- Article Summary

-

Introduction: Policy Whiplash Fuels a Renewable Rush

The U.S. renewable energy sector is experiencing a paradoxical surge. While long-term clarity is clouded by shifting political winds and looming legislative threats, short-term deployment of clean energy technologies is accelerating. Developers, manufacturers, and utilities are racing to lock in federal tax credits, finalize financing, and break ground on projects before any potential rollback of incentives or regulatory shifts materialize.

This phenomenon, what some are calling a “policy-induced urgency, ” is a defining feature of the current renewable energy landscape. With the Inflation Reduction Act (IRA) still largely intact but increasingly under scrutiny, stakeholders are seizing the moment. On July 4, 2025, the U.S. Congress passed and President Trump signed the “One Big Beautiful Bill” (BBB, H.R.1). This sweeping tax package includes provisions that accelerate the phase-out of critical clean energy tax credits. In response, developers are front-loading activity, driving record-breaking quarters in manufacturing, construction, and energy storage.

This article explores how uncertainty about U.S. climate and energy policy is paradoxically fueling a short-term boom. It examines five key areas where action has accelerated in recent months, driven not just by incentives, but by the fear of losing them.

Surging Solar Manufacturing: A Preemptive Sprint

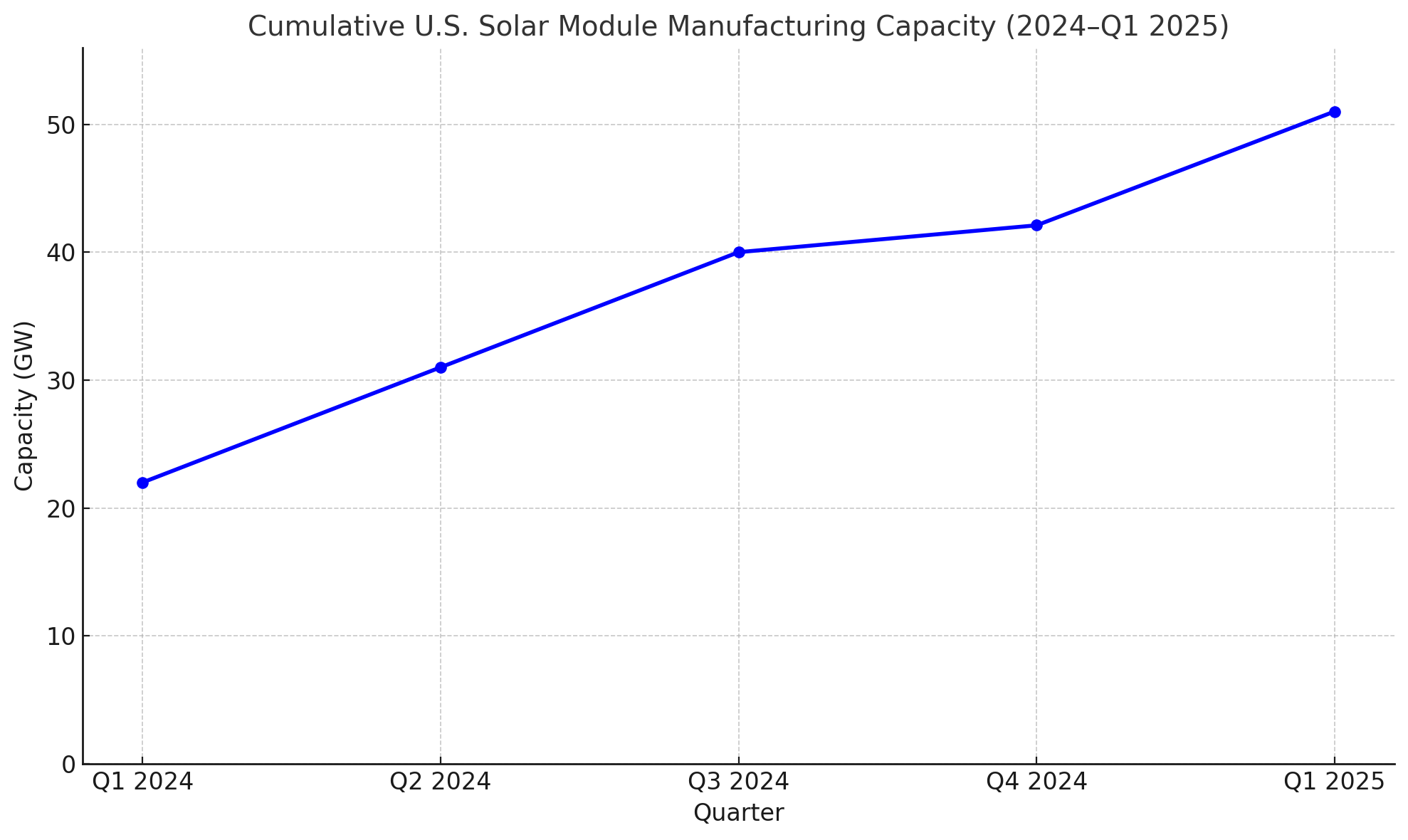

One of the most direct outcomes of recent policy ambiguity has been the record-breaking surge in solar module manufacturing capacity. According to Wood Mackenzie, the U.S. added 8.6 gigawatts (GW) of new solar module capacity in Q2 2025, one of the strongest quarters in U.S. history. Developers are moving fast to capture tax credits before potential reversals.

