- Article Summary

-

Introduction

Singapore has committed to achieving net zero emissions by 2050, a goal that reflects both ambition and necessity for a nation vulnerable to climate change impacts such as sea-level rise and extreme weather. Yet Singapore’s small land size and dense urban environment limit opportunities for large-scale domestic carbon reduction projects. This constraint has pushed policymakers to adopt a dual approach: maximizing domestic emissions reductions while complementing these efforts with high-quality international offsets. Nature-based carbon credits, in particular, have become a central piece of this strategy. The recent announcement that Singapore will purchase more than two million nature-based credits highlights how international cooperation can help bridge the gap between ambition and capacity.

Singapore’s Net Zero Targets and Policy Framework

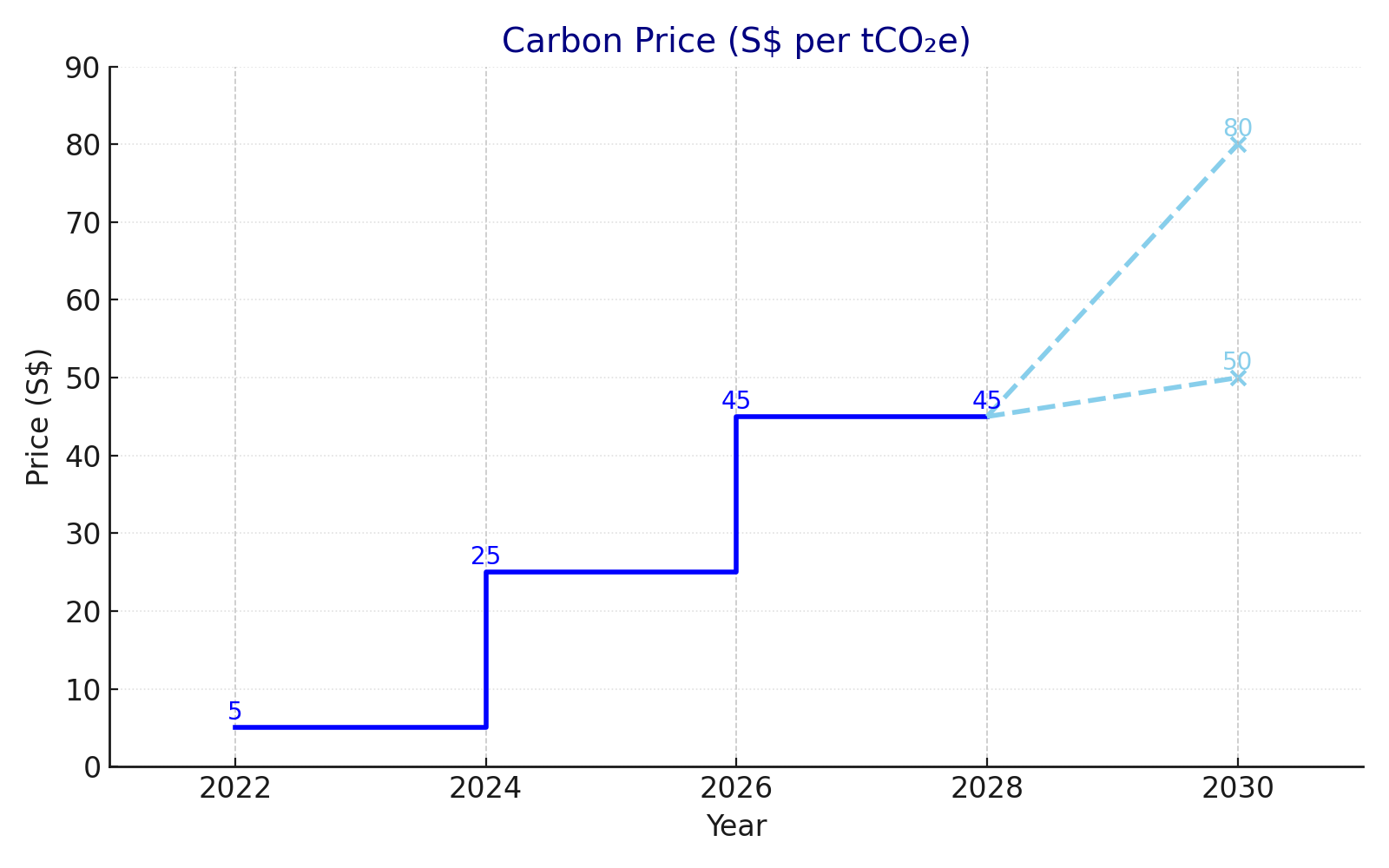

Singapore’s Nationally Determined Contribution (NDC) commits to peaking emissions before 2030 and reaching net zero by 2050. These targets are supported by the Singapore Green Plan 2030, which focuses on renewable energy, sustainable transport, green finance, and enhanced resilience. A rising carbon tax, which increased to S$25 per tonne of CO₂ in 2024 and is set to reach between S$50 and S$80 by 2030, provides market signals for emissions reductions. However, due to land constraints that limit solar deployment, renewable capacity, and nature-based domestic sequestration, Singapore recognizes that international cooperation is necessary. Thus, international carbon credits have been embedded into its national climate roadmap.

Why Nature-Based Carbon Credits Are Central to Singapore’s Strategy

Nature-based carbon credits represent emission reductions from activities such as avoided deforestation, reforestation, and sustainable land management. For Singapore, these credits serve several purposes:

- They enable the nation to compensate for hard-to-abate domestic emissions while contributing to global mitigation.

- They generate co-benefits such as biodiversity protection, water regulation, and community livelihoods, which align with global sustainable development goals.

- They offer cost-effectiveness when compared to certain domestic abatement measures.

Importantly, Singapore emphasizes that only high-integrity credits, meaning those verified for permanence, additionality, and environmental integrity, are acceptable for its national portfolio. This insistence positions Singapore as a responsible buyer in the international carbon market.

Recent Developments: Singapore’s International Carbon Credit Deals

