- Article Summary

-

Introduction

Power Purchase Agreements (PPAs) have become one of the most popular tools for corporations seeking to decarbonize their operations. By securing a long-term contract with a renewable energy developer, companies can lock in a predictable electricity price while advancing their sustainability commitments. However, recent market movements are changing the game. Following the passage of the “One Big Beautiful Bill Act” (BBB) in July 2025, U.S. wind and solar PPA prices rose by approximately 4%, triggering a scramble among corporate buyers to secure deals before further increases or shifts in policy.

Policy Catalyst Behind the Surge

The BBB does not expand clean energy incentives like the Inflation Reduction Act (IRA) did; in fact, it moves in the opposite direction. The law shortens the timeline and accelerates the phase‑out of key IRA‑era tax credits, including the technology‑neutral Production Tax Credit (PTC) and Investment Tax Credit (ITC), unless construction begins by mid‑2026. It also imposes stricter sourcing rules and “foreign entity of concern” restrictions. These changes are creating urgency for developers and buyers to finalize PPAs while projects can still qualify. History shows similar surges when incentives were at risk of expiring, such as during prior PTC deadlines.

Procurement Teams Facing a Time Crunch

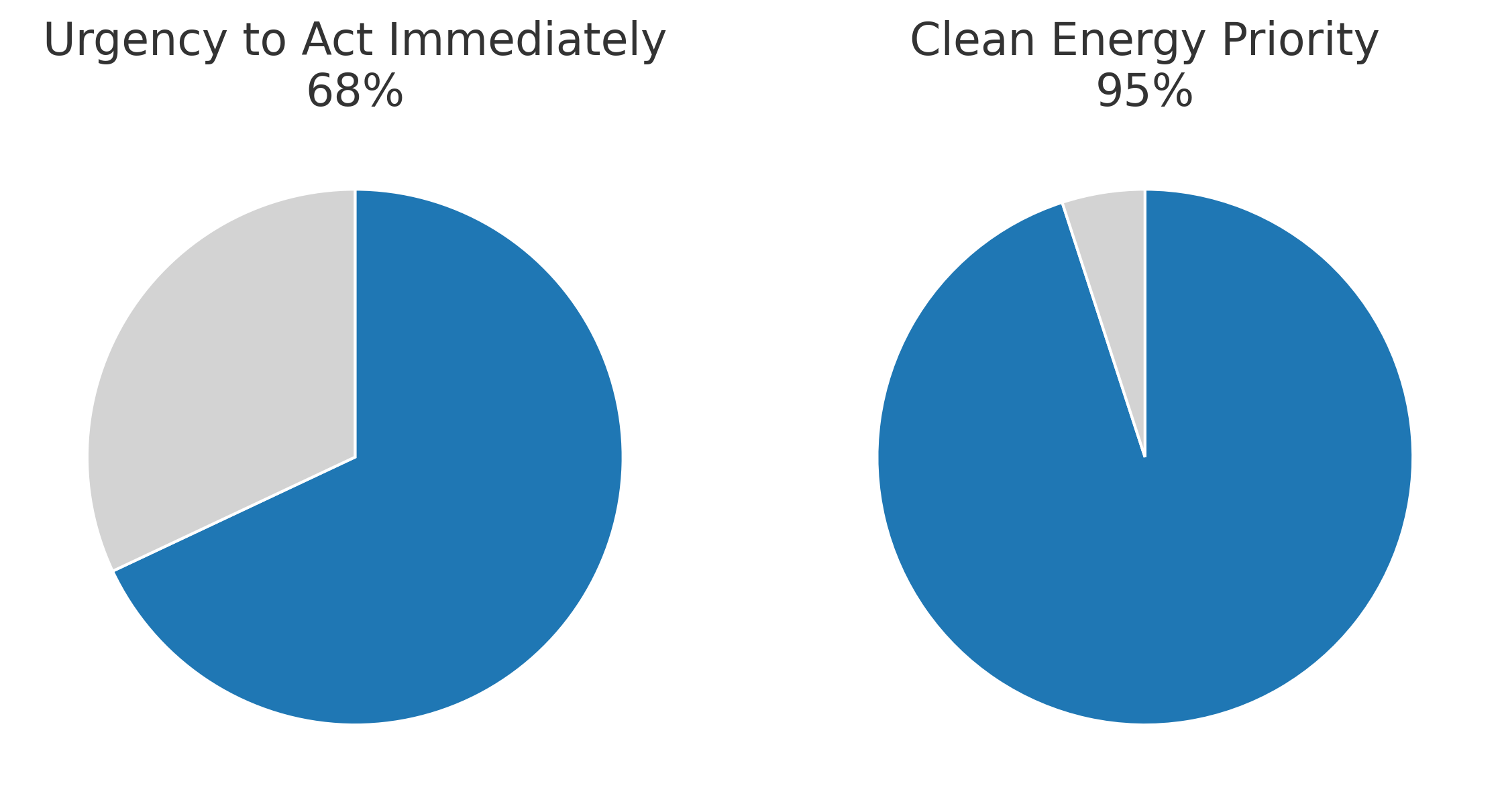

LevelTen Energy data shows that 68% of procurement professionals feel an immediate need to act, and 95% still prioritize clean energy procurement despite higher prices. Corporate energy buyers are under pressure from multiple fronts: boards and executives demanding progress toward Scope 2 emissions reductions, investors scrutinizing ESG performance, and internal sustainability commitments tied to public pledges like RE100. Waiting carries significant risks: higher future costs, fewer viable projects, and competition from energy-hungry sectors like hyperscale data centers.

Market Dynamics Shaping Urgency

Beyond the BBB’s policy changes, structural market dynamics are intensifying the rush. On the supply side, developers face bottlenecks in interconnection queues, lengthy permitting processes, and rising equipment costs. On the demand side, the explosion in AI and data center capacity is forecast to add as much as 20 GW of new load by 2030 in the U.S. alone. Developers increasingly prioritize counterparties that can commit quickly, offer favorable credit terms, and accept flexible contract structures. Geographic pricing disparities also play a role. Regions with strong solar or wind resources but limited transmission capacity are seeing particularly intense competition.

Strategies for Securing PPAs Amid Price Pressures

To navigate this competitive environment, procurement teams are adopting new strategies:

- Early Engagement: Building relationships with developers well before request‑for‑proposal (RFP) processes to reserve capacity.

- Contract Flexibility: Exploring shorter‑term PPAs, stepped‑pricing models, and synthetic PPAs that can reduce risk exposure.

- Portfolio Diversification: Spreading procurement across multiple technologies such as solar, wind, and hybrid projects with storage, and across regions to hedge against localized risks.

- Consortium Buying: Partnering with other companies to aggregate demand, gaining scale benefits and negotiating leverage.

Outlook and Long-Term Considerations

While current conditions favor quick movers, analysts suggest that PPA prices could stabilize or even decline by 2026 if supply expands and remaining tax credits are maximized before phase‑outs take effect. However, risks remain. Changes in political leadership or further policy adjustments could accelerate the reduction of incentives. Forward‑thinking companies are embedding procurement resilience into their energy strategies, incorporating risk‑adjusted financial modeling, scenario analysis, and diversified supply portfolios.

Conclusion

The recent rise in renewable PPA prices underscores the critical importance of timing in corporate energy procurement. With the BBB’s accelerated phase‑outs, market constraints, and intensifying competition converging, the next 12–18 months will be decisive. Companies that move swiftly, negotiate strategically, and maintain flexibility will be best positioned to secure favorable contracts and to meet their sustainability targets in an increasingly competitive marketplace.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.