- Article Summary

-

Overview

On Independence Day, July 4th 2025, President Trump signed the “One Big Beautiful Bill” (BBB), marking a significant shift in U.S. policy, including energy. While supporters tout the bill’s economic benefits through tax simplification, critics argue it will substantially increase energy costs, reduce clean-energy investments, and set back climate initiatives. This article examines how BBB will reshape energy costs, impacting both residential and industrial sectors in the U.S.

Key Policy Changes: Rolling Back Clean-Energy Incentives

The BBB Act substantially reduces or eliminates key provisions of the 2022 Inflation Reduction Act (IRA), particularly those related to renewable energy and energy efficiency. Previously robust incentives for solar, wind, electric vehicles (EVs), battery storage, and home efficiency upgrades have been drastically curtailed, creating significant disruptions in the clean-energy market.

Analysts from Energy Innovation predict that removing these incentives will eliminate many cost-saving opportunities for consumers, significantly increasing reliance on fossil fuels, which carry higher market volatility due to geopolitical tensions, extraction costs, transportation complexities, and regulatory uncertainties.

Household Energy Costs on the Rise

A detailed analysis by Energy Innovation estimates an increase of approximately $170 billion in cumulative energy expenses for American households between 2025 and 2034. Similarly, the League of Conservation Voters (LCV) projects notable increases in household electricity bills—averaging an additional $110 annually by next year and potentially reaching upwards of $400 annually within five years.

These increases are primarily attributed to decreased renewable energy investments, leaving consumers dependent on fossil fuels, which are subject to more volatile and typically higher prices.

Utility Prices: Sharp Rate Increases Expected

Utility prices across the nation are forecasted to rise substantially. According to NERA and CEBA data, electricity prices could spike nearly 30% by 2029 in states heavily impacted by the rollback of renewable incentives. On a national scale, wholesale power prices are anticipated to surge by roughly 50% by 2035, significantly impacting both commercial and residential energy budgets.

This sharp escalation will predominantly result from a renewed emphasis on natural gas and coal-fired power plants, as the economic viability of renewable alternatives diminishes due to withdrawn incentives.