In September 2025, Singapore announced that it had signed agreements with Ghana, Peru, and Paraguay to secure more than 2.175 million tonnes of high-quality nature-based carbon credits for delivery between 2026 and 2030. Valued at approximately S$76 million, these credits are structured under Article 6 of the Paris Agreement, which governs internationally transferred mitigation outcomes (ITMOs). The projects include forest conservation and reforestation efforts that not only reduce carbon emissions but also strengthen local community resilience and safeguard ecosystems. Specifically, they involve the Kowen Antami REDD+ and Together for Forests REDD+ projects in Peru, the Boomitra Grassland Restoration Project in Paraguay, and the Kwahu Landscape Restoration Project in Ghana. These were selected through an international RFP process, underscoring Singapore’s commitment to transparency and high-integrity standards. By selecting diverse partners across different continents, Singapore is reinforcing both climate cooperation and global equity in its approach. The deals also highlight Singapore’s role in shaping international carbon markets as a hub for transparent, high-integrity climate finance.

Challenges and Future Outlook

Despite their potential, nature-based carbon credits face challenges. Concerns include the permanence of forest-based sequestration, risks of leakage where deforestation shifts to other areas, and the credibility of verification methods. Over-reliance on offsets could also draw criticism if it is perceived as substituting for domestic emissions reductions. To address these issues, Singapore must ensure continuous monitoring, transparent reporting, and balanced climate action that prioritizes local decarbonization alongside offsets. Looking ahead, Singapore is well-positioned to lead in scaling voluntary carbon markets, developing strong verification technologies, and fostering regional partnerships in Southeast Asia. With global demand for high-integrity credits growing, Singapore’s strategy provides both a blueprint and a benchmark for small, resource-constrained economies.

Conclusion

Singapore’s journey to net zero demonstrates how international cooperation can complement domestic decarbonization strategies. Nature-based carbon credits are not a replacement for emissions cuts within Singapore but a pragmatic tool to overcome physical limitations while supporting global climate action. By focusing on integrity, transparency, and sustainability, Singapore is setting an example of how small nations can responsibly use carbon markets. As the world accelerates toward 2050 targets, Singapore’s balanced approach, where domestic action is reinforced by high-quality international offsets, offers valuable lessons for countries navigating similar constraints.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.