- Article Summary

-

Overview

As corporations sharpen their focus on net-zero goals, transportation emissions are increasingly coming under scrutiny—not just for compliance, but for competitive differentiation. Hydrogen fuel cell vehicles (FCVs) are no longer experimental outliers. With increasing deployment in logistics, public fleets, and industrial operations, FCVs are emerging as a credible, scalable, and ESG-aligned solution for long-haul and high-utilization transport.

This article explores the strategic ESG potential of hydrogen mobility, anchored by practical corporate examples and structured insights into FCV implementation and reporting.

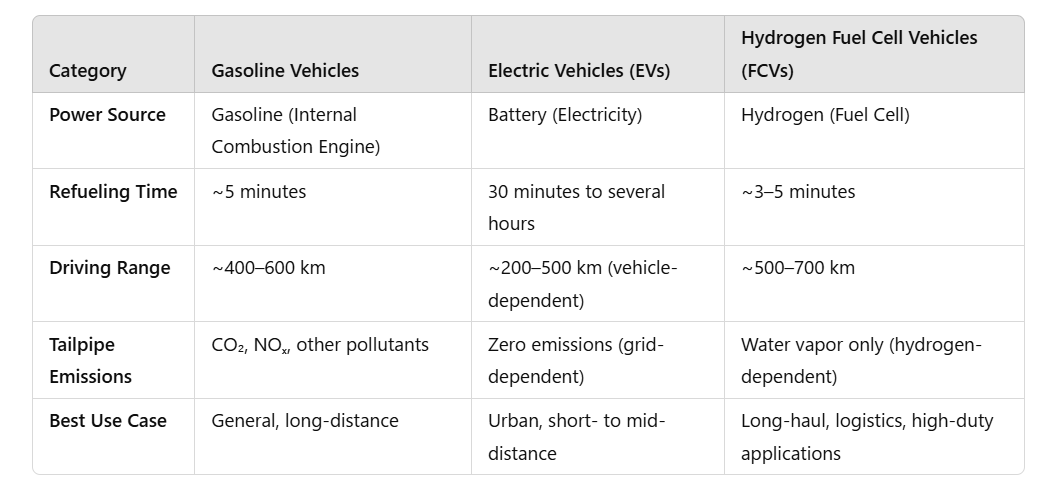

Comparing Key Vehicle Types

To understand the value proposition of FCVs, it is helpful to benchmark them against gasoline and electric vehicles. Each technology brings distinct environmental, operational, and strategic trade-offs:

FCVs’ Early Corporate Adopters

Several forward-looking companies have already integrated FCVs into their transport operations—not just for emissions reduction, but for ESG positioning and resilience.

✅ Toyota

Toyota uses its own Mirai FCVs for internal logistics and employee transportation. The company has also introduced hydrogen-powered Class 8 trucks at the Port of Los Angeles through its “Project Portal,” aiming to decarbonize freight transport.

✅ Amazon & Walmart (via Nikola and Plug Power)

Both Amazon and Walmart have partnered with hydrogen providers such as Plug Power to deploy FCV-powered forklifts and material handling equipment in warehouses—where rapid refueling and high uptime are essential.

✅ DHL

DHL has trialed hydrogen trucks as part of its Deutsche Post DHL Group “GoGreen” strategy. The company aims to operate 60% of its last-mile delivery with clean transport by 2030, positioning FCVs as a solution for high-mileage regional routes.

✅ Air Liquide & TotalEnergies

These energy companies are not only investing in hydrogen production but also integrating FCVs into their fleet operations and building hydrogen refueling infrastructure across Europe.

These cases demonstrate that FCVs are not a future concept—they are being implemented now, especially in high-volume, logistically intensive operations.

ESG Relevance of Hydrogen FCVs

1. Scope 1 and Scope 3 Emissions Reductions

Replacing diesel-powered vehicles with FCVs allows companies to cut:

- Scope 1 Emissions: Direct emissions from owned and controlled vehicles.

- Scope 3 Emissions: Indirect emissions from transportation by third-party logistics providers.