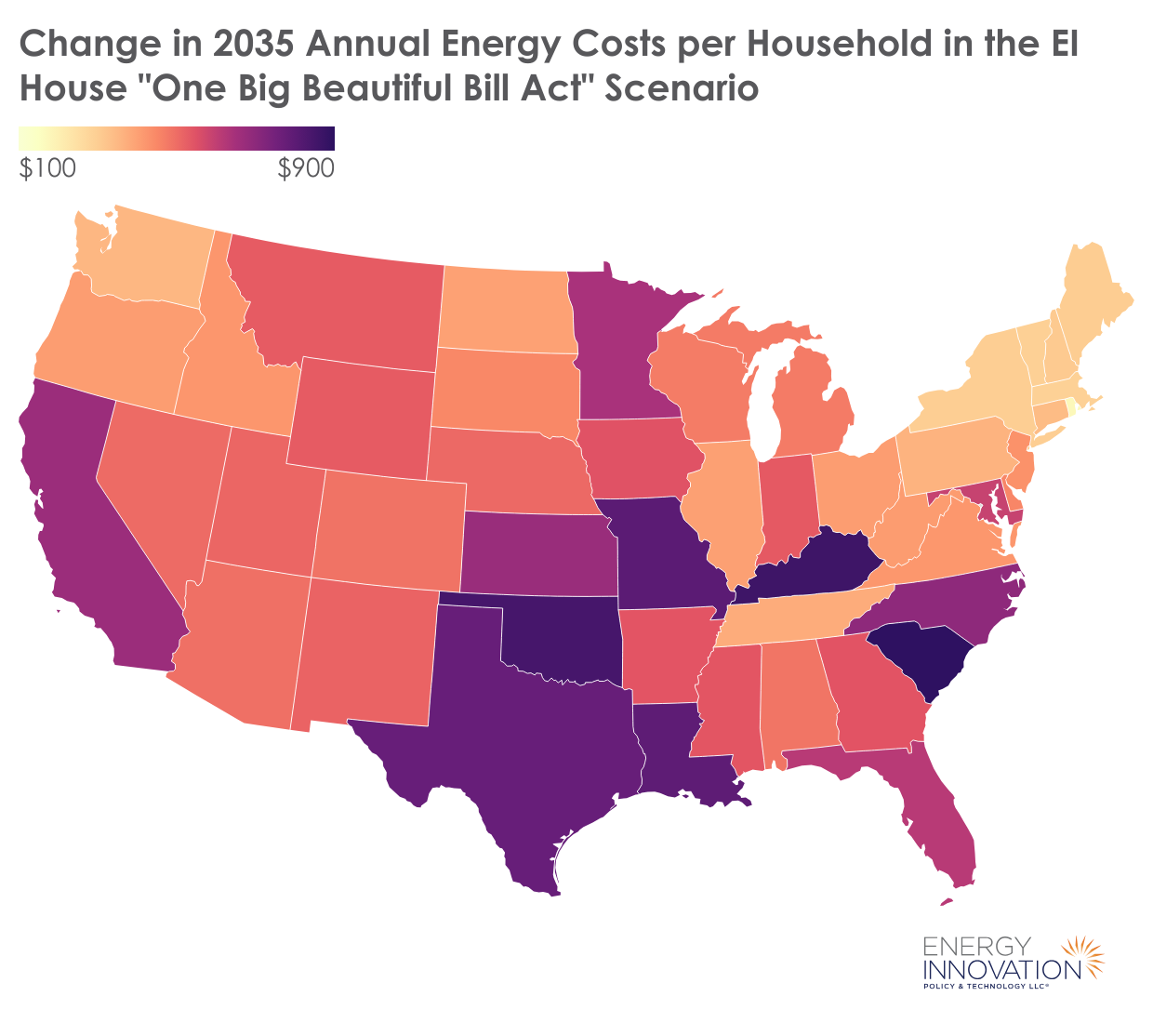

Regional Differences in Energy Costs

| Example States | Average Renewable Energy % (2025) | Avg. Annual Energy Cost Increase per Household (2035) |

|---|---|---|

| California, New York, Massachusetts | ~60-70% | ~$150–$250 |

| Texas, Oklahoma, West Virginia | ~10-20% | ~$500–$900 |

The table clearly highlights the difference between states that have aggressively pursued renewable energy strategies and states that have maintained significant reliance on fossil fuels. States like California will likely experience more moderate increases in energy costs, benefiting from the stability of renewables, while states such as Texas may face significantly steeper increases due to their heavier dependence on fossil fuel markets.

Economic Implications: Inflation and Higher Interest Rates

The Congressional Budget Office (CBO) projects the BBB Act will increase the federal deficit by $2.8 trillion by 2034. Economists from the Atlantic Council warn this heightened deficit could result in increased inflationary pressures, prompting the Federal Reserve to raise interest rates. Higher interest rates will subsequently elevate borrowing costs across the energy sector, exacerbating overall energy expenses.

The domino effect of increased borrowing costs, higher fossil fuel dependence, and reduced clean-energy investment paints a troubling economic picture that could ultimately weaken energy market stability and hinder economic growth.

Conclusion: The Long-Term Outlook

The passage of the BBB Act represents a critical turning point in U.S. energy policy. By significantly curbing renewable incentives, the act will likely increase energy expenses substantially across various sectors. Households should brace for rising bills, while industries may encounter greater operational and financial challenges. In the longer term, these changes risk undermining the affordability and stability of the energy market, potentially stalling progress toward cleaner, more sustainable energy solutions.

In navigating this challenging landscape, policymakers, businesses, and consumers alike must closely monitor energy markets, actively pursue efficiency measures, and advocate for balanced policies that support both economic stability and environmental sustainability.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions, including Scope 1-3. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.