The trigger? The BBB legislation outlines a sharp sunset for many renewable incentives. The Residential Clean Energy Credit (Section 25D) will now expire on December 31, 2025, cutting short its original duration. Similarly, the Commercial Investment Tax Credit (Section 48) for solar and wind will terminate after December 31, 2027. Although these dates leave a short window for deployment, the compressed timeline has caused manufacturers to accelerate operations dramatically.

This flurry of activity demonstrates the fragile confidence in long-term federal support. Manufacturers are hedging against risk by compressing what might have been a five-year plan into the next 12–18 months.

Battery Storage Builds Soar Amid Credit Clock Watching

The same urgency is seen in energy storage. With federal tax credits for standalone storage newly introduced via the IRA, developers are rushing to complete projects while the regulatory environment still favors rapid deployment.

In Nevada, the Reid Gardner Battery Energy Storage System, a 220 MW / 440 MWh project, was recently commissioned with the help of $100 million in federal support. Across the country, similar projects are being fast-tracked. Developers anticipate that changes in Congress could revise credit structures or add new compliance burdens, reducing the economic attractiveness of new builds.

Under BBB, standalone and retrofit battery credits (under Section 48E) remain technically available through 2032, but eligibility is narrowed to leased or PPA-tied systems, and cross-subsidies are under review. As a result, developers are bundling battery projects with solar deployments to maximize near-term credit access.

Recent Utility-Scale Battery Storage Projects (Q4 2024–Q2 2025)

| Project Name | Location | Capacity (MW) | Federal Credit Used | Status |

|---|---|---|---|---|

| Reid Gardner BESS | Nevada | 220 | ITC (Storage) | Operational |

| Black Mesa Battery Hub | Arizona | 300 | IRA Storage Credit | Under Construction |

| Gulf Coast Grid Reserve | Texas | 180 | 45X Credit | Permitted |

This rush to deploy before the “policy window” closes is producing what the U.S. Energy Information Administration calls a “2025 supercycle” in battery installations, growth that is unlikely to persist at the same pace without long-term policy stability.

Offshore Wind Races to Approval Before Regulatory Shifts

While solar and storage are seeing development peaks, the offshore wind sector is undergoing a fast-tracked permitting spree. The Biden administration, via the Bureau of Ocean Energy Management (BOEM), has accelerated project reviews, approving multiple multi-gigawatt developments in recent months.

Notable examples include:

- Maryland Offshore Wind (US Wind) – 2.2 GW project approved in December 2024

- Coastal Virginia Offshore Wind – 2.6 GW under construction, 50% complete

- Sunrise Wind (New York) – 924 MW began turbine installations in early 2025

These projects are being shepherded through while federal support remains robust, but developers acknowledge the precariousness of the moment. Under BBB, the commercial ITC for offshore wind will expire after December 31, 2027, and developers must begin construction by mid-2026 to qualify. These deadlines are pushing utilities to speed up permitting and equipment contracts.

As one executive noted, “We are trying to get everything locked down while we still can count on the rules not changing.” This sense of urgency is driving permitting acceleration and supply chain finalizations.

Manufacturers Hedging Bets With Accelerated Factory Builds

The IRA’s domestic content incentives were designed to bring clean energy manufacturing back to U.S. soil, and they’ve succeeded. But with BBB curtailing the duration of these benefits, manufacturers are pushing to begin production before the window closes.

Since 2022, over 120 new clean tech factories have been announced in the U.S. These include solar cell fabs, battery gigafactories, and EV component plants. In the first half of 2025 alone, $34 billion in new investments were publicly committed, most aiming to begin operations before 2027.

Table 2: Selected U.S. Clean Energy Manufacturing Announcements (H1 2025)

| Company | Facility Type | Location | Investment ($B) | Status |

| First Solar | Module Factory | Louisiana | 1.1 | Under Construction |

| LG Energy | Battery Gigafactory | Arizona | 3.5 | Construction Begun |

| Siemens Gamesa | Offshore Wind Blades | Virginia | 0.9 | Permitted |

These companies are front-loading capital expenditures to ensure eligibility for IRA credits, and to establish market presence before political tides turn. The result: a short-term spike in economic activity, jobs, and industrial output that may taper if uncertainty persists.

Conclusion: Racing Against the Clock

The U.S. renewable energy sector is experiencing a rare alignment of incentives and anxiety. Strong policies like the IRA and Bipartisan Infrastructure Law are catalyzing clean energy growth, but political developments such as the BBB are injecting new uncertainty into the system. Rather than stall activity, this has triggered a short-term boom, as developers and manufacturers rush to capitalize on current rules before they potentially disappear.

This dynamic is unsustainable in the long run. Bursts of growth followed by periods of uncertainty make it difficult for supply chains to stabilize, for skilled labor to be developed, and for communities to trust the energy transition. Nonetheless, in the short term, policy instability has become an accelerator rather than a brake.

As the 2024–2025 political cycle unfolds, the U.S. clean energy industry is acting like it’s in a race against the clock. The outcome will determine whether the recent boom is a foundation for long-term resilience, or merely a surge before a slowdown.

Why Work with ASUENE Inc.?

Asuene is a key player in carbon accounting, offering a comprehensive platform that measures, reduces, and reports emissions. Asuene serves over 10,000 clients worldwide, providing an all-in-one solution that integrates GHG accounting, ESG supply chain management, a Carbon Credit exchange platform, and third-party verification.

ASUENE supports companies in achieving net-zero goals through advanced technology, consulting services, and an extensive network.