Example:

A multinational food distributor replaced a segment of its diesel delivery fleet with hydrogen trucks, achieving a 30% reduction in Scope 1 emissions. Additionally, by requiring third-party carriers to adopt FCVs, it reported measurable Scope 3 progress in its CDP disclosure.

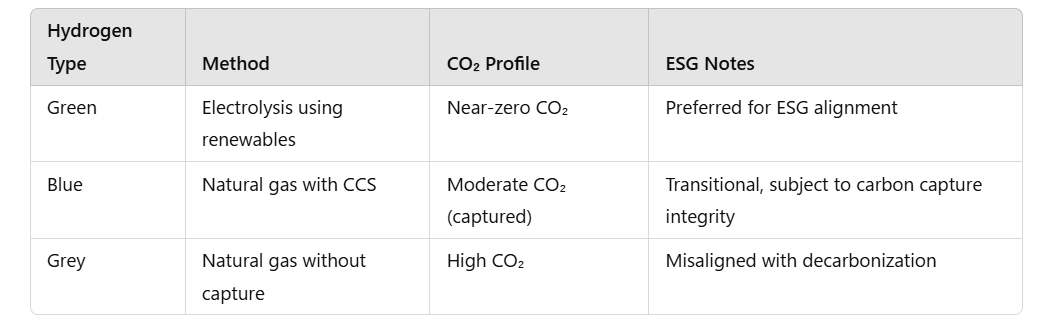

2. Hydrogen Sourcing and Supply Chain ESG

The sustainability of hydrogen is not inherent—it depends on how the hydrogen is produced:

ESG Action Point:

Under CSRD and CDP, companies should assess hydrogen suppliers on criteria such as:

- GHG emissions per kg of H₂

- Water usage intensity

- Supply chain transparency (e.g., human rights due diligence)

