainability performance. With their emphasis on financial materiality, industry specificity, and investor-centric metrics, they provide clarity in a crowded ESG landscape.

In a future where ESG integration is no longer optional but expected, SASB Standards offer a pragmatic and credible pathway. Their increasing integration into broader frameworks like those of the ISSB and growing corporate adoption make them a cornerstone of ESG disclosure today and tomorrow.

Companies that proactively align with SASB are not only preparing for regulatory compliance—they are building transparency, investor confidence, and long-term value.

Would you like me to generate a downloadable PDF or provide editable formats (e.g., Word or HTML) with visuals included?

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.