- Article Summary

-

Introduction: A turning point for ESG in business strategy

The discourse surrounding environmental, social, and governance (ESG) strategies has taken a dramatic turn in the United States. While headlines increasingly highlight political backlash, accusations of greenwashing, and skepticism over ESG’s financial relevance, a contrasting reality is emerging in boardrooms and among institutional investors. According to the recently published 2025 Sustainable Signals survey by Morgan Stanley, an overwhelming 88% of asset managers and institutional investors view ESG not as a burden but as a critical driver of long-term value creation. This sentiment is reinforced by findings from The Conference Board, which reveal that more than half of U.S. companies are actively reassessing their ESG approaches, not to scale them back, but to refine and strengthen them.

The blog explores how ESG, far from being derailed, is entering a new chapter. Businesses are pivoting from risk-mitigation frameworks to ESG strategies that prioritize growth, innovation, and stakeholder trust. Amid the noise of backlash, companies are doubling down on ESG, motivated not by compliance, but by competitive advantage.

ESG as a strategic growth driver: The data speaks

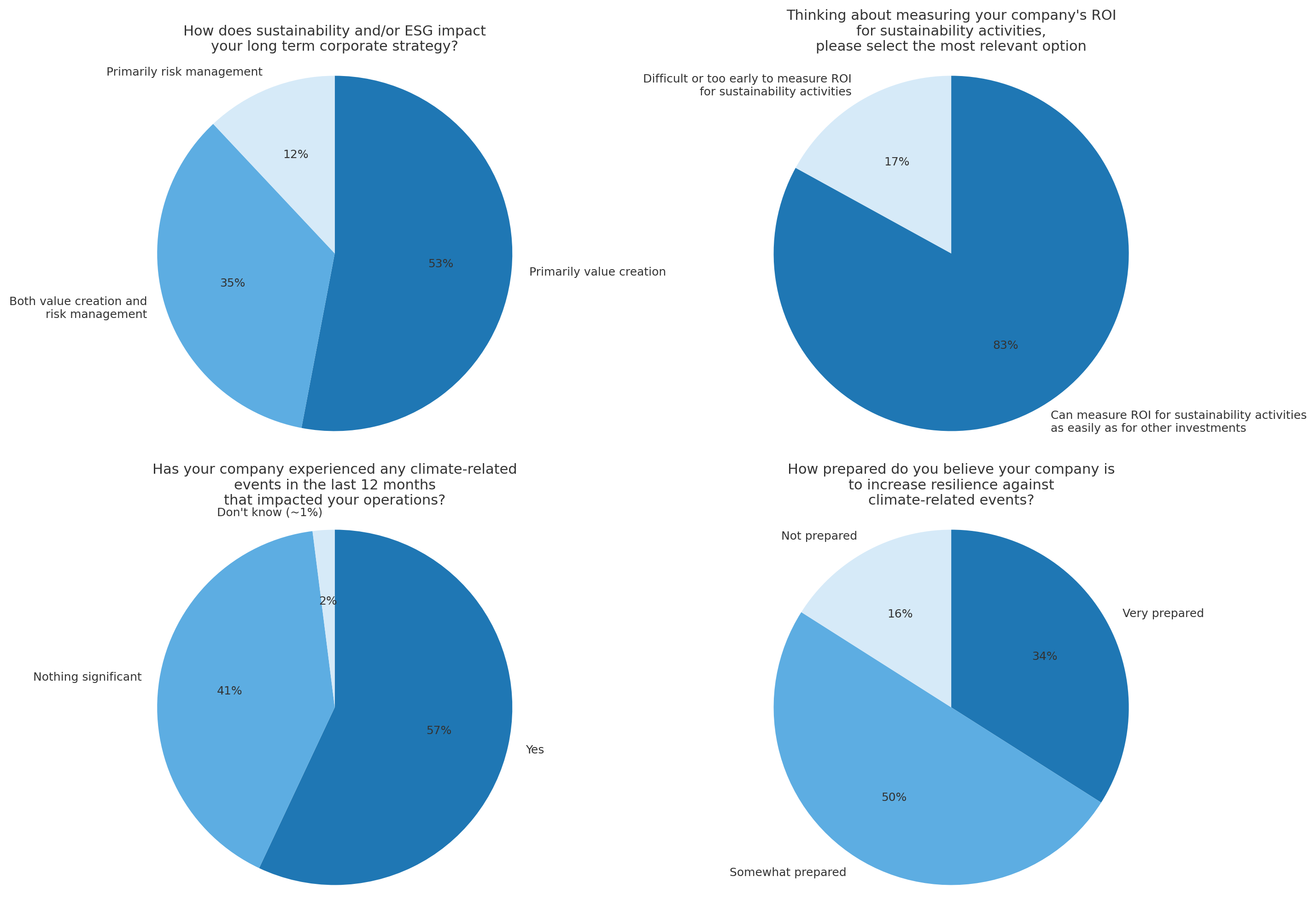

Morgan Stanley’s 2025 Sustainable Signals report provides compelling evidence that ESG is being embraced as a central tenet of corporate strategy. The following data from the report’s “Key Takeaways for 2025” section highlights this shift:

- 88% of companies globally see sustainability as a value creation opportunity, up 3 points from 2024

- 65% report they are meeting or exceeding expectations in delivering their sustainability strategies

- More than 80% say they measure ROI on sustainability-related capex, R&D, and opex, just like other investments

- 57% of companies experienced business impact from physical climate events in the past year

- 84% feel “very” or “somewhat prepared” to increase resilience against climate-related risks

These figures suggest that ESG is no longer an aspirational initiative. It is embedded in operational planning, capital expenditure, and enterprise risk management.

Chart: Corporate Progress on ESG (Morgan Stanley Sustainable Signals 2025)

These insights reflect a growing alignment between ESG and long-term profitability. Companies are not only managing risks, they are increasingly seeing ESG as a pathway to innovation, resilience, and strategic growth.

Reworking ESG: How companies are adapting under scrutiny

The recent surge in ESG skepticism has not triggered mass abandonment of sustainability strategies. Instead, it has prompted a period of reassessment. The Conference Board’s Sustainability Under Scrutiny 2025 study found that over 50% of companies are reworking their ESG messaging, governance structures, and reporting standards. This recalibration reflects an evolution of ESG from marketing language to value-aligned execution.