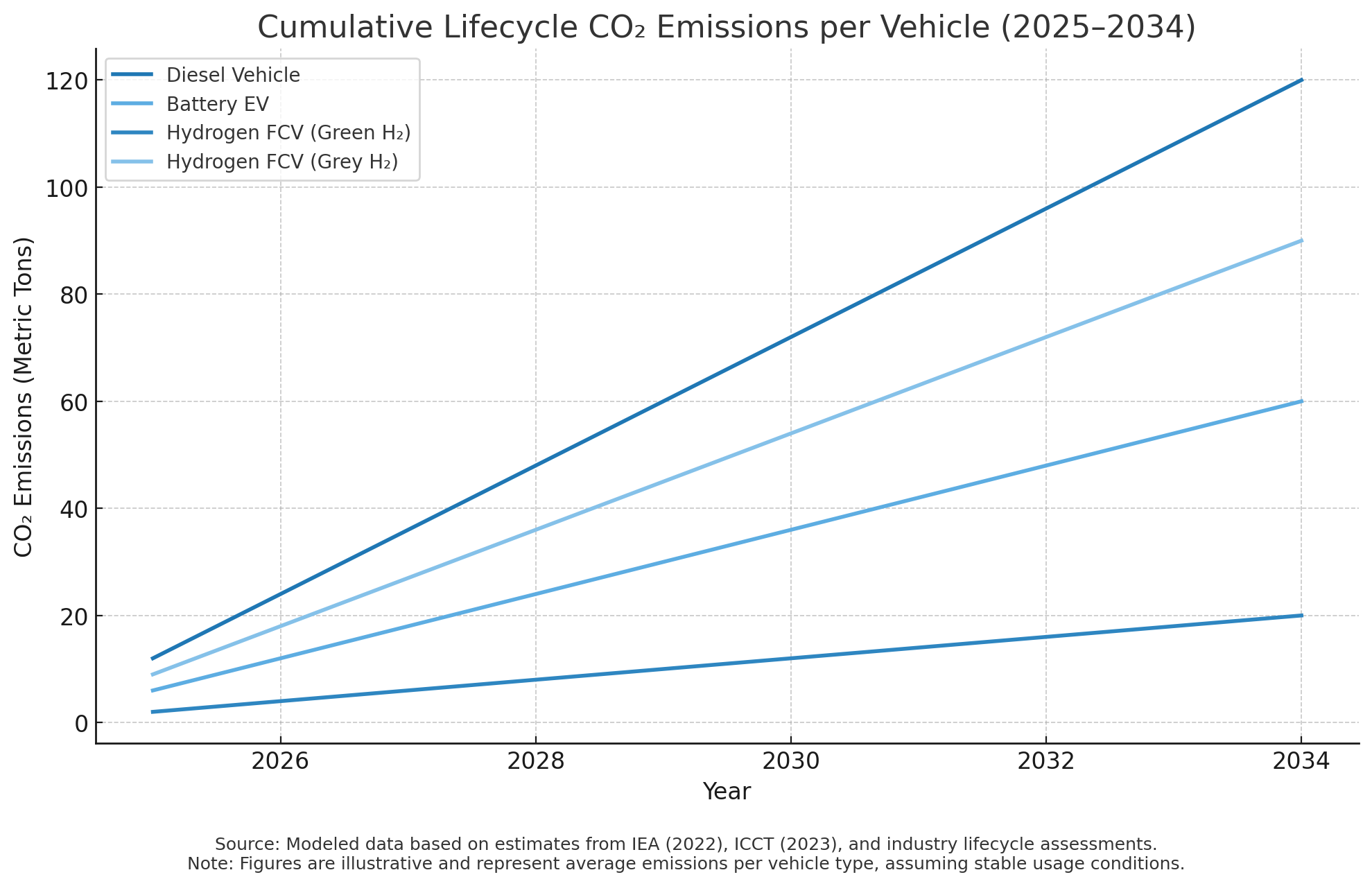

3. TCFD Reporting and Strategic Disclosure

Companies can align FCV strategies with the Task Force on Climate-related Financial Disclosures (TCFD) by:

- Reporting FCV adoption under the “Strategy” and “Metrics & Targets” pillars.

- Including scenario analyses related to fuel costs, emissions pathways, and capital reallocation.

Pro Tip:

Include comparative emissions modeling—e.g., diesel vs. BEV vs. FCV—using “well-to-wheel” life cycle emissions to demonstrate climate resilience strategies.

4. Third-Party Assurance and Credible Reporting

Why it matters:

Investors and regulators increasingly expect verified emissions data.

Steps for assurance:

- Track Emission Reductions: Use standard emission factors for hydrogen mobility.

- Engage Verifiers: Work with independent assurance providers to validate emission data.

- Integrate into ESG Reports: Disclose reductions under Scope 1 and Scope 3 transportation categories.

5. Water Use and Waste Considerations in Hydrogen Mobility

Hydrogen combustion itself emits only water vapor, but upstream impacts are critical:

- Water Consumption: Green hydrogen requires ~9 liters of purified water per kg of hydrogen.

- Component Waste: Fuel cells use membranes and platinum-based catalysts that must be recycled at end-of-life.

Sustainable Practice Tip:

Partner with hydrogen producers using closed-loop water systems, and FCV manufacturers with certified recycling programs.

Hydrogen FCVs – More Than a Clean Engine

Hydrogen FCVs are not just a clean technology; they are a platform for corporate sustainability leadership. From Scope 1 and Scope 3 emissions reductions, to ESG-aligned procurement and third-party assurance, FCVs intersect directly with frameworks such as CSRD, TCFD, CDP, and SBTi.

For companies operating logistics networks, heavy-duty fleets, or high-utilization equipment, FCVs offer a credible pathway to decarbonization—one that supports both operational goals and ESG disclosure requirements.

Download Our Expert Publications!

Why Work with ASUENE Inc.?

ASUENE USA Inc., a subsidiary of Asuene Inc., is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3, with expertise in decarbonization and GRI compliance. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification. With a strong focus on the manufacturing and construction sectors, ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network. While the article primarily emphasizes GRI 101, ASUENE’s role in biodiversity reporting may also be relevant, further reinforcing its value as a strategic partner in ESG disclosure and reduction efforts.