- Article Summary

-

Overview

As financial institutions face mounting pressure to disclose and reduce their climate-related impacts, the Partnership for Carbon Accounting Financials (PCAF) has emerged as a transformative force in climate accountability. Originally launched in Europe and now expanding globally, including across the U.S., PCAF provides a standardized methodology for assessing and disclosing financed emissions: the greenhouse gas (GHG) emissions linked to loans and investments. With increasing regulatory alignment, such as the EU’s Corporate Sustainability Reporting Directive (CSRD) and emerging U.S. disclosure expectations, PCAF is no longer just a voluntary initiative. It is becoming foundational to how banks and investors measure and manage climate risk and opportunity.

PCAF Asset Classes and Required Data Inputs

PCAF defines specific methodologies for the following asset classes:

- Listed Equity and Corporate Bonds

- Business Loans and Unlisted Equity

- Project Finance

- Commercial Real Estate

- Mortgages

- Motor Vehicle Loans

- Sovereign Debt

Each asset class requires a tailored set of data inputs for emissions attribution. Typical data required includes:

- Outstanding investment or loan amount

- Borrower-level emissions data (actual or estimated)

- Ownership share or attribution factor

- Financial performance indicators (e.g., revenue, EVIC)

- Asset-specific factors (e.g., building energy use for real estate, fuel efficiency for auto loans)

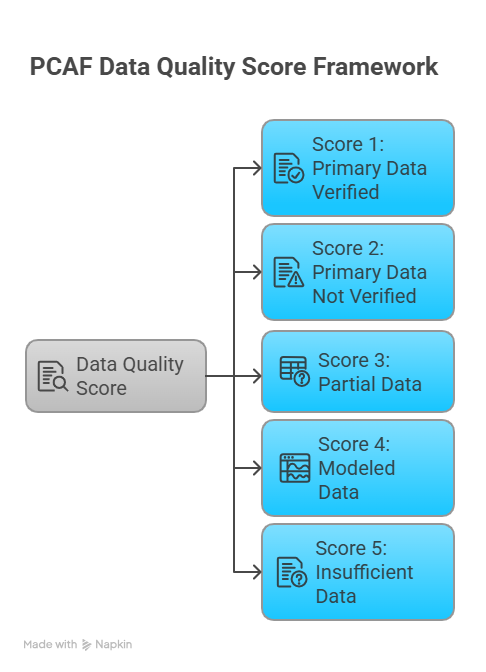

The accuracy of financed emissions reporting improves significantly when institutions can access borrower-reported emissions data. In the absence of actual data, PCAF recommends using industry averages, national databases, or modeled estimates. The methodology allows for transparency through a scoring system that ranks data quality from highest (score 1) to lowest (score 5), promoting continuous improvement over time.

The accuracy of financed emissions reporting improves significantly when institutions can access borrower-reported emissions data. In the absence of actual data, PCAF recommends using industry averages, national databases, or modeled estimates.

To ensure transparency and comparability, PCAF incorporates a Data Quality Score framework. This five-tier scoring system assesses the reliability and granularity of the data used to calculate emissions:

This scoring system allows institutions to transparently communicate the confidence level of their emissions disclosures and encourages continuous improvement in data collection and accuracy over time.