Key trends include:

- Moving away from ambiguous ESG branding while retaining strong sustainability goals

- Strengthening governance oversight and linking ESG performance to executive compensation

- Aligning disclosures with materiality frameworks such as SASB and TCFD

Table: Evolution of ESG Strategy

| Category | Old ESG Approach | Evolved ESG Strategy |

| Branding | ESG-labeled products | Integrated sustainability messaging |

| Governance | Minimal board oversight | ESG committees and linked compensation |

| Metrics | Vague KPIs | Aligned with SASB, TCFD, double materiality |

This trend does not signal the end of ESG but its maturation. Companies are becoming more strategic, less performative. The objective is clarity, accountability, and resilience, qualities that improve investor confidence and corporate reputation.

Navigating the ESG backlash: Risk or opportunity?

The current ESG backlash, while loud, is not monolithic. Critics have pointed to greenwashing, inconsistent metrics, and politicization as reasons for concern. However, these critiques are pushing companies toward more credible and measurable ESG efforts. Rather than retreating, many firms are using this moment to audit their practices and eliminate superficial ESG elements.

Institutional investors, particularly in Europe and increasingly in the U.S., are not reducing their focus on ESG. Instead, they are demanding higher standards and better data. This dynamic has encouraged the adoption of more robust assurance processes, third-party audits, and industry-specific benchmarks.

Several organizations are shifting their public language away from ESG while continuing to invest in decarbonization, DEI programs, and responsible supply chains. The labels may change, but the fundamentals remain. For forward-looking companies, the backlash represents an opportunity to lead with transparency and deliver demonstrable impact.

Conclusion: ESG’s resilience and the road ahead

Contrary to the notion that ESG is in decline, the evidence points to its evolution. The Morgan Stanley and Conference Board findings demonstrate that ESG is not only alive but thriving, provided it is implemented strategically. The backlash has sparked important conversations about integrity, impact, and accountability, pushing ESG from marketing departments into core business operations.

As companies reframe ESG from a reputational exercise into a value creation strategy, they position themselves for long-term success. The path forward requires precision, integration, and measurable outcomes. The language around ESG may continue to shift, but its business case remains solid. In the face of skepticism, ESG is proving its worth where it matters most, in the value it delivers to companies, investors, and society at large.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.