- Article Summary

-

Introduction

Carbon pricing has become one of the most widely adopted policy tools for addressing climate change, yet debates continue over its real-world effectiveness. Governments around the world have introduced carbon taxes, emissions trading systems, and fuel excise taxes with the intention of aligning economic incentives with climate goals. The OECD’s Effective Carbon Rates 2025 report provides one of the most comprehensive assessments of how these instruments work together in practice, offering a data-driven view of how much carbon pollution is actually priced and at what level.

Rather than focusing on policy announcements or nominal tax rates, the OECD approach looks at the effective price applied to emissions across sectors and countries. This perspective is particularly valuable for businesses and investors, who face the real costs created by these policies rather than their stated intentions. By examining coverage, sectoral differences, and policy design, the report sheds light on where carbon pricing is sending strong signals and where gaps remain.

How Much of the World’s Emissions Are Actually Priced

One of the most important contributions of the Effective Carbon Rates 2025 report is its clear answer to a foundational question: how much of global emissions face any meaningful price at all. The OECD aggregates carbon taxes, emissions trading systems, and fuel excise taxes to calculate the share of emissions that are subject to a non-zero carbon price across a large group of countries representing the majority of global output and emissions.

The data shows that coverage has expanded steadily over the past decade. Between 2018 and 2023, carbon pricing coverage expanded markedly across 79 countries, with the share of greenhouse gas emissions subject to a carbon tax, an emissions trading system, or a fuel excise tax rising from 33 percent to 44 percent. This growth has been driven in large part by the expansion of emissions trading systems, particularly in power generation and heavy industry, where coverage has increased far more rapidly than in other sectors. More countries have adopted emissions trading systems, existing schemes have broadened their sectoral scope, and carbon taxes have been adjusted or introduced in additional jurisdictions. As a result, carbon pricing has moved from a policy tool used by a small group of early adopters to one that affects a substantial share of the global economy.

However, the report also highlights that coverage alone does not guarantee strong incentives to reduce emissions. A carbon price can exist without being high enough to influence investment or behavior. This distinction is critical for understanding why emissions trends do not always align with policy expansion.

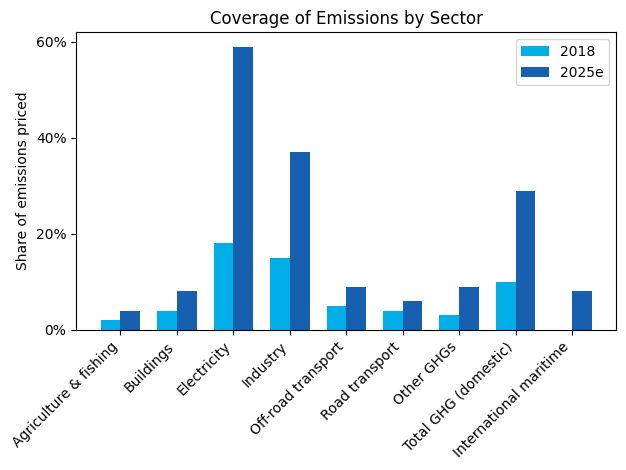

Effective Carbon Rates Differ Sharply by Sector

Looking beyond coverage, the OECD data reveals large differences in effective carbon rates across economic sectors. Power generation and road transport typically face the highest effective carbon prices, reflecting the combined impact of fuel excise taxes and emissions trading systems. In contrast, sectors such as buildings and agriculture often face much lower prices, or none at all.

These differences matter because they shape investment decisions. High effective carbon rates in the power sector help explain the rapid growth of renewable energy in many countries. Lower rates in buildings and agriculture help explain why emissions reductions in those sectors have been slower and more uneven. The data makes clear that carbon pricing does not apply uniformly across the economy, even within countries that are considered climate policy leaders.

For companies with complex value chains, this unevenness creates both risks and opportunities. Operations concentrated in high-priced sectors face stronger cost pressures, while emissions in lightly priced sectors may become future targets for policy tightening. Understanding these sectoral patterns is therefore essential for credible transition planning.

What Policy Instruments Are Really Driving Carbon Prices

Another key insight from the Effective Carbon Rates 2025 report is how different policy instruments contribute to overall carbon pricing. Public debate often centers on explicit carbon taxes, yet the OECD data shows that fuel excise taxes and emissions trading systems frequently account for a large share of the effective carbon rate applied to emissions.

Fuel excise taxes, originally designed for revenue generation or energy security, often impose a substantial implicit carbon price on transport fuels. Emissions trading systems, meanwhile, have expanded in both geographic and sectoral scope, becoming a central pillar of carbon pricing in many economies. Carbon taxes remain important, particularly where they are designed explicitly around climate objectives, but they are only one part of the broader pricing landscape.

This breakdown has important implications for policy design. It shows that governments can influence emissions through multiple channels and that the overall price signal depends on how these instruments interact. For businesses, it reinforces the need to look beyond headline tax rates and assess the full set of policies affecting energy and emissions costs.

Insert a stacked bar chart here showing the contribution of carbon taxes, emissions trading systems, and fuel excise taxes to effective carbon rates.

Conclusion

The OECD’s Effective Carbon Rates 2025 report provides a clear and nuanced picture of carbon pricing as it exists today. Coverage has expanded significantly, sectoral price differences are pronounced, and a mix of policy instruments shapes the incentives faced by companies and consumers. Together, these findings suggest that carbon pricing is firmly embedded in the global policy toolkit, while also underscoring the limits of current approaches.

For policymakers, the data points to the importance of broadening coverage and strengthening price signals in underpriced sectors. For businesses, it highlights why carbon pricing should be treated as a core strategic issue rather than a narrow compliance concern. As governments continue to refine climate policy frameworks, understanding effective carbon rates will remain essential for navigating the transition to a lower-carbon economy.

Why Work with ASUENE Inc.?

ASUENE is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. The company serves over 10,000 clients worldwide with an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.