PCAF vs. GHG Protocol: Alignments and Distinctions

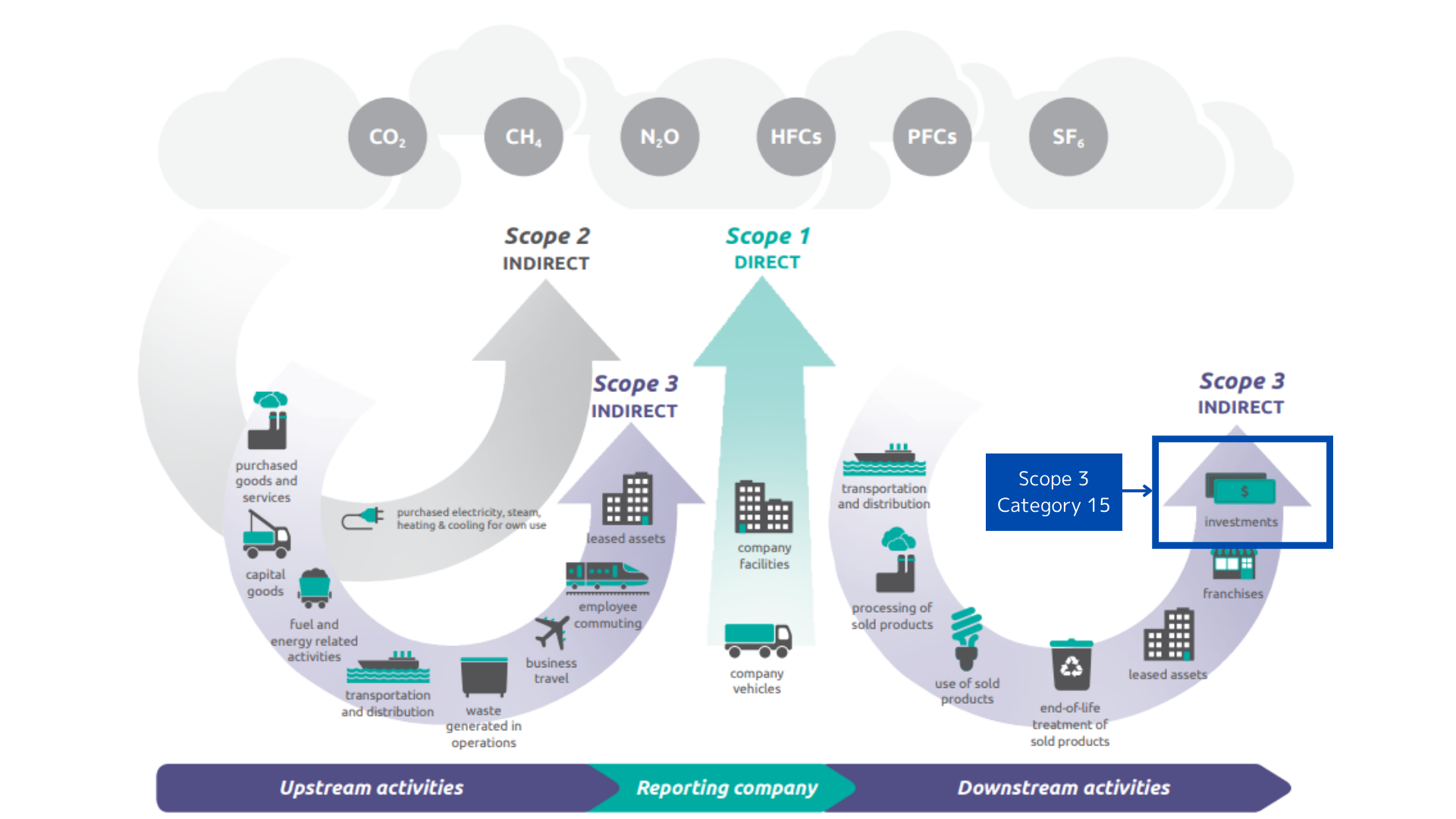

The PCAF standard draws heavily from and complements the GHG Protocol, particularly in its treatment of Scope 3, Category 15 (Investments). The GHG Protocol develops comprehensive global standards for measuring and managing GHG emissions and is widely recognized across industries.

However, it provides limited specific guidance for financial institutions, particularly in calculating financed emissions. This is where PCAF adds value by offering tailored methodologies for different financial asset classes, enabling more precise emissions accounting. The two frameworks are interoperable, and many institutions use them together to improve emissions disclosure and transparency.

PCAF enhances the GHG Protocol’s high-level guidance by introducing clear attribution rules, standardized emission factors, and approaches for calculating emissions intensity and absolute emissions across asset classes. This includes listed equity, corporate and sovereign bonds, business loans, project finance, commercial real estate, and motor vehicle loans.

PCAF vs. TCFD: Methodology vs. Strategy

While PCAF offers technical guidance on how to calculate financed emissions, the Task Force on Climate-related Financial Disclosures (TCFD) provides a strategic framework focused on governance, strategy, risk management, and metrics/targets. TCFD encourages organizations to assess and disclose climate-related financial risks and opportunities, including physical and transition risks.

However, TCFD does not prescribe methodologies for calculating emissions or climate metrics. This is where PCAF adds value by supplying the quantification tools that TCFD-aligned disclosures often require. Many financial institutions integrate PCAF results into their TCFD reports to strengthen their risk management and demonstrate transparency.

Together, PCAF and TCFD form a comprehensive toolkit, with PCAF enabling measurement and TCFD facilitating strategic disclosure and governance. PCAF provides the numerical foundation, while TCFD structures the narrative and strategic outlook based on those data.

PCAF’s Role in EU’s CSRD Compliance

The European Union’s CSRD, effective from 2024 with a phased rollout through 2028, mandates detailed disclosures of environmental, social, and governance (ESG) metrics, including GHG emissions across all scopes. For financial institutions, this includes financed emissions, which are central to their overall climate impact.

PCAF’s standardized methodology aligns closely with the European Sustainability Reporting Standards (ESRS), which underpin the CSRD. As such, EU-based institutions are increasingly adopting PCAF not just for internal risk assessment but also to ensure regulatory compliance. Institutions that fail to measure and report financed emissions under CSRD could face reputational damage and legal consequences.

By using PCAF, financial firms can streamline their reporting and avoid duplication, as the standard offers a recognized and auditable approach that fits within the broader European regulatory ecosystem.

PCAF Adoption in the United States

While the U.S. has lagged behind Europe in mandatory climate disclosures, recent developments indicate a significant shift. The U.S. Securities and Exchange Commission (SEC) proposed climate disclosure rules in 2022, which are expected to include Scope 3 emissions if material or if the institution has set Scope 3 reduction targets.

This aligns with growing investor and stakeholder expectations for transparency on financed emissions. U.S.-based financial institutions such as Morgan Stanley, Bank of America, and Citi have already joined PCAF, recognizing the need for credible data to support their net-zero commitments and climate risk assessments.

Furthermore, the Inflation Reduction Act and various state-level initiatives have begun to incentivize or require emissions transparency, creating additional momentum for PCAF-aligned reporting. U.S. institutions that proactively adopt PCAF will be better positioned to meet forthcoming regulatory expectations and demonstrate leadership in sustainable finance.

Conclusion

PCAF is redefining climate accountability in the financial sector by bridging the gap between voluntary climate disclosures and regulatory requirements. Through its detailed, asset-class-specific methodology, PCAF enables institutions to quantify and manage their financed emissions with unprecedented accuracy. When integrated with frameworks like the GHG Protocol and TCFD, and aligned with emerging regulations such as CSRD and SEC mandates, PCAF empowers financial institutions to transition from broad climate pledges to measurable, transparent action. As climate risk becomes synonymous with financial risk, adopting robust standards like PCAF is not just a compliance exercise but a strategic imperative.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3 and PCAF based disclosures. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.